Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

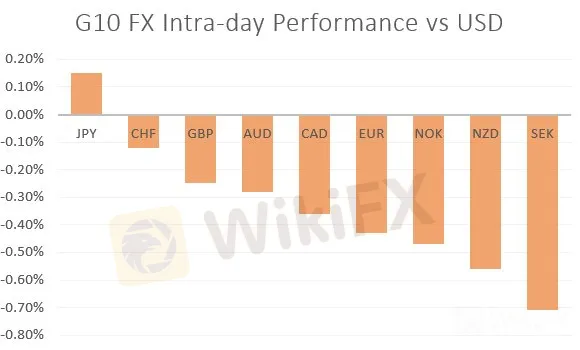

Abstract:USD Back on the Throne, EUR Drops, GBP Bounces Off Support - US Market Open

MARKET DEVELOPMENT – USD Back on the Throne, EUR Drops, GBP Bounces Off Support

EUR: A reality check for the Euro, which came back under pressure after Eurozone PMIs (Mfg. in particular) fell short of estimates. In reaction the Euro drop to lows of 1.1250, which in turn keeps the currency within its recent range. The apparent green shoots from Asia have yet to stem through into the Euro-Area, thus keeping EURUSD offered.

AUD: Main highlight overnight had been the Australian jobs report, which to the RBAs delight, provided a set of robust figures. Consequently, AUDUSD drifted higher, however, yet again the 0.7200 capped further upside, which in turn saw the pair drift back towards 0.7150.

GBP: Despite better than expected retail sales across the board, the initial bid in GBP was subsequently pared amid the broad strength in the USD index. 1.3000 area continues to keep GBPUSD supported and thus confine the pair to a relatively tight range.

Source: Thomson Reuters, DailyFX

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Performance like this hasn't been seen since 2021

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.