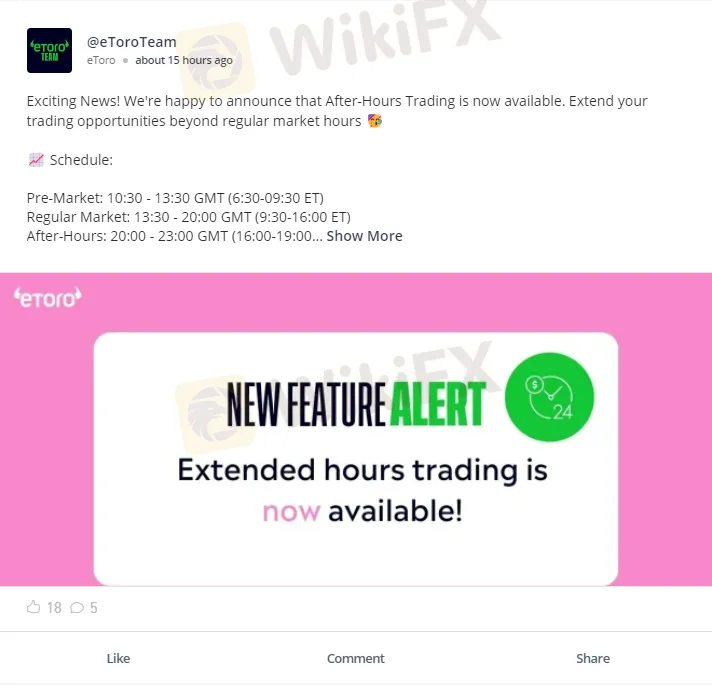

Abstract:eToro introduces After-Hours Trading, offering extended trading hours and more asset options. This article breaks down the schedule, available assets, benefits, and potential risks of this new feature. Stay informed and maximize your trading opportunities with eToro's latest addition.

In a move to provide traders with even more flexibility, eToro has announced the launch of its new After-Hours Trading feature. This innovative addition will enable traders to extend their trading hours beyond the typical market timings, granting them more opportunities to react to market changes.

The Schedule

The trading timings will now be segmented into three main windows:

Pre-Market: 10:30 - 13:30 GMT (6:30-09:30 ET)

Regular Market: 13:30 - 20:00 GMT (9:30-16:00 ET)

After-Hours: 20:00 - 23:00 GMT (16:00-19:00 ET)

Available Assets for After-Hours Trading

Several prominent assets will be available for After-Hours Trading. This includes big names like Tesla (TSLA.EXT), Amazon (AMZN.EXT), Apple (AAPL.EXT), and more. It's important to note that these extended markets trading (both pre and post-market hours) will be offered exclusively through leveraged CFD and can be identified by a separate symbol ending with .EXT.

Understanding the .EXT Symbol

To simplify, the .EXT symbol denotes an extended-hours trade. These symbols represent the same stock but are distinguished from regular trading hours. They come with a separate asset page displaying similar data, feed, and other content, with the added “Extended” icon to mark its difference from the regular assets.

Benefits of Extended Hours Trading

Immediate Reaction to News and Earnings Reports: Numerous companies release crucial information outside of the standard trading hours, causing potential significant price movements. This feature will allow traders to respond instantly.

Greater Flexibility: Depending on individual schedules, traders now have more options to execute trades.

Opportunity for Better Prices: The potential exists for traders to purchase stocks at more favorable prices during these hours.

Preparation for Standard Hours: Insight into the potential opening price of a stock during extended hours can set traders up for success during regular market timings.

Potential Risks

It's crucial for traders to understand that the extended-hours market usually sees less trading volume. This could lead to more volatile price movements which might not always represent the broader market sentiment.

How to Access Extended-Hours Stocks on eToro

Those looking to explore the new feature can find extended-hours stocks on eToro's Discover page or simply use the search bar in the eToro app. Input the name of the desired stock and look for the .EXT asset.

Executing Post-Market Orders

The process remains straightforward. Traders can enter post-market orders using the same screens they would for regular CFD trades.

In conclusion, eToro's new feature offers traders more opportunities and flexibility, but as with all trading, understanding the system and potential risks is vital. Happy trading!