WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:eToro, Israeli social trading, and multi-asset brokerage firm, has extended its service offering and trading tools by embracing additional markets, including Italian equities traded on underlying exchanges.

The broker recently alerted its customers about the additional features in a statement. eToro users may now trade stock CFDs for certain Italian firms.

In recent years, the justification for adding new assets has grown as the company's customers from specific countries, such as fund managers, hedge funds, and commodities trading advisers, have shown a desire to actively trade local equities.

The new capabilities come on the heels of eToro enabling its US users to trade options for free, intensifying the brokers' battle to abolish trading costs. The Israeli corporation claims that the launch would broaden its offering to US customers, which is presently limited to equities, exchange-traded funds (ETFs), and cryptocurrencies.

eToro, which operates in a field dominated by both established businesses and high-flying applications, said that more of its key products would be accessible to American consumers in the near future.

Scaling eToro's US operations follow the firm's regulatory approval to purchase options trading platform Gatsby for about $50 million. Gatsby, co-founded in 2018 by Jeff Myers and Ryan Belanger-Saleh, is a commission-free option and stock-trading software geared towards younger traders.

Over the previous several months, eToro has witnessed key appointments and exits. Dylan Holmani, the broker's head of Global Sponsorships for over seven years, left the company in December. It had previously elevated Orel Assia to the position of head of growth for its eToro Money program.

Meron Shani was recently appointed as the broker's Chief Financial Officer. His appointment followed the departure of Shalom Berkovitz, the company's departing CFO and deputy CEO.

Meron joined eToro as vice president of finance in 2019. He was responsible for a variety of tasks within the organization, including financial, legal, compliance, and risk management. He comes into his new job with a strong history in the igaming business, where he has held numerous financial roles for over 19 years.

The executive changes occurred after eToro fired off 100 workers, half of whom were based in Israel. This figure reflects around 6% of the company's overall personnel.

Meanwhile,

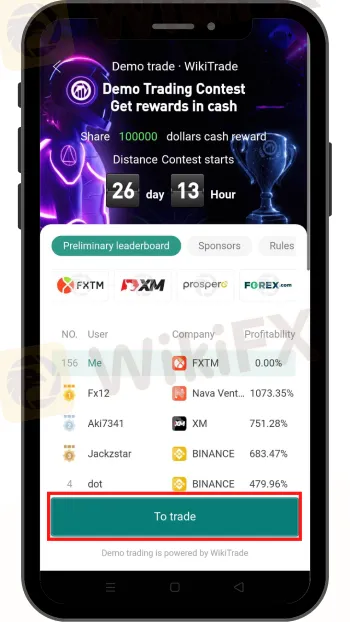

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

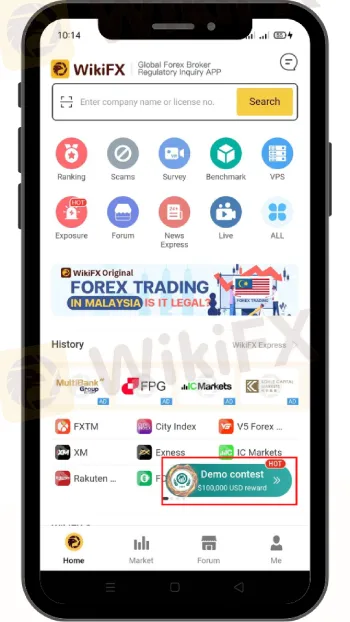

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

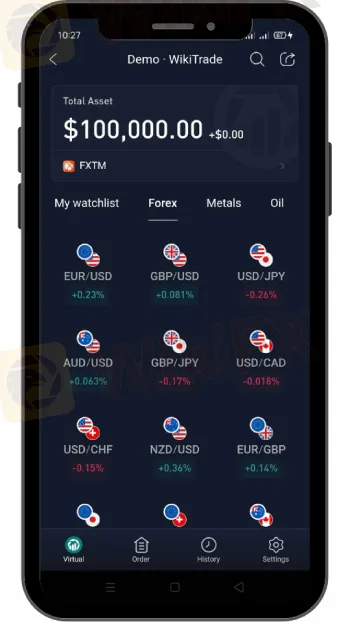

You should see the trading platform and may select the trading instruments you wanted to trade

Good luck and enjoy your trading experience!

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.