Abstract:This article is about to shed light on the broker named Sway Markets.

About Sway Markets

Sway Markets is an online broker offering trading services in forex, commodities, and cryptocurrencies. The company was established in 2022 and is headquartered in Australia. Sway Markets offers a diverse range of trading instruments, including forex, crypto, stocks, indices, commodities, and futures. This can be beneficial for traders who are looking to diversify their portfolios and take advantage of different market opportunities.

Is it Legit?

Sway Markets is a regulated broker which is regulated by ASIC with a license number 001300469.

Accounts Types&Minimum Deposit

Sway Markets offers four different account types, including ECN, No Commission, VIP, and Islamic accounts.

ECN Account: This account type offers spreads starting from 0.8 pips and commission from $7.5 per lot.

No Commission Account: This account type offers spreads starting from 1.2 pips and no commission fees.

VIP Account: This account type offers spreads starting from 0.3 pips and commission from $3.5 per lot.

Islamic Account: This account type is designed for traders who want to trade in accordance with Shariah law. Islamic accounts have no swap or rollover fees, but they have wider spreads compared to the other account types.

The minimum deposit is $10. Each account type has its own advantages and disadvantages, and traders can choose the one that best suits their trading needs and preferences.

Leverage

It is important to note that leverage is a risky tool that can amplify both profits and losses. While Sway Markets may offer leverage up to 1:500.

Spreads & Commissions

Sway Markets offers different account types with varying spreads and commissions. The ECN and Islamic accounts seem to have the lowest spreads starting from 0.8 pips, while the No Commission accounts have slightly higher spreads starting from 1.2 pips. The VIP accounts seem to have the lowest spreads starting from 0.3 pips and a commission per lot of $3.50.

On the other hand, the ECN and Islamic accounts seem to have the highest commission per lot starting from $7.50, while the No Commission accounts have no commission charges. It's important to note that these values may depend on the trading instrument and the trading volume.

Overall, Sway Markets seems to offer competitive trading conditions with various account types to cater to different trading needs.

Trading Platforms

Sway Markets offers the popular MetaTrader5 (MT5) platform. The MT5 platform is available for download on desktop and mobile devices, allowing traders to access their accounts and trade from anywhere with an internet connection. The platform features a wide range of trading tools and indicators, as well as the ability to use automated trading strategies through Expert Advisors (EAs).

Sway Markets on Social Media Platforms

Sway Markets has made a recent announcement on its official X account, mainly that the broker has now enabled USDT & ETH as part of its Funding Methods.

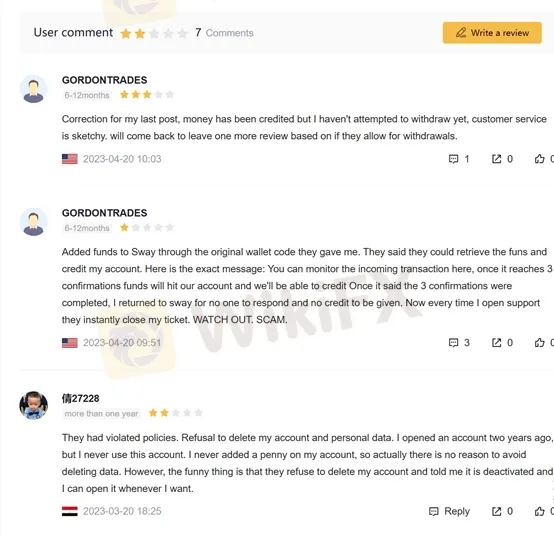

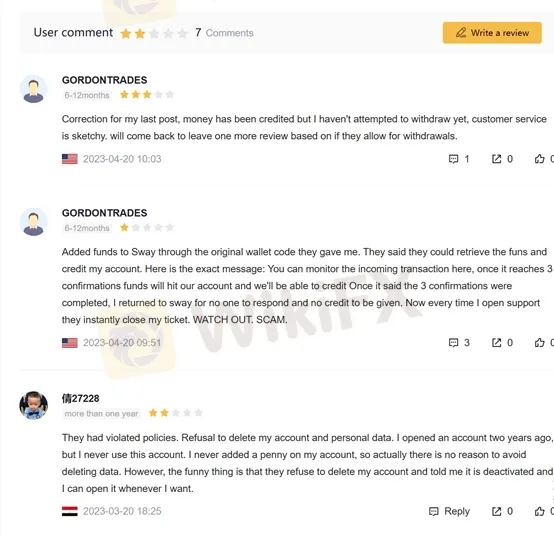

Feedback on Sway Markets

On WikiFX, there is a comment section on the main page of certain brokers. registered investors can add their thoughts about the broker. WikiFX hasnt received exposures related to this broker yet. But we advise you to choose a broker with care.

Conclusion

If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. Before deciding to invest in this broker, make sure to open WikiFX and check the latest updates about this broker, so you may not regret every step you make.