简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Oct 24, 2025

Zusammenfassung:Markets on CPI Watch: Dollar Range Poised to Break as Trade Talks Boost SentimentUS–China Set for Trade Talks: Market LiftedGlobal risk sentiment improved significantly on Thursday. U.S. equities, whi

Markets on CPI Watch: Dollar Range Poised to Break as Trade Talks Boost Sentiment

US–China Set for Trade Talks: Market Lifted

Global risk sentiment improved significantly on Thursday. U.S. equities, which had come under pressure earlier this week, rebounded broadly, with the Nasdaq leading gains — up nearly 0.9% — as technology and semiconductor stocks staged a solid recovery. Major European indices also ended higher, with the UKs FTSE 100 reaching a fresh record high.

The U.S. Dollar Index held firm above 98.50 in choppy trade, maintaining a constructive tone. Gold stabilized after defending the $4,000 psychological support level, closing more than 1.6% higher on COMEX — a sign that strong dip-buying interest remains intact.

On the trade front, both Washington and Beijing have agreed to hold a new round of negotiations in Malaysia from October 24 to 27. Optimism surrounding a potential easing in trade tensions was the key driver behind Thursdays improvement in risk sentiment. At this stage, sentiment remains positive on diplomatic hopes, but upcoming trade updates could still spark volatility going into the weekend.

CPI in Focus: Dollar Hinges on It

Today‘s main macro focus will be on the delayed release of the U.S. September Consumer Price Index, which was pushed back due to the government shutdown. This is the last major economic data release before next week’s FOMC meeting, making it a critical gauge for the U.S. Dollar and the Federal Reserves policy outlook.

Markets have already priced in a 25 bps rate cut at the October meeting. While todays CPI print is unlikely to alter that expectation, it will heavily influence rate-cut expectations for December and shape the broader forward-guidance narrative from the Fed.

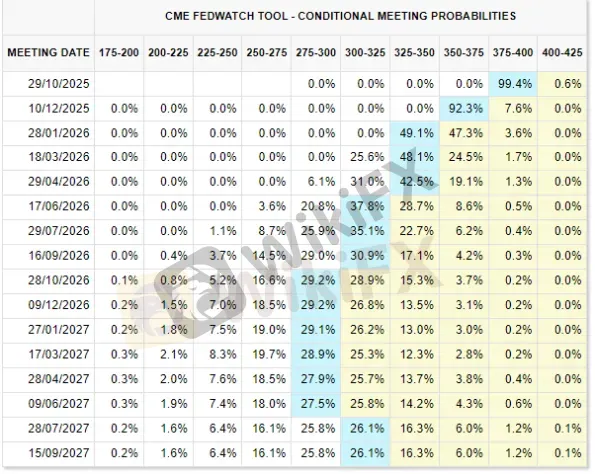

CME FedWatch Rate Probabilities, Source: CME Group

According to the CME Group FedWatch Tool, markets currently expect additional easing in December and likely another cut in Q1 2026. However, that outlook could shift after tonights CPI data — making this a key catalyst for FX and rates markets into the weekend.

Market Implications: U.S. September CPI

The CPI data will play a crucial role in shaping market expectations for the Fed‘s rate-cut path, which in turn will influence the U.S. dollar’s direction. The potential market scenarios are as follows:

· Hotter-than-expected CPI — Less Dovish Fed: A stronger CPI print could prompt traders to reassess the likelihood of a December rate cut. This scenario would likely strengthen the U.S. dollar while putting pressure on gold and broader risk assets.

· Softer-than-expected CPI — More Dovish Fed: A weaker CPI print would reinforce expectations of further easing, which could weigh on the U.S. dollar while supporting gold and overall risk sentiment.

US Dollar Index Outlook

In this scenario, the U.S. CPI data could play a decisive role in shaping the dollars near-term direction. The U.S. Dollar Index is currently trading in a tight range between 98.50 and 99.00, both of which remain critical short-term levels for the greenback.

From a technical perspective, the recent uptrend channel and price action holding above the 98.50 support level suggest that the dollar remains in a near-term bullish structure. Whether this upside can be sustained will depend heavily on the outcome of the CPI release.

US Dollar Index, H4 Chart

Based on the CPI implications mentioned above, a hotter-than-expected print could push the dollar higher, potentially breaking above 99.00 and triggering a short-term upside extension beyond this level—potentially the 100.00 mark—as well.

Conversely, a softer CPI reading would likely weigh on the greenback. A clean break below 98.00 would invalidate the recent uptrend structure and open the door for further downside toward 97.50, which would likely push the dollar back into a broader consolidation phase.

EUR/USD, H4 Chart

Meanwhile, EUR/USDs strong correlation with the U.S. Dollar Index suggests the pair could see a decisive move if the CPI release drives significant volatility in the greenback. The pair is currently hovering around the 1.1600 support area, which has become a key technical level.

USD/JPY: Yield in play

USD/JPY is another key dollar pair to watch around the CPI release, as it could offer a clear directional move. If the CPI comes in hotter than expected, it may push back the Feds rate-cut timeline, which would be bullish for the U.S. dollar and could trigger another strong rally in USD/JPY.

In Japan, the recent leadership victory of Sanae Takaichi points to a policy stance favoring fiscal expansion and continued dovishness from the Bank of Japan, keeping domestic yields low. A hotter U.S. CPI would widen the U.S.–Japan yield gap, further supporting the dollar against the yen.

USD/JPY, Daily Chart

Technically, USD/JPY is holding firm above the 150.00 level, leaving room for further upside if the dollar strengthens. Unless the CPI comes in significantly weaker than expected, even an in-line print could give the pair a short-term boost.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Ethereum-Gebühren stürzen ab – JPMorgan warnt vor Strohfeuer

Macrons Sonnenbrille aus Davos lässt die Aktie dieses kleinen italienischen Herstellers explodieren

Krypto-Boom voraus? Circle-Chef rechnet mit 40 Prozent Wachstum pro Jahr

XRP hält die Linie – diese Signale geben Ripple-Anlegern jetzt Hoffnung

Wechselkursberechnung