Abstract:One unfortunate investor, Sinan, hailing from Turkey, recently found himself in a distressing situation with Squared Financial, a brokerage platform. Sinan shared his harrowing experience with WikiFX, shedding light on how he lost both his principal and hard-earned profit due to what he claims is commercial misconduct by Squared Financial.

One unfortunate investor, Sinan, hailing from Turkey, recently found himself in a distressing situation with Squared Financial, a brokerage platform. Sinan shared his harrowing experience with WikiFX, shedding light on how he lost both his principal and hard-earned profit due to what he claims is commercial misconduct by Squared Financial.

About Squared Financial

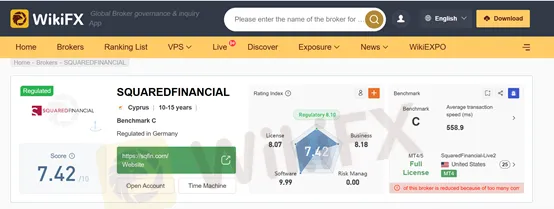

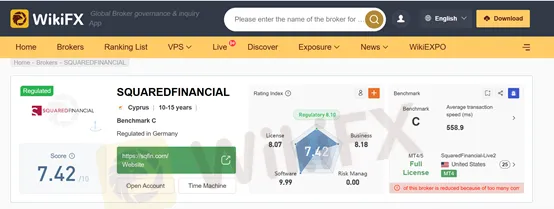

SQUAREDFINANCIAL is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. Squared Financial is a regulated online trading broker that offers access to trade multiple financial instruments, including forex, metals, stocks, indices, futures, energies, and cryptocurrencies. Squared Financial offers its clients a wide range of trading instruments, covering over 10,000 financial instruments across 7 asset classes. This allows traders to diversify their investments and have access to multiple markets to find trading opportunities. The asset classes available for trading include forex, metals, stocks, indices, futures, energies, and cryptocurrencies. Squared Financial has a decent WikiFX score, however, we think this broker lacks risk management.

Complaints

Recently we received multiple complaints against this broker, which is a red flag.

The Case in Details

Sinan, a 25-year-old trader, opened an account with Squared Financial, investing $2731.81 in girket on 01.03.2024. Initially, his trading experience seemed normal, and by the end of his third day, he had accumulated a total profit of $3304. Encouraged by his success, Sinan decided to initiate a withdrawal request for $3000 on 08.01.2024, anticipating the enjoyment of his gains.

To Sinan's shock, on 09.01.2024, he received a notification from Squared Financial stating that, due to alleged commercial misconduct, his entire profit of $3304 had been removed from his account. Furthermore, he was informed that he had to return his initial investment, leaving him with nothing to show for his trading efforts.

Sinan vehemently denies any wrongdoing on his part and insists that his trading activities were entirely consistent with normal market movements. To support his claim, he has provided evidence, that he believes proves the legitimacy of his trades and the unjust nature of Squared Financial's actions.

Sinan has shared evidence with WikiFX, including trade logs, statements, and other relevant documents that he believes corroborate his account of the events. These materials are crucial in shedding light on the alleged misconduct by Squared Financial and supporting Sinan's case.

Conclusion

Squared Financial's actions, as described by the victim, paint a grim picture of a forex broker engaging in systematic deception and extortion.

This expose serves as a warning to the trading community, urging individuals to thoroughly research and verify the credibility of forex brokers before entrusting them with their hard-earned funds. Squared Financial, it seems, is not the haven of financial success it claims to be but rather a dangerous trap for unsuspecting traders.