Abstract:Regarding Forex trading in the United States, selecting the right broker is crucial for success. US traders need brokers that are reliable, regulated, and provide favorable trading conditions. In 2024, the following brokers stand out as the best options for US traders based on their ratings, trading conditions, and market reputation.

Regarding Forex trading in the United States, selecting the right broker is crucial for success. US traders need brokers that are reliable, regulated, and provide favorable trading conditions. In 2024, the following brokers stand out as the best options for US traders based on their ratings, trading conditions, and market reputation.

Best Forex Brokers for US Traders in 2024:

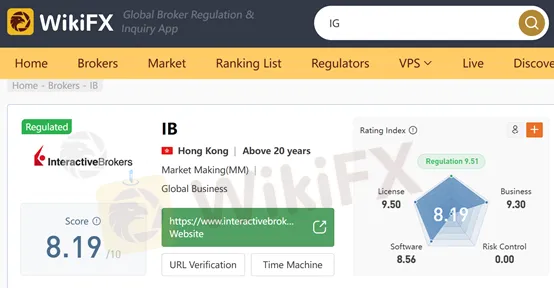

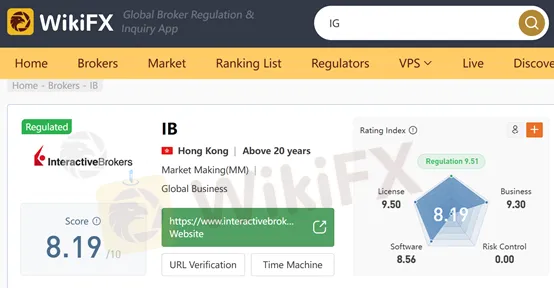

Interactive Brokers

WikiFX Rating: 8.19/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:40

Minimum Deposit: $2,000

Interactive Brokers is renowned for its comprehensive trading platform and a wide range of trading instruments. The broker offers competitive spreads starting from 0.1 pips and a leverage of up to 1:40. Although the minimum deposit of $2,000 is relatively high, the advanced tools and extensive market access make it a preferred choice for serious traders.

OANDA

WikiFX Rating: 8.36/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:200

Minimum Deposit: $0

OANDA is highly rated for its user-friendly platform and no minimum deposit requirement, making it accessible for traders of all levels. The broker offers competitive spreads and a maximum leverage of 1:200, providing flexibility for various trading strategies. OANDA's strong regulatory status and comprehensive market analysis tools further enhance its appeal.

FOREX.com

WikiFX Rating: 8.46/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:400

Minimum Deposit: $500

FOREX.com is a well-established broker with a high WikiFX rating, reflecting its reliability and excellent trading conditions. Traders benefit from low spreads, starting at 0.1 pips, and high leverage of up to 1:400. The minimum deposit of $500 is reasonable, making it a solid choice for both novice and experienced traders. FOREX.com also offers a wide range of educational resources and market insights.

IG

WikiFX Rating: 8.49/10

Minimum Spread: 1 pip

Maximum Leverage: 200:1

Minimum Deposit: $0

IG is a top-rated broker known for its robust trading platform and extensive market coverage. With a WikiFX rating of 8.49, IG provides reliable services with spreads starting from 1 pip and leverage up to 200:1. The absence of a minimum deposit requirement allows traders to start with any amount they are comfortable with. IG's advanced charting tools and comprehensive research materials are particularly beneficial for informed trading decisions.

Conclusion

These sophisticated brokers have years of experience and are well-established in the US market. They offer a range of services tailored to meet the needs of different traders. Whether you are a beginner or an experienced trader, you can choose the broker that best suits your trading style and financial goals.

By considering factors such as spreads, leverage, minimum deposits, and overall ratings, you can make an informed decision to enhance your trading experience in 2024.