Abstract:The U.S. dollar is up for the fifth consecutive week as traders brace themselves for the upcoming CPI and PPI reports. The rise of USD could be continue in the foreseeable future and could cause disruptions especially in the emerging markets.

<WikiFX Malaysia Original – Editor: Fion>

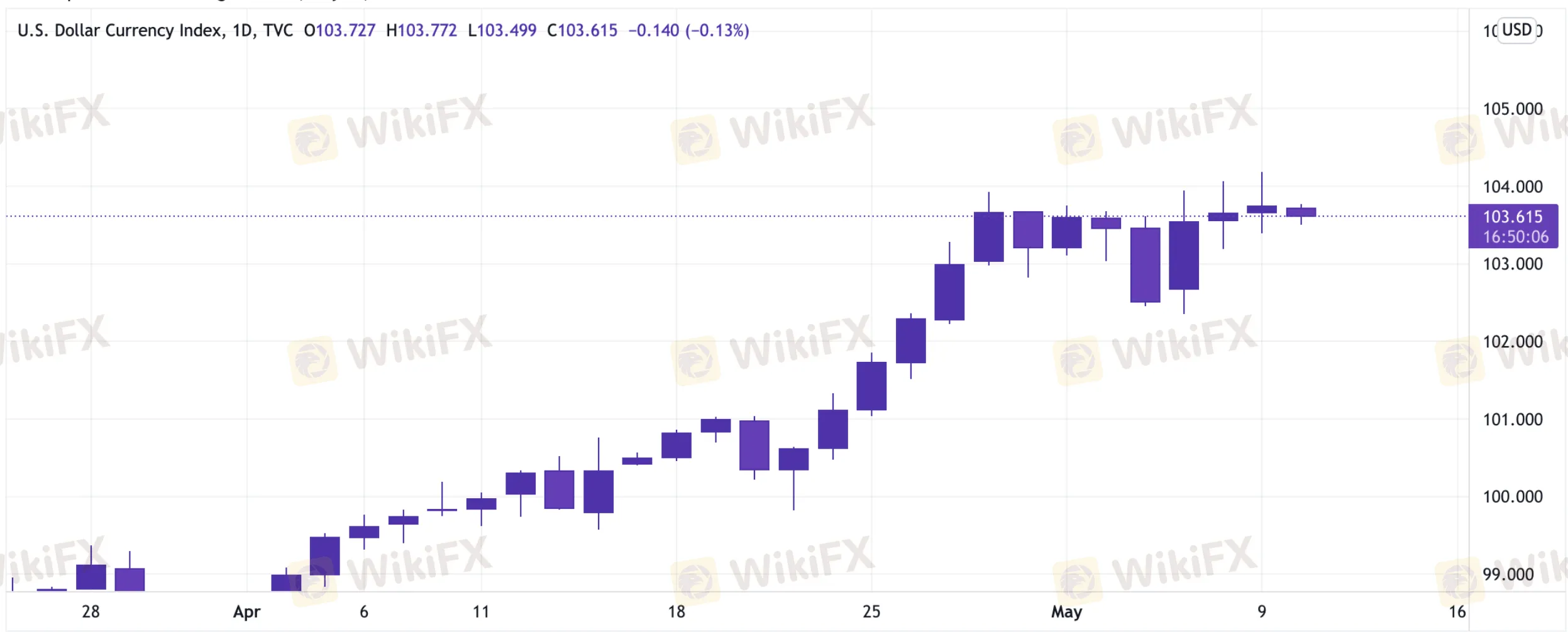

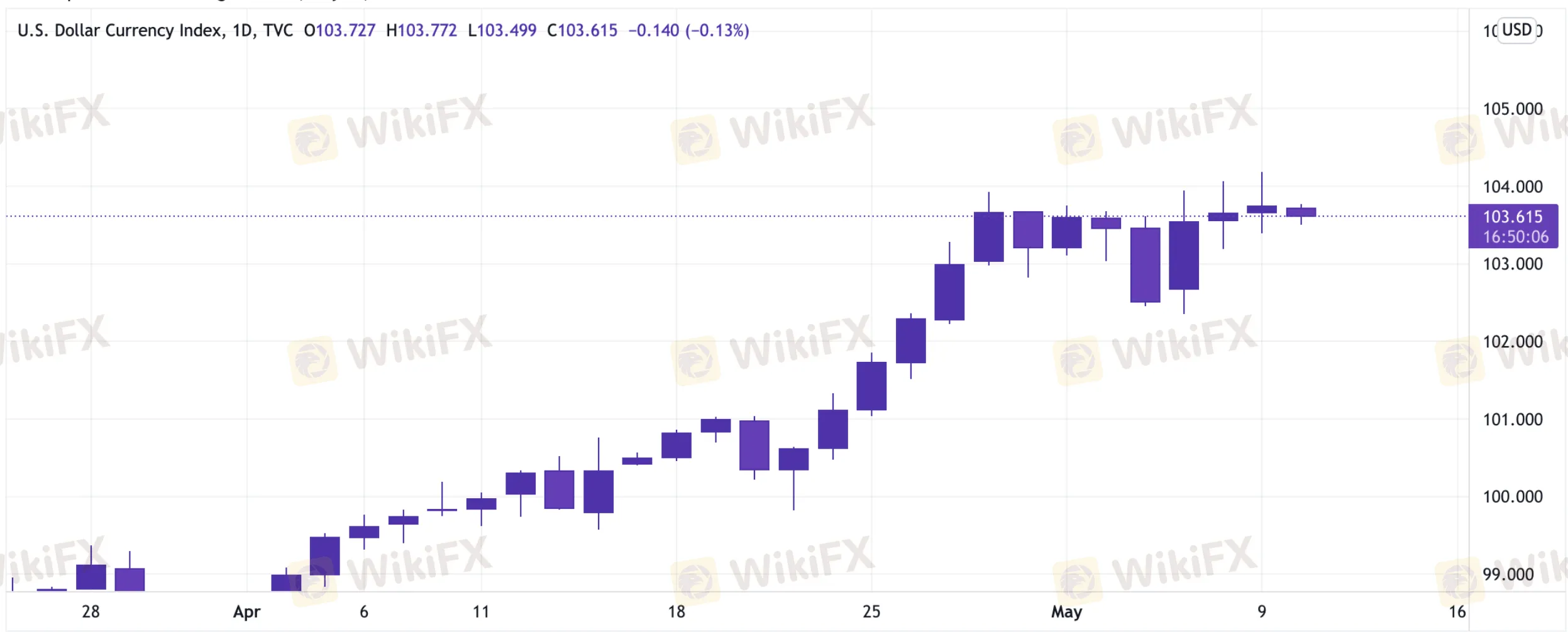

On Monday (May 9), the U.S. dollar index hit a 20-year high of 104.1921, stemming in part from concerns about the Federal Reserve‘s ability to fight high inflation, sparking risk aversion and boosting the dollar’s safe-haven appeal. As of writing, the USD is trading at 103.615 and this marks the fifth consecutive week of its rally as the U.S. Treasury yields climb.

Samy Chaar, the chief economist at Lombard Odier, said the dollar's surge has the potential to “disrupt the broader market environment and expose economic and financial vulnerabilities in the existing financial system.”

The dollar index has gained about 8% year-to-date. Although many analysts argue that the dollar has reached its peak, this current uptrend seems difficult to reverse as the dollar‘s safe-haven appeal remains intact. Barclays’ dollar financing stress indicator is approaching its highest level in 7 years and Barclays range analysis reports a possibility for the dollar index to rise another 2-3%.

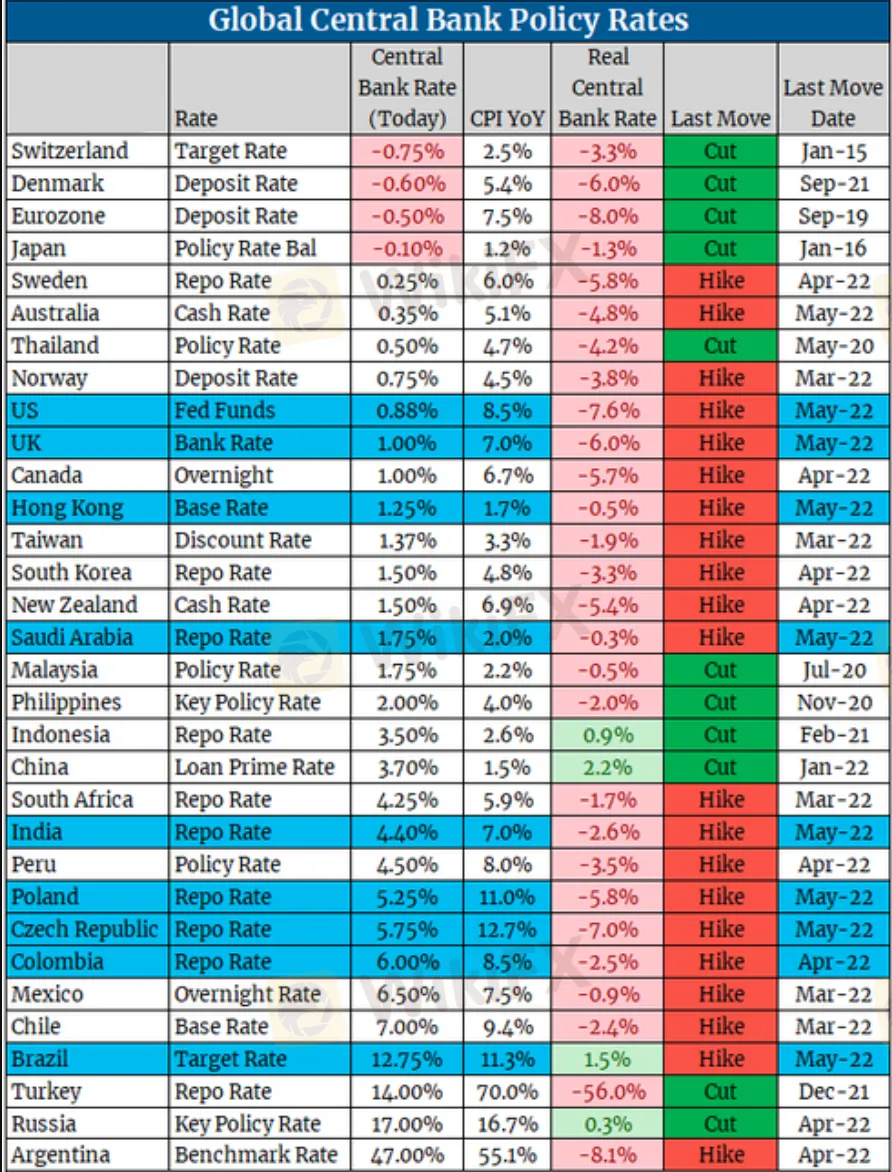

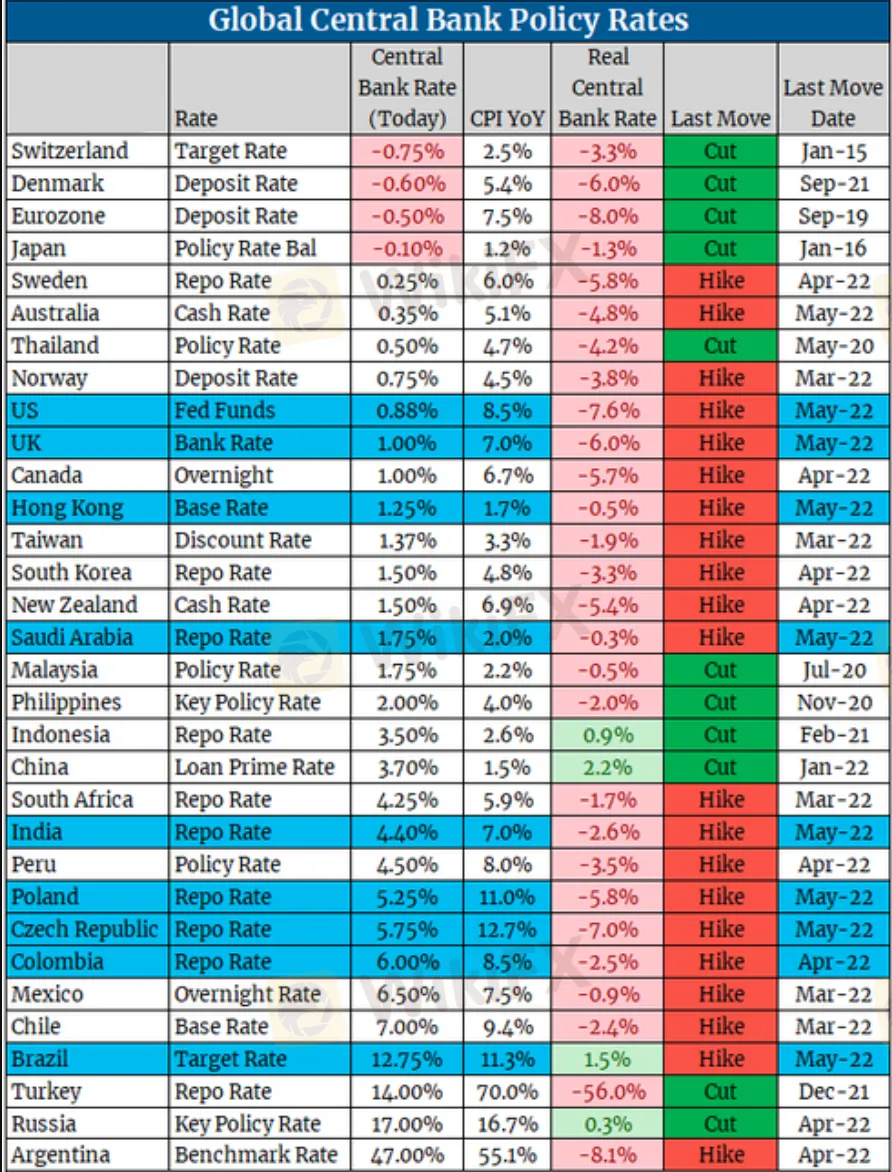

As the dollar strengthens, developing countries must tighten monetary policy to prevent their currencies from depreciating. Failure to do so will increase inflation and push up the cost of servicing dollar-denominated debts. In just a few days since the start of May, several central banks from emerging economies have raised their interest rates accordingly too.

Generally, in foreign exchange and commodity markets, a stronger dollar makes dollar-denominated commodities more expensive, consequently dampening consumer demand and thus prices. However, that has not happened this year due to existing supply chain challenges such as Russia-Ukraine conflict and global epidemic blockade that have hampered production and trading of major commodities which have been driving prices up.

On the contrary, the Fed is more than happy to see the dollar rise even higher at the moment. Société Générale S.A. expects that every 10% appreciation of the dollar could lead to a 0.5 percentage point drop in the U.S. CPI. Therefore, the Fed may also raise interest rates by 200 basis points, while the Fed's policy rate could reach a peak of approximately 3.5% by mid-2023.

Federal Reserve Bank of Minneapolis President, Neel Kashkari explained on Friday that suppose if supply chain issues continue to persist, the Fed ought to be more aggressive in raising interest rates while facing the risk of recession. However, he also mentioned that this approach alone is unlikely to be the core solution to bring inflation down to the Feds 2% target. He reiterated that policymakers should pay close attention to the degree of interest rate rise to maintain a healthy equilibrium.

The U.S. will be releasing the Consumer Price Index (CPI) and Producer Price Index reports on both May 11 and 12 (UTC +8) respectively.

According to the survey carried out by Reuters, economists are expecting to see the median estimate of prices rise at an annual rate of 8.1% in April. It is time for dollar traders and investors to fasten their seatbelts once again in preparation for a volatile ride.

<WikiFX Malaysia Original – Editor: Fion>