Celebrate the New Year and Usher in a Safer 2026 for All Traders!

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

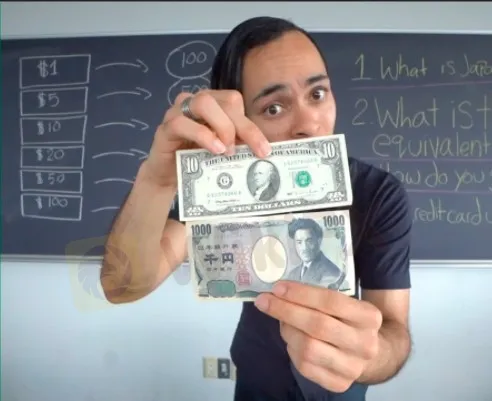

Abstract:The U.S. government spending is shrinking much more quickly while the Japanese budget deficit continues to grow with increased spending and debt finance.

AT-A-GLANCE

Relative monetary policy: Expectations for rapid Fed rate rises have also boosted USD

Relative growth: The U.S. economy has also been growing much more quickly than Japans recently

The U.S. government spending is shrinking much more quickly while the Japanese budget deficit continues to grow with increased spending and debt finance.

Higher energy prices/falling trade surpluses have weighed on JPY

Increased relative risks, especially as regards JPYs role in the FX carry trade weigh against the yen.

Over the past fifteen months the U.S. dollar (USD) has gained more than 20% versus the Japanese yen (JPY) with nearly half the move coming during the past few weeks. The yens recent decline can be understood when looking at the five macroeconomic forces that tend to govern exchange rates:

Relative changes in the pace of economic growth

Relative changes in expected interest rate policy

Relative changes in government spending policies

Relative changes in export growth

Relative changes in risk assessment

Sometimes these forces pull in opposite directions. When this is the case, a currency pair will often show little direction and move sideways. At times, however, one or more of the forces becomes dominant and the exchange rate will begin to trend in one direction or the other. In the case of the JPYUSD exchange rate, all five forces have begun pulling the same direction.

Current Account Surpluses/Deficits and Energy Prices

According to SWIFT the yen is the third most widely used currency the world for international trade, behind the U.S. dollar and the euro. Even so, it is used in only 3% of global commercial transactions compared to around 80% for the dollar. As the global reserve currency, USD is structurally advantaged due to the U.S. dollar‘s status as a global reserve currency. The U.S. dollar is the far dominant numeraire for commodity trading, the leading asset in central bank foreign reserve portfolios, and serves as a global flight-to-quality currency. All of these advantages have led to the U.S. running chronic trade deficits that have varied from 2% to 6% of GDP so far this century, as natural offsets to the inbound capital flows that accrue to the world’s primary reserve currency. By contrast, the Japanese yen enjoys no special reserve currency status, and its trade flows depend mostly on the global demand for its exports. Japan tends to run trade surpluses, but size of those surpluses varies over time (Figure 1), as global demand for Japans exports wax and wane.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

Markets turn cautious as investors await the Fed’s December meeting minutes. The US Dollar stabilizes near 98.10, gold drops sharply from record highs, while GBP/USD, EUR/USD, and USD/JPY react to central bank signals.

Following the successful conclusion of the global public voting phase, the WikiFX Golden Insight Award has now officially entered its final evaluation stage—the expert judging. This marks a critical juncture in the 2025 Golden Insight Award selection process, ushering in the most authoritative and rigorous phase of professional assessment and industry consensus-building.