Abstract:IG US, a leading forex broker, announced today a significant rebranding of its brokerage and platform technology to tastyfx. This strategic move aims to offer a more tailored experience for US-based customers.

IG US, a leading forex broker, announced today a significant rebranding of its brokerage and platform technology to tastyfx. This strategic move aims to offer a more tailored experience for US-based customers, enhancing FX trading and integrating it more closely with their needs.

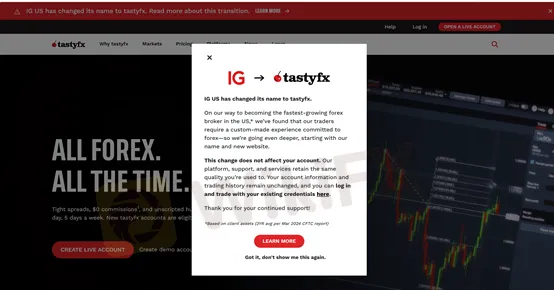

Rebranding to tastyfx

Although the broker has changed its name, its business function will largely remain the same with enhancements focused on improving forex trading technology. The rebrand to tastyfx is designed to create a forex-focused brand specifically for US clients, featuring fast technology, zero commissions, and supportive customer service.

“Changing our name to tastyfx marks the beginning of a new chapter for us,” said Peter Mulmat, CEO of tastyfx. “Weve seen incredible growth in our business over the past few years, but tastyfx will go even further in offering forex traders in the US an unparalleled experience.”

JJ Kinahan, CEO of IG North America and President of tastytrade, added: “The tastyfx rebrand is another illustration of how were evolving our company identity and our brands, while continuing to offer the fast, easy forex trading experience that our customers love.”

Enhancements

The trading platform, though rebranded, will maintain its core structure with ongoing enhancements. These improvements aim to provide traders with better technology for a more efficient and rewarding trading experience.

What Has Changed?

Several key changes accompany the rebrand:

Social Media: Social media handles are changing to @tastyfx. Existing followers do not need to re-follow.

Website: The new URL is now tastyfx.com. While the old URL (IG.com/us) will remain accessible for a limited time, users are encouraged to update their bookmarks.

Emails: Email addresses will now use the @tastyfx.com domain. Although the old @ig.com addresses will work temporarily, users should transition to the new ones.

Mobile App: The app will be rebranded to tastyfx. Current users will need to update their app, while new users can download it from the Apple App Store or Google Play Store.

Expanding Horizons

The rebrand comes at a time when the US retail forex market is expanding, drawing in traders with its varied opportunities. This move positions tastyfx to capitalize on this growth, offering enhanced services and support to US-based forex traders.

Additionally, IG Group has initiated a waiting list for options trading in the UK through its tastytrade brand, signaling its official entry into UK options trading. This expansion, supported by industry leaders Cboe and CME Group, aims to align with IG Group's strategic objectives despite the challenges posed by UK regulations.

Conclusion

The rebranding to tastyfx marks a significant milestone for IG US, enhancing the trading experience for forex traders in the US. With the same reliable platform, improved technology, and a fresh focus, tastyfx is set to offer unparalleled service and opportunities in the expanding US forex market.