Brokers Raise Margins Amid Gold and Oil Volatility in MENA Markets

Gold and oil markets surged amid rising Middle East tensions, prompting brokers across the MENA region to adjust margin requirements and trading conditions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

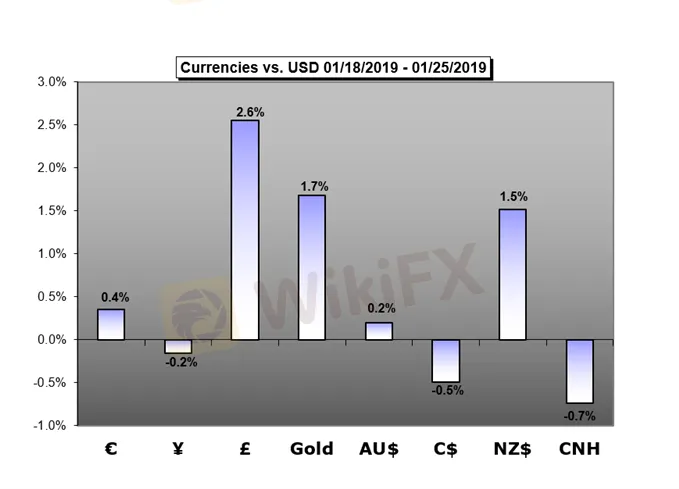

Abstract:The fundamental environment will grow increasingly tumultuous over the coming week. We wil continue to sort through general themes like the lifting of the US

Australian Dollar Forecast – Australian Dollar May Look Past CPI Report for the Fed and US Data

Why did the Australian Dollar fall after an upbeat jobs report? The same logic may undermine the impact of CPI data as AUD eyes the Fed and a plethora of US economic statistics ahead.

Crude Oil Forecast - Prices May Continue CLimb on GDP Growth Recovery Bet

Factors that dragged global growth forecasts lower could subside which has potential to rejuvenate the world economy and oil demand.

British Pound Forecast – Positive Backdrop, Bullish Outlook

Sterling is coming off its weekly highs heading into the weekend, but the outlook for a reinvigorated British Pound remains bullish.

US Dollar Forecast – US Dollar Torn Between Domestic Strength, Global Headwind

The US Dollar may be torn between signs of economic resilience domestically and worrying developments abroad. Another round of trade war negotiations is a wild card.

Gold Forecast – Gold Prices Eye Fed Rate Decision and US-China Trade Talks Next

After Golds sharp rally on Friday, price rests at a crucial inflection point ahead of the Fed rate decision and US-China trade talks.

Equities Forecast – Stock Markets Look to Earnings and FOMC, DAX to Eurozone GD

The US stock market will look to earnings from some of the major corporations like Microsoft, Amazon and Facebook. Elsewhere, the DAX will look to German employment data.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Gold and oil markets surged amid rising Middle East tensions, prompting brokers across the MENA region to adjust margin requirements and trading conditions.

China’s Supreme People’s Court disclosed a major cross-border investment scam in which fraudsters used fake gold trading and fabricated profits to deceive victims, resulting in losses exceeding 280 million yuan. The case highlights the growing sophistication of online investment fraud and reinforces the need for investor vigilance and proper due diligence.

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

USD/JPY just broke through 1-year highs earlier than expected.