WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:CMC Markets Singapore Invest Pte. Ltd., the Singapore subsidiary, is anticipated to soft-launch CMC Invest at the end of 1Q 2023, allowing customers a multi-product single platform to trade international and local equities, ETFs, futures, and options, pending final regulatory permission.

“This news represents a significant milestone and validation for CMC Markets. Our company has been delivering CFDs in Singapore since 2007, but the CMSI Capital Markets Services Licence will enable us to provide our customers with more solid investment products such as shares and ETFs.”

The Monetary Authority of Singapore has given CMC Markets regulatory in-principle permission for a capital markets services license (CMSL) to enable online and mobile trading of internationally listed shares, exchange-traded funds, futures, and options.

CMC Markets Singapore Invest Pte. Ltd., the Singapore subsidiary, is anticipated to soft-launch CMC Invest at the end of 1Q 2023, allowing customers a multi-product single platform to trade international and local equities, ETFs, futures, and options, pending final regulatory permission.

CMC Invest will provide 0% commission and real-time pricing to customers in certain markets like as Singapore, the United States, and Australia. CMC Markets already holds CMC Invest licenses in the UK and Australia.

Meanwhile,

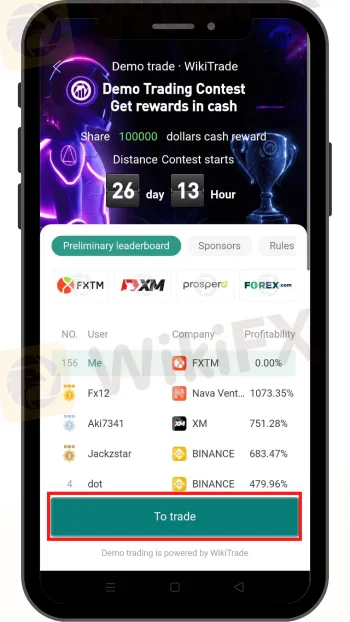

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

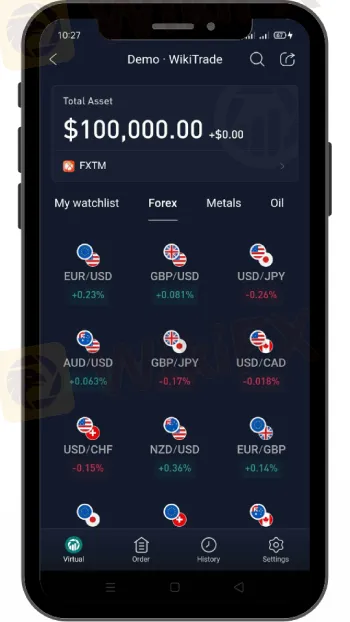

You should see the trading platform and may select the trading instruments you wanted to trade

Good luck and enjoy your trading experience!

CMC Markets, founded in 1989, is a prominent brokerage business that services retail and institutional customers via regulated offices and branches in 12 countries, with a substantial presence in the United Kingdom, Australia, Germany, and Singapore.

Clients may trade up to 10,000 financial instruments spanning equities, indices, foreign currencies, commodities, and treasuries using CFDs, spread bets (in the UK and Ireland only), and stockbroking services in Australia.

The recent surge in multi-asset trading has prompted CMC Markets to develop CMC Invest, which will soon be available to Singapore citizens, giving them access to worldwide and local equities, ETFs, futures, and options.

“This news represents a big milestone and confirmation for CMC Markets,” said Christopher Forbes, Head of CMC Invest Singapore. Our company has been providing CFDs in Singapore since 2007, but the CMSI Capital Markets Services Licence will enable us to provide our customers with more solid investment products such as shares and ETFs.

“We know that Singapore is a sophisticated market when it comes to the financial services sector and we opted to establish CMC Invest here owing to its excellent corporate governance infrastructure and regulator. This underscores our commitment to Singapore, and we look forward to providing our customers with a new world-class platform.”

CMC Invest has unveiled a new Plus plan in the United Kingdom, giving flexible stocks and shares ISAs, a USD currency wallet, and a broader investment selection for a monthly custodial cost of £10.

The UK investing platform's new strategy, which includes a flexible stocks and shares ISA and allows clients to construct an investment portfolio that fits them, is aimed at consumers who wish to contribute up to £20,000 per tax year and shelter their investment returns from tax.

Only a few investment providers provide flexible ISAs, which enable users to withdraw money from their ISA and re-invest it within the same tax year without affecting their ISA limits.

In the United Kingdom, the dividend allowance and yearly capital gains tax exemption will be reduced from £12,300 in the current fiscal year to £6,000 in 2023/24 and £3,000 in 2024/25. As a result, flexible ISAs are a very appealing option for clients.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.