Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:For Jeremy Fong, U.S. crypto lender Celsius was an ideal place to stash his digital currency holdings – and earn some spending money from its double-digit interest rates along the way.

“I was probably earning $100 a week,” at sites like Celsius, said Fong, a 29-year civil aerospace worker who lives in the central English city of Derby. “That covered my groceries.”

Now, though, Fongs crypto – about a quarter of his portfolio – is stuck at Celsius.

The New Jersey-based crypto lender froze withdrawals for its 1.7 million customers last week, citing “extreme” market conditions, spurring a sell-off that wiped hundreds of billions of dollars from the paper value of the cryptocurrencies globally.

Fongs long-term crypto holdings are now down about 30%. “Definitely in a very uncomfortable position,” he told Reuters. “My first instinct is just to withdraw everything,” from Celsius, he said.

The Celsius blow-up followed the collapse of two other major tokens last month that shook a crypto sector already under pressure as soaring inflation and rising interest rates prompt a flight from stocks and other higher-risk assets.

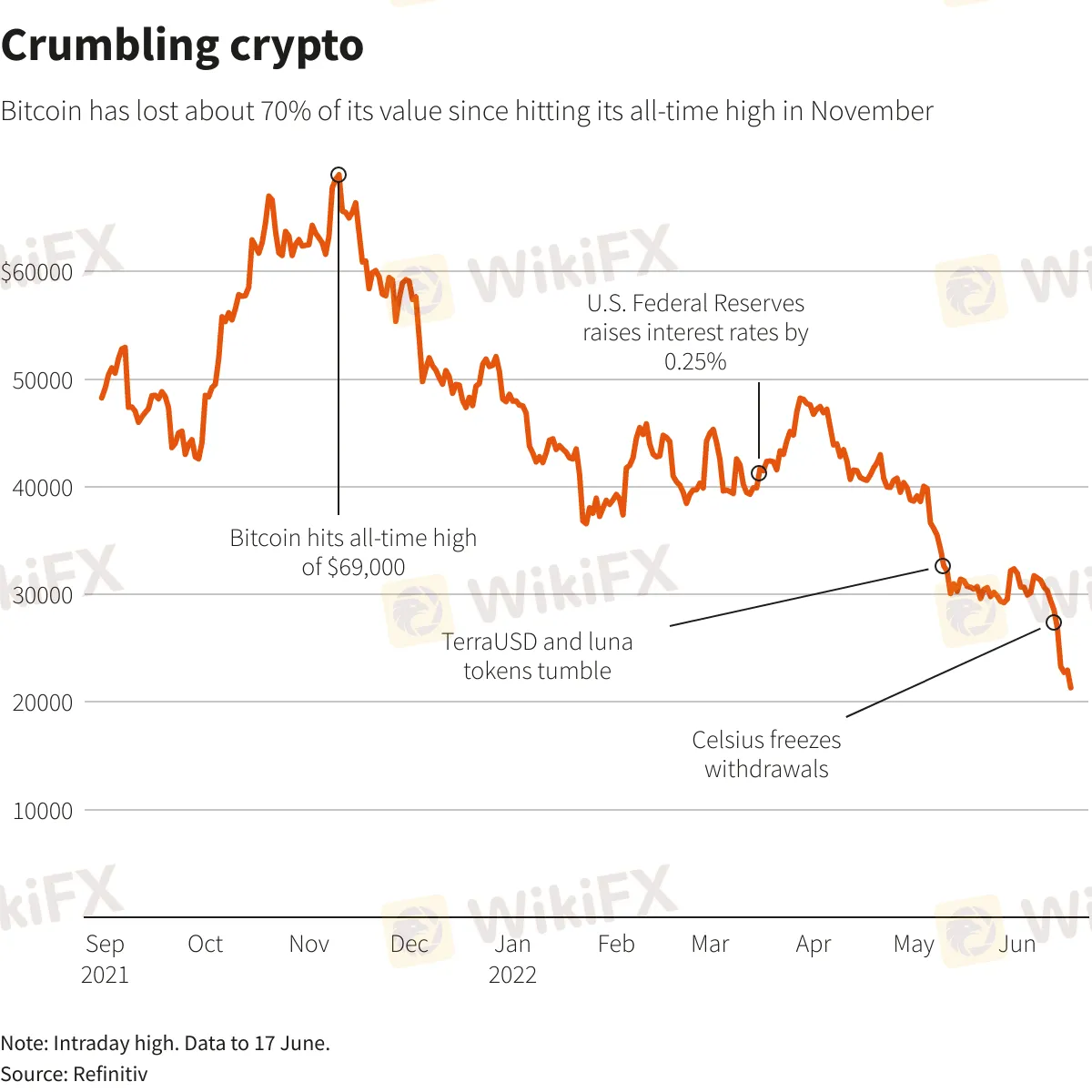

Bitcoin fell below $20,000 on June 18 for the first time since December 2020. It has plummeted around 60% this year. The overall crypto market has slumped to around $900 billion, down from a record $3 trillion in November.

The tumble has left individual investors across the world bruised and bewildered. Many are angry at Celsius. Others swear never to invest in crypto again. Some, like Fong, want stronger oversight of the freewheeling sector.

Susannah Streeter, an analyst at Hargreaves Lansdown, compared the turmoil to dotcom stocks crash in the early 2000s – with technology and low-cost capital making it easy for individual investors to gain access to crypto.

“We‘ve got this collision of smartphone technology, trading apps, cheap money and a highly speculative asset,” she said. “That’s why youve seen a meteoric rise and fall.”

‘PACING IN THE DARK AT 2 A.M.’

Crypto lenders, such as Celsius, offer high interest rates to investors – mostly individuals – who deposit their coins with these sites. These lenders, mostly unregulated, then invest deposits in the wholesale crypto market.

Celsius troubles appear to be related to its wholesale crypto investments. As these investments turned sour the company was unable to meet client redemptions from investors amid the broader crypto market slump.

The redemption freeze at Celsius was akin to a small bank shutting its doors. But a traditional bank, overseen by regulators, would have some form of protection for depositors.

One of those impacted by the Celsius freeze was 38-year old Alisha Gee in Pennsylvania.

Gee invested “every last bit” of her paycheques in crypto since 2018, which have built up into a five-figure sum. She has $30,000 of deposits at Celsius – part of her overall crypto holdings – earning her interest of $40-$100 a week, which she hoped would help her to pay off her mortgage.

Just over a week ago, Gee got an email from Celsius saying she couldnt make withdrawals. “I just was pacing in the dark at 2 a.m., just back and forth,” she said.

“I believed in the company,” Gee said. “It doesn‘t feel good to lose $30,000, especially that I could’ve put towards my mortgage.”

Gee said she would continue to use Celsius, saying she was “loyal” to the company and hadnt experienced problems before.

Celsius CEO Alex Mashinsky tweeted on June 15 the company was “working non-stop,” but has given few details of how or when withdrawals would resume. Celsius said on Monday it was aiming to “stabilize our liquidity and operations.”

Guardrails

For some, enthusiasm for crypto is undimmed.

“I have seen multiple bear market cycles by now, so I am avoiding any knee-jerk reaction,” said 23-year old Sumnesh Salodkar in Mumbai, whose crypto holdings are down but still in positive territory.

For others, warnings from regulators across the world about the risks of dabbling in crypto have become reality.

Halil Ibrahim Gocer, a 21-year old in the Turkish capital Ankara, said his fathers crypto investments of $5,000 have tumbled to $600 since he introduced him to crypto.

“Knowledge can only take you so far in crypto,” said Gocer. “Luck is what matters.”

Another investor, a 32-year old IT worker in Mumbai, said he poured three-quarters of his savings – several hundred dollars – into crypto. Its value has plummeted by around 70%-80%.

“This will be my last investment in cryptocurrencies,” he said, requesting anonymity.

Regulators in countries around the world have been working out how to build crypto guardrails that can protect investors and dampen risks to wider financial stability.

The crypto market turmoil sparked by Celsius highlights the “urgent need” for crypto rules, a U.S. Treasury official said last week.

Fong, the UK investor who has lost access to his crypto at Celsius, wants things to change.

“A bit of regulation would be good, essentially. But then I think its a balance,” he said. “If you do not want too much regulation, this is what you get” he said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.