SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

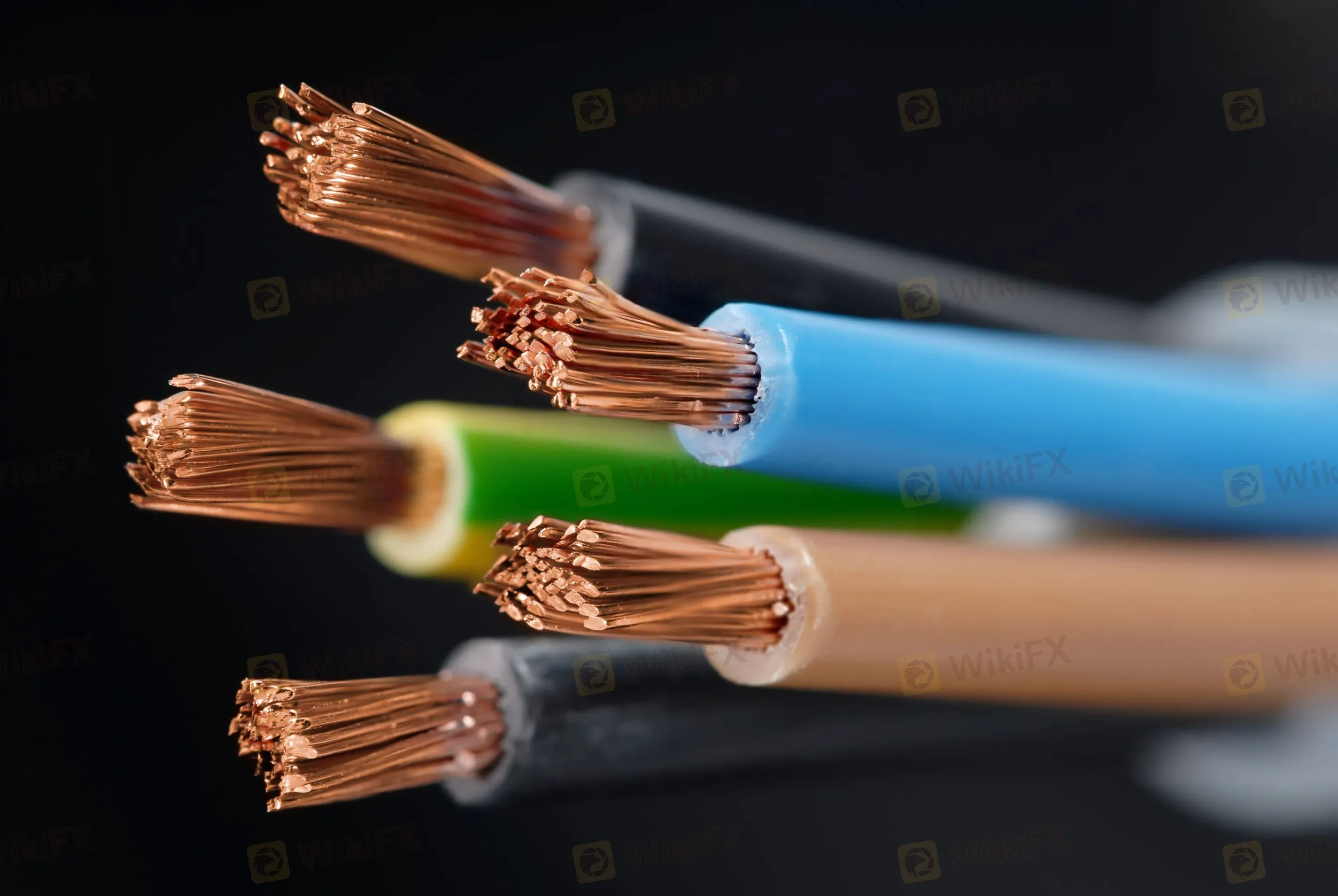

Abstract:Copper prices hold onto the bear-run as firmer US dollar and hardships for the largest customer, namely China, challenge the inventory conditions and favor sellers. The commodity prices hit the four-month low on LME earlier in the week and remain depressed afterward.

Copper remains pressured near four-month low on LME, down over 1.0% on SFE.

Inflation fears propel US dollars safe-haven demand ahead of NFP.

Chinas covid woes, tussles with the US challenge metal prices.

“Benchmark three-month copper on the London Metal Exchange (LME) was down 0.4% at $9,455.50 a tonne, as of 0156 GMT,” said Reuters. The news also mentioned that the most-active June copper contract on the Shanghai Futures Exchange fell 1.3% to 72,100 yuan ($10,783.89).

That said, the risk-aversion wave takes clues from the concerns that the higher inflation will escalate interest rate and negatively affect the global growth, which in turn dampens the red metals industrial demand.

The inflation-linked woes worsened the previous day after the Bank of England (BOE) forecasted double-digit inflation and economic recession. The same rocked the US boat due to the rising inflation fears and firmer jobs market, which the Fed seemed to have taken lightly by rejecting 75 basis points (bps) of a rate hike.

On the other hand, the US Securities and Exchange Commission (SEC) added over 80 Chinese firms to the list of companies facing probable delisting from the US exchanges, which portrayed fresh Sino-American tussles and weighed on the risk appetite as well. Further, the worsening covid conditions in China and the European Unions (EU) readiness for more sanctions on Russia add to the risk-off mood.

The downbeat Factory Orders from Germany, softer activity data from the West and Perus refrain to remove temporarily suspension of civil liberties in an area comprising a major copper mine are some additional challenges for the red metal prices.

On the positive side, depleting inventory levels and supply crunch are some motivations for the buyers to stay on the table.

That being said, the commodity prices are likely to remain depressed in the short-term considering the global woes and downbeat conditions in China. Today‘s US employment data may add to the metal’s weakness should the headline Nonfarm Payrolls (NFP) beat the expectedly easy figures with strong numbers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.