BIONM App Promised 15% in Two Months and Cost a Retiree RM1.36 Million

A 70 year old manager has lost RM1.36 million after falling victim to an online investment scam through a mobile app named ‘BIONM’.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Tuesday, lawyers and officials for the now-defunct cryptocurrency platform FTX went to court and said that an investigation is still going on into the assets that the company's founder and former CEO, Sam Bankman-Fried, once owned.

They also asked that the identities of the company's consumers be kept private.

The two-hour hearing was a normal way to approve FTX's requests to pay its consultants, workers, and suppliers. It was also a chance to settle any early disagreements about how the lawsuit should go.

But the first hearing proved that FTX's Chapter 11 reorganization might be one of the most unusual cases ever heard in a US bankruptcy court. In fact, FTX's lawyer called it “an unprecedented event.”

Here are the three most important takeaways.

As expected, U.S. Bankruptcy Judge John Dorsey, who is in charge of the case, gave FTX permission to pay its ongoing business costs. Bankman-Fried and his senior deputies before him, who have since left the platform, were not paid.

But FTX's lawyer, James Bromley of Sullivan & Cromwell, pointed out in a court presentation that the crypto exchange's new administrators and forensic investigators can't find its assets because of unusual circumstances.

“While significant progress has been made, your honor, we stand here today with a lack of information,” Bromley told Judge Dorsey. “We do not have the typical quantity of information that a debtor would have.” But we create more and more every day.

Bromley went on to criticize Bankman-Fried for running FTX with lax corporate and accounting procedures.

“Your Honor, what we have is a multinational organization, but it was essentially administered as Sam Bankman-personal Fried's domain,” he stated.

Still, the fact that more assets might be found is good news for people who want their money back, like consumers and other creditors. In court, Bromley said that “a large percentage of the debtor's assets are stolen or missing.”

FTX has hired Nikki Friedlaender, former chief of Complex Frauds and the Cybercrime unit in the Southern District of New York, and Steve Pekin, former director of enforcement for the Securities and Exchange Commission, as well as blockchain analytics firm Chainalysis and investigative firm Nardello, to determine whether the $400 million in stolen crypto assets can be recovered.

As of Tuesday, the exchange had shown that it owed about $9 billion and had about $1.24 billion in cash and cash equivalents. After payments for current costs, the indebted firms expect $459 million in cash on hand for the week ending December 23, according to FTX management.

During Tuesday's session, a disagreement arose over the identities of FTX's more than 1 million clients, whose monies are now entangled in the bankruptcy.

The U.S. Trustee, a government agent appointed in bankruptcy proceedings in the United States, objected to FTX's claim that the identities of its clients should be kept under seal.

“We suggest that overbroad redactions do not help transparency in these circumstances,” Ben Hackman said on behalf of the U.S. Trustee, saying that identities should be made public unless prohibited by foreign legislation, such as the European Union's GDPR.

Judge Dorsey eventually agreed to FTX's request to keep the names and addresses of the people involved secret for now, until the case is heard again at a later time.

Redacting the identities of crypto company creditors is an unsettled subject in US Federal Bankruptcy courts. In September, in the Southern District of New York, Celsius Network lost its bid to keep the names of its creditors secret.

“For the time being, the court went the safe road and prioritized consumer privacy and security concerns,” Jason DiBattista, Levin's director of legal analysis, told Yahoo Finance of today's judgment.

In anticipation of a dispute over which nation has the power to oversee FTX's assets—the United States or The Bahamas, where FTX is located — FTX identified two criteria that might benefit the United States Bankruptcy Court.

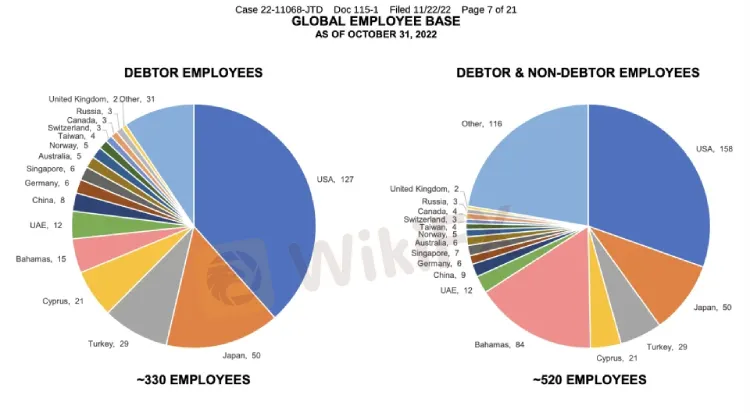

As of October 31, 2022, the debtor firms in the U.S. filing had 330 people working for them around the world, with 127 of those people working in the U.S.

He said that most of the company's customers come from the Cayman Islands and the Virgin Islands. Customers from China, the UK, and Singapore are next in line. Among FTX's overseas firms, 94% of its clients were FTX Trading Ltd., a US debtor.

FTX Digital Markets Ltd., a Bahamian company, has around 6% of the consumers.

The corporation has also spent $300 million on Bahamian real estate via FTX.com.

Stay tuned for more Forex hot news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

A 70 year old manager has lost RM1.36 million after falling victim to an online investment scam through a mobile app named ‘BIONM’.

A 45-year-old businessman has lost more than RM1.7 million in an alleged online investment scam.

A Malaysian activist has alleged the emergence of a new scam compound near Myawaddy, Myanmar, dubbed “KK Park 2.0,” highlighting how fraud syndicates may be adapting to regional crackdowns by shifting operations to remote, heavily secured locations.

Did you find a contrasting difference between Diago Finance’s deposit and withdrawal processes? Were deposits seamless, but withdrawals remained difficult? Did you fail to receive your funds despite paying extra fees? Did the Saint Lucia-based forex broker scam your hard-earned capital? You are not alone! Many traders have expressed concerns over the alleged illegitimate trading activities carried out by the broker. In this Diago Finance review article, we have investigated some complaints against the broker. Take a look!