Abstract:In this article, we'll look in-depth at Maono Global Markets, examining its key features.

About Maono Global Markets

Maono Global Markets is a borage firm that claims to be registered in South Africa. This broker was founded in 2022. According to Maono Global Markets‘ website, Maono Global Markets (MGM) and Maono Forex Trading Institute (MFTI) both was founded by Chief Executive Officer Jody Francis. While Achieving many successes with MFTI’s live and virtual learning platforms in such a short space of time, the Maono group realized the necessity to expand the business and it led to the newly formed division, namely Maono Global Markets. MGM offers a variety of market instruments, including Forex, Shares, and Indices.

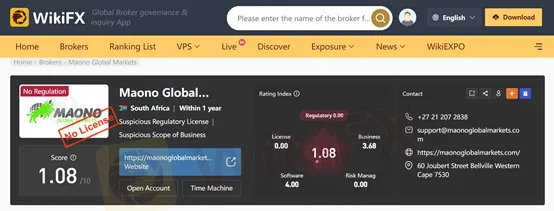

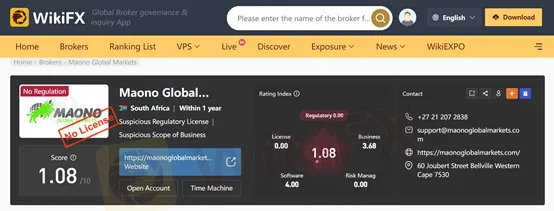

Is it Legit?

As far as we know, MGM is not a regulated broker. It is not regulated by any regulatory institution. WikiFX has given this broker a low score of 1.08/10.

Trading Platform

Maono Global Markets offers MT5 as its trading platform. MT5 provides traders with a user-friendly interface, powerful charting tools, and a wide range of technical indicators for market analysis.

Account Types

This broker offers three different types. They are Standard accounts, 100% Bonus Accounts, and Micro Accounts. This account type grants access to a wide range of trading instruments, including Forex, Shares, and Indices. It operates on the MetaTrader 5 (MT5) platform, known for its advanced trading features and analytical tools. Additionally, the account promises instant withdrawals, a feature appealing to traders who prioritize quick access to their funds.

The BA Account offers similar features to the Standard Account, including the same high leverage of 1:500 and low spreads starting from 1 pip. It also provides access to the same range of instruments and operates on the MT5 platform. The standout feature of this account is the 100% bonus, which likely refers to a deposit bonus, though the specific terms and conditions of this bonus are not clear. The Micro Account appears to be designed for less experienced traders or those who prefer to trade with smaller amounts. While it offers trading in Forex, Shares, and Indices and operates on the MT5 platform, the specific details about leverage, spreads, and minimum deposit requirements are not explicitly stated. This account also features instant withdrawals, adding a level of convenience for traders.

Spreads and Commissions

Maono Global Markets offers different spreads and commissions based on the account type. In the Standard and BA (100% Bonus) accounts, spreads start from 1 pip. The exact commission structure for these accounts is not detailed.

The Micro Account, aimed at new or small-scale traders, might have different spread and commission structures, but specific details are not provided. In such accounts, brokers often offer higher spreads but lower minimum trade sizes, and potentially lower or no commissions.

Potential clients need to consider all trading costs, including spreads and commissions, which can vary depending on the account type. For accurate information, traders should consult Maono Global Markets for the exact spread and commission structure for each account type.

Leverage

Maono Global Markets offers a maximum trading leverage of up to 1:500.

User Review

Conclusion

We dont advise you to invest in such a young broker. On the other hand, its unregulated status may cause you financial loss. If you want more information about certain brokers' reliability, you can open our website. Or you can download the WikiFX App to find your most trusted broker.