Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Investment markets always carry a risk of loss. However, it shouldn't be the result of your negligence, which refers to losing your hard-earned money to scam brokers that you can avoid with precautions.

Today, we discuss how shabby brokers like UPTOS defrauds investors and what you should do to prevent yourself from falling into their trap.

Uptos - A Quick Overview

Uptos (https://uptos.com/) is an offshore brokerage firm based in St. Vincent and Grenadines. The broker allows clients to access various tradable assets across multiple financial markets, including forex, stocks, indices, commodities, and digital currencies. The company claims to offer reliable trading conditions through its custom-built trading platform supported across all channels, including Web, Desktop, and Mobile. It also supports copy trading.

Is Uptos Regulated?

No, Uptos is not regulated anywhere in the world. Moreover, the company claims to be registered in St. Vincent and Grenadines. However, it doesn't appear in the search result on St. Vincent and the Grenadine Financial Services Authority (SVG FSA) website. What's more, the SVG FSA doesn't regulate or issue licenses to financial intermediaries dealing in forex and CFD trading. Therefore, Uptos is a scam.

Clientele Feedback

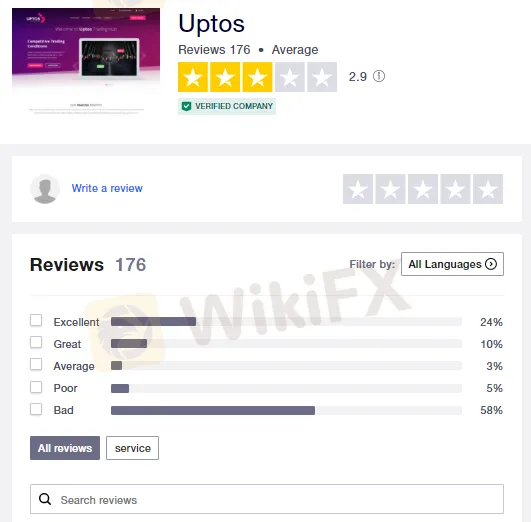

Clients seem to be highly disappointed with the broker. Almost 60% of investors have denounced the company for its poor code of conduct.

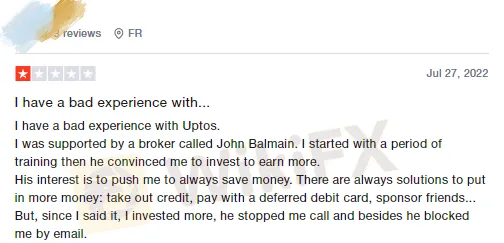

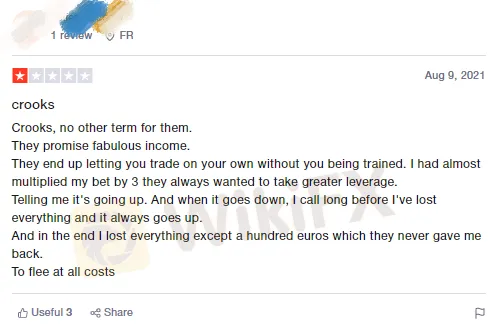

According to clients, the company stole their money through price manipulation. Traders have also accused the company of withdrawal issues, account closures, and poor customer support. Let us share some screenshots we captured from different reviewers' websites.

How does Uptos Defraud Traders?

Uptos traps clients in an organized manner. When you visit a broker's website for the first time, you are unlikely to distinguish it from a legitimate platform. In addition to enticing them to use automated trading features for quick returns, brokers also come up with attractive trading strategies that attract investors.

From product listing and specifications to the publicity of advanced trading tools and features and claiming legal compliance, the company has every resource to make you believe it to be a trusted partner.

When you signup with the broker, its marketing team follow-up and urges you to make a deposit. Pretending to be your account manager, it assure you of a profitable trading endeavor.

After receiving funds from you, it either push you to make more deposits by luring you into special deals or persuade you to try its auto-trading feature.

According to clients, the auto trading robot brings you profitable trades initially. However, you start losing your positions after a while. Further, when you try to withdraw your leftover funds, the company drives you nuts and doesn't release your money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.