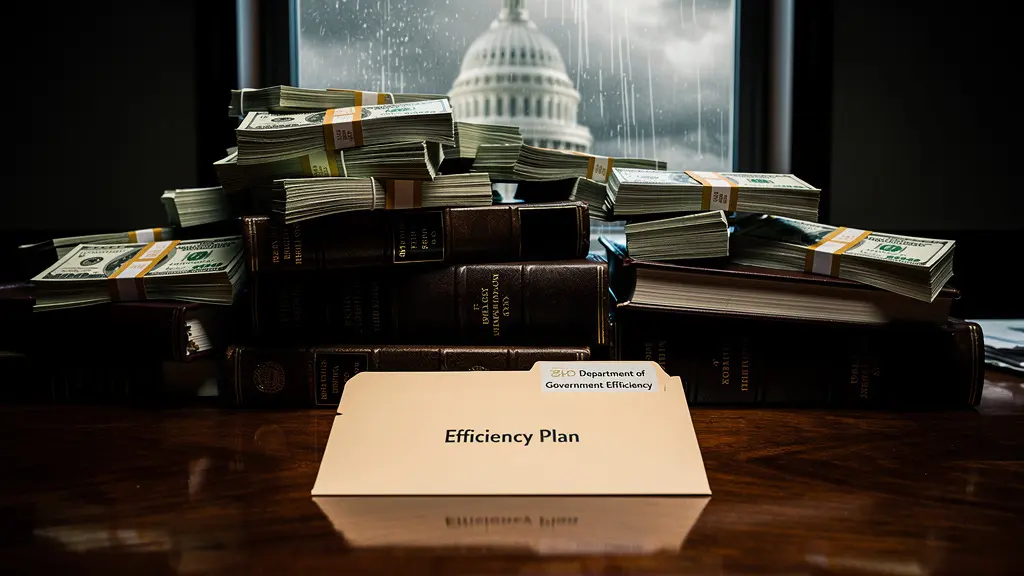

US Fiscal Monitor: Efficiency Office Cuts Jobs, But Spending Hits New Highs

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The recent trading overview suggests that the markets are lacking any significant drivers as equities experienced a modest bounce yesterday but fizzled towards the end.

The recent trading overview suggests that the markets are lacking any significant drivers as equities experienced a modest bounce yesterday but fizzled towards the end. The S&P 500 remained below the 4,000 mark, indicating a delicate market mood. In foreign exchange, the dollar was soft, with notable bounces seen in GBP/USD, AUD/USD, and NZD/USD during the day.

Navigating today's market might be challenging, with month-end flows adding to the already delicate market mood. Citi analysts have noted that dollar buying should be expected, so traders should be cautious, especially ahead of the London fix later today.

Looking ahead, euro area inflation data is expected to be released later this week, which could potentially have an impact on the market.

In summary, the current market conditions require traders to exercise caution and closely monitor the market to make informed trading decisions.

WikiFX is a global foreign exchange regulatory inquiry platform that provides information and reviews about foreign exchange brokers, including their regulatory status, business information, and user reviews. It is a third-party service that aims to help traders make informed decisions by providing transparent and reliable information about foreign exchange brokers. The platform also offers a range of services, including forex education, market analysis, and risk management tools. WikiFX has a presence in over 30 countries and regions, with a user base of over 600,000 traders worldwide.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

If you are looking into the Indonesian forex market, you have likely crossed paths with MIFX (Monex Investindo Futures). They are significantly influential in Southeast Asia, particularly Indonesia, with a footprint expanding into Malaysia and Vietnam. But popularity doesn't always equal safety.

VenturyFX is a relatively new brokerage established in 2023 with its headquarters located in Mauritius. While the broker serves clients internationally, notably in regions such as Brazil/Colombia/Spain/Mexico, it currently operates without valid regulatory oversight. The broker holds a WikiFX Score of 1.37, which is considered low and indicates a high-risk environment for traders.