WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

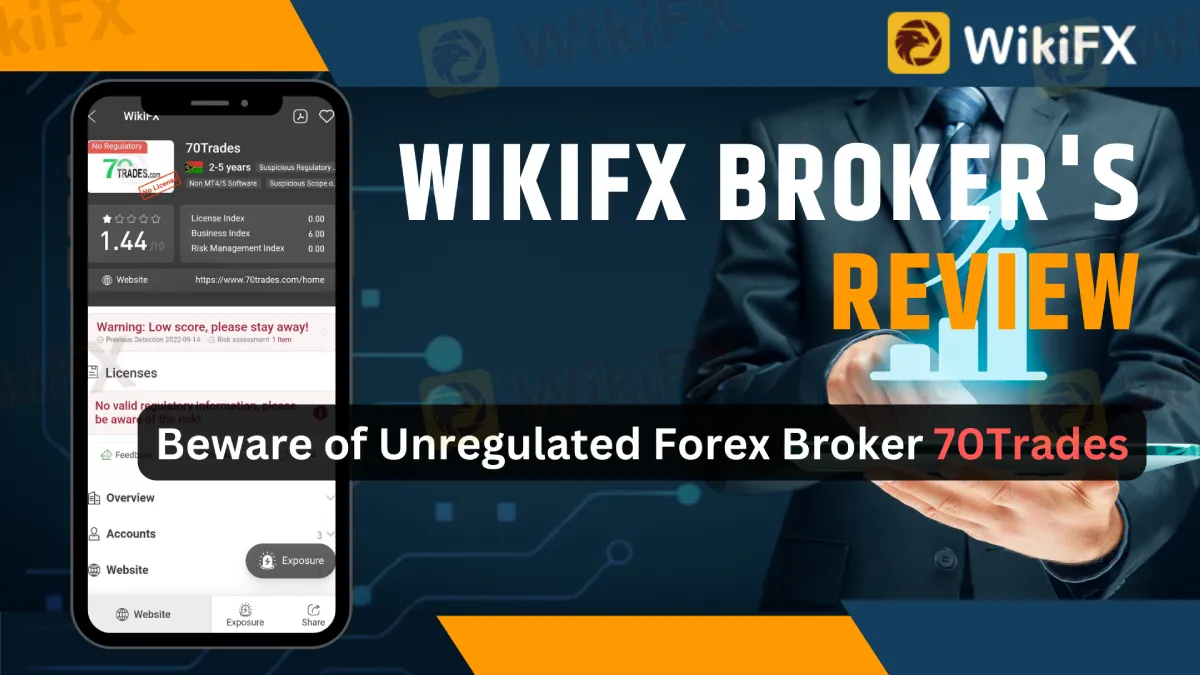

Abstract:Scams have long been a problem in the Forex market. Due to a lack of resources, it was difficult for inexperienced traders to distinguish between a legitimate and a fraudulent broker in the past. However, times have changed. It is now much easier to avoid fraudulent Forex brokers. It merely takes a few minutes to read up on basic information on independent reviewing websites like WikiFX and determine if the broker is worthwhile. This essay will draw your notice to a dubious broker, 70Trades.

A Quick Review of 70 Trades

70Trades (https://70trades.com/) is a 2016 offshore forex broker. The firm provides retail trading services in a variety of asset types, including equities, commodities, currencies, and indexes. While the broker's Web-based platform enables customers to access financial markets online, the firm also offers a mobile trading app to help investors on the move. Customer service is provided in a variety of languages by phone, email, and live chat. Online trading lessons, market news and updates, expert analysis, and webinars are also available.

Is 70Trades a regulated industry?

Securcap Securities Limited, situated in Seychelles, operates under the brand name 70Trades. The broker is licensed by the Seychelles Financial Services Authority and operates under License (Seychelles FSA) No. SD012. Furthermore, it is not registered or controlled anyplace else.

What do others think about 70Trades?

Customers have ranked the firm as one of the worst brokers accessible. The firm is chastised for its intimidating, high-pressure selling practices, as well as the disappearance of monies from accounts.

Investors have also experienced withdrawal troubles with the firm and expressed dissatisfaction with its poor customer service. Let us show you some screenshots from the websites of BrokersView and a few other independent reviews.

What Makes 70Trades a Risky Broker?

Without strong evidence, it is impossible to claim that a broker is a dishonest business. So, here are the indicators that should be enough to demonstrate that 70Trades is a suspect broker:

First and foremost, the Seychelles FSA is an offshore regulator. Brokers must have a minimum licensing capital of $50,000 and pay a US$2,500 application fee. Depending on the kind of license, it might take anywhere from 6 to 18 months to receive one. Overall, regulation in Seychelles is lax.

Second, the firm does not provide third-party trading platforms such as MT4, MT5, and cTrader. As a result, customers must trade using the custom-built online terminal or mobile app, which has various risks.

Third, a customer claimed that the organization utilized pressure-oriented marketing strategies to entice him or her into “false lucrative transactions.” Clients were also displeased with the account inactivity charge of up to $500 and thought that the broker was just concerned with generating money.

Furthermore, bad client feedback on various websites speaks poorly of 70Trades, which has a 1.44 score on WikiFX owing to its regulatory status, which is the most significant element for a forex broker to be allowed to conduct business in the forex market.

Why are clients unhappy with this broker?

After you join up, the firm contacts you through email or phone and requests deposits; the marketing staff poses as your dedicated account manager and lies to persuade you to put money into your account.

When you fill your account and begin trading, the broker manipulates prices and enables you to win a few bets; according to some customers, you may even withdraw modest amounts of money from your account.

Clients believe that the company does this on purpose to gain your trust and get you to add more funds to your account. However, once you appear to have funded your account to the maximum extent, it begins to play against you. You begin losing most of your trades, and your account balance quickly vanishes. The broker barely answers your calls or responds to your emails afterward.

In conclusion

Trading with 70Trades is not encouraged.

Remember that the forex market is full of untrustworthy brokers, so you must exercise extreme caution when choosing a broker. Reading reviews about brokers on BrokersView may save you time and money.

Keep an eye out for more broker news.

WikiFX App may be downloaded through the App Store or the Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.