TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Canada’s mega regulator, the Investment Industry Regulatory Organization (IIROC) today warned Canadian investors not to be fooled by Unicorn FX.

Unicorn FX is falsely claiming to hold a local registration while not actually licensed by the commission or any other competent authority. According to the IIROC, the broker is posting on its website a certificate of incorporation carrying its name and purporting to be incorporated in Canada, yet this certificate is a complete forgery, the watchdog says.

“UnicornFX, also known as Unicorn Global Limited, is falsely claiming to be a legitimate foreign exchange broker regulated by IIROC. This unregulated, offshore company is using a forged certificate claiming to be regulated by IIROC. IIROC does not issue certificates to regulated firms,” the regulator said.

The IIROC also warns of the substantial potential for fraud at this time, saying that crooks often try to capitalize on high-profile news events to lure investors into financial cons.

Of note, IIROC enjoys a unique structure as it regularly updates FX margin trading requirements subject to FX volatility.

While IIROC rarely uses this power, but the watchdog intervenes, particularly in situations where no other domestic regulator has the power to act (such as where a firm is proposing to offer a foreign-produced highly-leveraged product to retail clients).

The chief regulatory body in Canada has recently proposed a regulatory framework that provides clarity for derivatives activities. Among other things, all highly leveraged products offered to retail clients must be approved in advance by IIROC. Brokers must obtain prior approval for their leveraged products either when releasing new instruments or introducing any changes to the current offerings.

CFD sellers also have their rights restricted with regard to the level of promotion of CFD contracts in order to eliminate existing regulatory arbitrage situations. Further, an additional risk warning is now required, clearly indicating the level of risk to which CFD buyers would be exposed. The risk disclosure statement provided must be approved by IIROC.

The self-regulatory organization has also revised the “institutional client” definition. The new approach aims to avoid drawbacks of the current classification methodology where all individual clients are considered retail, regardless of their investment knowledge or assets they have under administration.

While a retail client can be a wealthy individual or a small business, both are often knowledgeable and, therefore, less likely to make uneducated investments. As such, the predominant distinction between retail and institutional clients will be their financial assets. Specifically, individuals and firms may be eligible to reclassify as a professional client whenever their capitals exceed $5 million and $25 million, respectively.

The updated rules harmonize Canadas regulations with product approval requirements introduced in Europe by ESMA, which banned offering binary options and restricted leverage on CFDs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

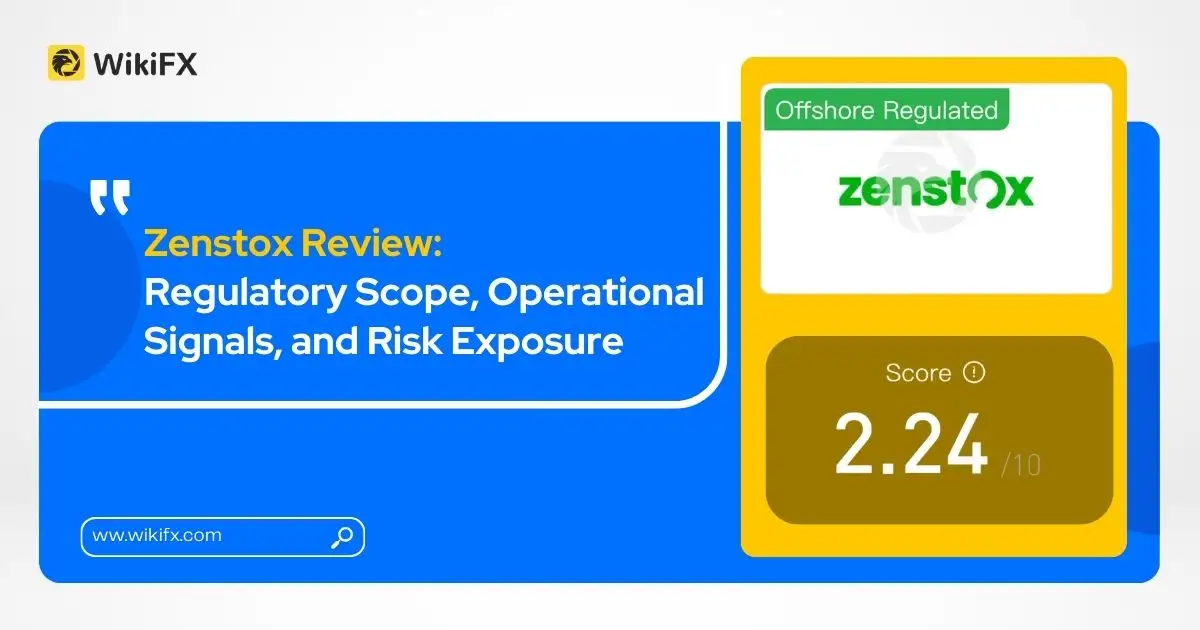

New findings raise concerns over Zenstox’s offshore licensing, internal trading structure, and reported fund access issues.

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Yiannos Ashiotis, the Group Managing Partner of Pnyx Hill and the Board Chairman of Revolut Digital Assets Europe.

TopFX is a regulated broker under CySEC, holding Market Maker license No.138/11 since 2011.