Oil Prices Drop as OPEC+ Pauses Supply Hikes Amid Oversupply Fears

Oil prices fell as OPEC+ paused supply hikes for early 2026, fueling oversupply concerns. A stronger U.S. dollar added to pressure on WTI crude.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

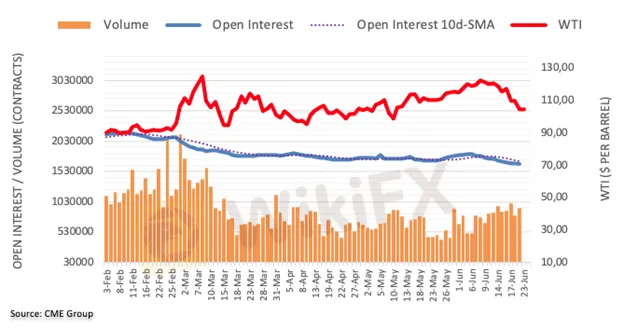

Abstract:Crude Oil (WTI) - Rebound in the offing?

WTI: The $100 mark should hold the downside

Prices of the WTI retreated sharply and revisited the $101.00 region on Wednesday. The strong downtick was due to shrinking open interest in the futures market, giving the hint that a deeper pullback is not favored in the near term.

The further downside in prices of the commodity should meet tough support around the $100.00 area.

That said, the black gold is on the downtrend for the second consecutive day, down 1.0% around $102.90, amid early European morning on Thursday.Aclear downside break signal of the three-month-old support line, near $101.00 by the press time, appears necessary for the bears.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Oil prices fell as OPEC+ paused supply hikes for early 2026, fueling oversupply concerns. A stronger U.S. dollar added to pressure on WTI crude.

Oil prices fell sharply this week as traders worried that OPEC+ might decide to pump more oil into the market at its upcoming meeting.

Finally, the day (August 27, 2025) arrived that India did not want. The imposition of 50% tariff by the US administration on most products exported from India. As per the US, the tariff is largely due to India continuing to purchase Russian oil. The extra 25% duty was added over 25% imposed at the beginning of August 2025 as India refused to stop purchasing Russian crude and defence hardware. Check out the sectors that will be hit the hardest with this tariff increase.

The week ahead: Top 5 things to watch