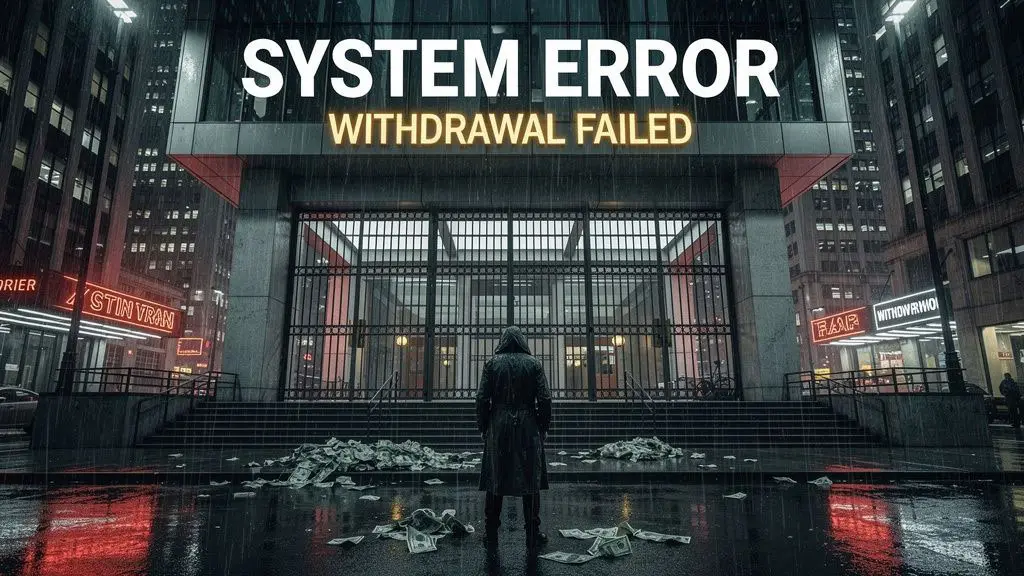

WikiFX Deep Dive Review: Is dbinvesting Safe?

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The Commodity Futures Trading Commission (CFTC) has continued its bust of fraudulent schemes. On Wednesday, the agency filed a civil enforcement action against Kay Yang and her two companies, AK Equity Group LLC and Xapphire LLC, for foreign exchange (forex) fraud.

Both SEC and CFTC filed civil complaints against the companies and the owner.

The owner of the firms collected and misappropriated the investor funds.

Take Advantage of the Biggest Financial Event in London.

Yang and her two companies have been charged with fraud and misappropriation related to the forex trading scheme. They are blamed for soliciting funds totaling at least $15.7 million from at least 67 investors.

Additionally, the US agency named Yangs husband, Chao Yang, as a relief defendant for receiving the investor funds of the trading scheme.

The US Securities and Exchange Commission (SEC) filed a separate civil complaint against Yang and her companies for the same schemes.

Defrauding Investors

The complaint lodged by the CFTC detailed that Yang with her two companies ran the trading scheme from around April 2017 through March 2020. They approached investors and collected funds for the sole purported purpose of forex trading.

The companies are alleged to have made several false representations to the existing and potential pool participants of the scheme. The false claims include the managing of hundreds of millions of dollars in a variety of investment vehicles and achieving positive monthly returns.

Moreover, they claimed that all the collected investor proceeds were allocated to forex trading and were adhering to strategies that include low leverage ratios and moderate trading frequencies.

“These were false claims and the defendants routinely suffered trading losses using high leverage and high-frequency trading strategies,” the CFTC stated.

In addition, Yang was blamed for using the investor funds for personal expenses. Also, she transferred around $200,000 to her personal bank account and another $1.4 million to her husbands. Further, she transferred more than $1 million to a joint bank account which is in the name of her and her husband.

The CFTC is now seeking full restitution of the solicited funds to the trading pool participants and disgorgement of all ill-gotten gains. Furthermore, the agency wants to impose civil monetary penalties and permanent registration and trading bans, along with a permanent injunction.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

BitPania is a relatively new brokerage established in 2024 and registered in Saint Lucia. The platform markets itself as a digital trading solution offering multiple account types and support for automated trading (EAs). However, potential investors should approach with significant caution. Currently, BitPania holds a WikiFX Score of 1.20, a very low rating that reflects its lack of regulatory oversight and recent user complaints regarding withdrawals.

ExpertOption presents itself as a sleek, modern trading platform with a low barrier to entry, attracting significant attention across social media and search engines. With its proprietary app and promises of easy profits, it’s no surprise many beginners are tempted to sign up. However, flashy interface design often hides fundamental risks.

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Robert Hahm, the Founder and CEO of Algorada. Robert Hahm is a seasoned financial executive who has successfully transitioned from managing traditional assets to founding a cutting-edge fintech platform. As the Founder and CEO of Algorada, he leverages decades of experience in portfolio management to bridge the gap between financial domain knowledge and the power of AI.