Abstract:Gains in banks, energy and mining stocks lifted Asian equities a little higher on Tuesday as investors braced for aggressive U.S. rate hikes and war disrupting oil supplies.

Oil futures rose nearly 3% to a two-week high in Asia.

The yen fell through the key 120 level against the dollar for the first times since 2016 and Treasuries extended losses after U.S. Federal Reserve Chairman Jerome Powell on Monday flagged a more aggressive tightening of monetary policy than previously anticipated.

MSCI‘s broadest index of Asia-Pacific shares outside Japan rose 0.2% led by gains in Australia’s miner-and-bank heavy index <.AXJO, which hit a two-month high. [.AX]

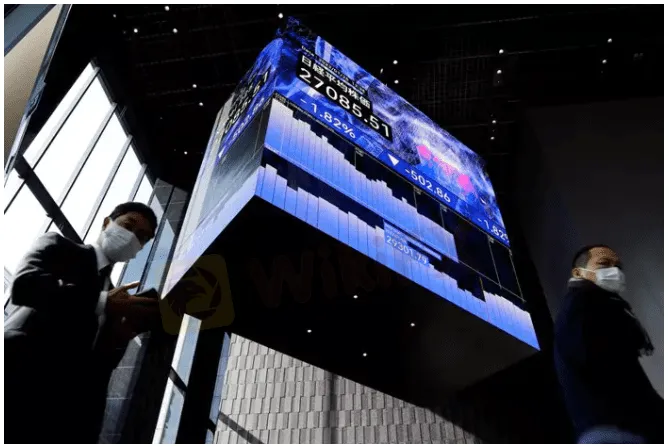

Japans Nikkei rose 1.7% to 27,276. [.T]

“This very sharp spike in commodity prices is actually having relatively mixed impacts … because we have some notable commodity exporters in this region, who would possibly stand to benefit,” said Manishi Raychaudhuri, Asia-Pacific equity strategist at BNP Paribas.

Meanwhile, “investors are coming to terms with the fact that the developed markets central banks would normalise monetary policy,” he said.

Powell had sparked a bond rout overnight after he told the National Association for Business Economics the U.S. central bank was prepared to do what it takes to combat inflation and that bigger-than-usual hikes would be deployed if needed.

Treasuries and U.S. stock futures remained on edge, with S&P 500 futures down 0.3% and rates-sensitive Nasdaq 100 futures down 0.4%. Benchmark 10-year Treasury yields hit an almost three-year high of 2.3330%. [US/]

Fed funds futures are now pricing a two-third chance of a 50-basis-point rate hike in May.

The Japanese yen, also sensitive to rising U.S. rates, fell past 120-per-dollar briefly and last bought 119.90. [FRX/]

Chinese markets, on the other hand, are awaiting policy easing after it was flagged by authorities last week.

China‘s blue chip index opened 0.2% lower while Hong Kong’s benchmark Hang Seng Index rose 0.7%.

Hong Kong shares of China Eastern Airlines fell 5.5% after its Boeing 737-800 with 132 people on board crashed in mountains in southern China on Monday.

Meanwhile, a lack of progress in the Russia-Ukraine peace negotiations continued to weigh on sentiment. Conflict raged on as Ukraine said on Monday it would not obey ultimatums from Russia after Moscow demanded it stop defending besieged Mariupol.

Oil futures extended gains on Tuesday morning on news that some European Union members were considering imposing sanctions on Russian oil and as attacks on Saudi oil facilities sent jitters through the market. [O/R]

Brent crude rose 2.9% to $118.93 per barrel. U.S. crude ticked up 2.4% to $114.85 a barrel.

The yen fell about 0.4% to briefly hit 120.08 per dollar in early Asia trade.

In other currency trade the euro was down 0.2% on the day at $1.0992, having lost 2.09% in a month, while the dollar index, which tracks the greenback against a basket of currencies of other major trading partners, was up at 98.758.

Gold was slightly lower at $1930.27 per ounce.