WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Check out our top picks for Forex brokers in the Asia Pacific (APAC). We've carefully reviewed their regulations, trading platforms, and customer support to help you find the right fit.

When it comes to Forex trading in Asia Pacific (APAC), selecting the correct broker might be the difference between success and failure. The region's different market characteristics make it more challenging to identify a reliable broker. While not regulated locally, some brokers have established great reputations as a result of offshore regulation by reputable bodies such as the FCA in the United Kingdom or ASIC in Australia, which adds another degree of complication to your selection.

Our comprehensive evaluation of the leading Forex brokers in Asia Pacific will assist you in navigating this complex industry. We painstakingly researched each broker, taking into account crucial elements such as regulatory compliance, customer support, and overall trading experience, to give you a comprehensive list of the top alternatives in this competitive market.

Who Are the Most Reliable Forex Brokers in the Asia Pacific?

The APAC area is a thriving center for Forex trading, with plenty of possibilities but also some concerns. The brokers we suggest have established their dependability by adhering to tight laws, having sophisticated trading platforms, and delivering excellent customer support. These brokers provide reasonable spreads, a diverse choice of trading instruments, and personalized services to fit the requirements of both beginner and experienced Asia Pacific traders.

FXCM

FXCM, also known as Forex Capital Markets, is a global online broker with a strong reputation for providing retail traders with a comprehensive range of trading services. Established in 1999, FXCM has grown to become one of the leading players in the forex and CFD markets. The company is committed to delivering a seamless trading experience by offering cutting-edge trading platforms, innovative trading tools, and a variety of educational resources. FXCM is particularly noted for its transparency and client-centric approach, which has helped it build a loyal client base over the years. The broker caters to a diverse group of traders, from beginners to seasoned professionals, by offering flexible account types, competitive spreads, and robust customer support.

· Regulatory Bodies: FXCM is regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

· WikiFX Rating: 9.45

· Leverage: Up to 1:30 (FCA), up to 1:500 (ASIC, FSCA)

· Minimum Spreads: From 1.3 pips on major currency pairs

· Minimum Deposit: $50

· Trading Platforms: Trading Station, MetaTrader 4, NinjaTrader, ZuluTrade

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Access to proprietary trading tools, free educational resources, and competitive pricing.

IC Markets Global

IC Markets is a globally recognized forex and CFD broker renowned for its commitment to providing a top-tier trading experience to retail and institutional clients. Established in 2007, IC Markets has positioned itself as one of the world's largest and most trusted brokers by offering superior trading conditions, including ultra-low spreads, lightning-fast execution speeds, and a broad range of trading instruments. The broker is top-rated among high-frequency traders, scalpers, and automated trading systems due to its deep liquidity and direct market access (DMA). IC Markets prides itself on its transparency and high standards of client service, ensuring that traders can operate in a secure and efficient trading environment.

· Regulatory Bodies: IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA).

· WikiFX Rating: 9.06

· Leverage: Up to 1:30 (ASIC), up to 1:500 (FSA)

· Minimum Spreads: From 0.0 pips (Raw Spread accounts)

· Minimum Deposit: $200

· Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

· Customer Support: 24/7 support via live chat, phone, and email

· Customer Benefits: Ultra-low spreads, fast execution, and advanced trading platforms.

XM

XM is a well-known online broker that has made its mark on the global trading scene by offering a client-focused approach and a broad range of trading products. Since its inception in 2009, XM has grown rapidly, now serving millions of clients across over 190 countries. The broker is highly regarded for its transparent business practices, competitive trading conditions, and comprehensive educational resources. XM offers a diverse array of account types to cater to different trading needs and preferences, from micro accounts for beginners to zero-spread accounts for professional traders. The broker's commitment to ethical trading and customer satisfaction has earned it numerous awards and a strong reputation in the industry.

· Regulatory Bodies: XM is regulated by the International Financial Services Commission (IFSC) in Belize, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

· WikiFX Rating: 9.04

· Leverage: Up to 1:30 (ASIC, CySEC), up to 1:1000 (IFSC)

· Minimum Spreads: From 0.6 pips on major currency pairs

· Minimum Deposit: $5

· Trading Platforms: MetaTrader 4, MetaTrader 5, XM WebTrader

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Low minimum deposit, negative balance protection, and free access to educational webinars and seminars.

EC Markets

EC Markets is a professional-grade online trading broker that offers a wide range of trading products and services tailored to meet the needs of both retail and institutional clients. With a strong focus on transparency, efficiency, and customer satisfaction, EC Markets has established itself as a reliable and trusted partner for traders seeking a high-quality trading environment. The broker is known for its competitive pricing, direct market access (DMA), and robust trading infrastructure, which ensures that clients can execute trades quickly and efficiently. EC Markets also places a strong emphasis on client education and support, providing a variety of resources to help traders improve their skills and make informed decisions.

· Regulatory Bodies: EC Markets is regulated by the Financial Conduct Authority (FCA) in the UK.

· WikiFX Rating: 9.04

· Leverage: Up to 1:30 (FCA)

· Minimum Spreads: From 0.5 pips on major currency pairs

· Minimum Deposit: £200

· Trading Platforms: MetaTrader 4, MetaTrader 5

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Direct market access (DMA), tight spreads, and a strong regulatory framework.

GO Markets

GO Markets is a prominent Australian-based online broker that has been serving traders since 2006. Renowned for its reliability, GO Markets provides a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies, catering to both retail and institutional clients. The broker is well-regarded for its competitive trading conditions, exceptional customer service, and robust trading platforms. GO Markets places a strong emphasis on providing a secure and user-friendly trading experience, making it an attractive choice for traders of all experience levels. The broker's commitment to client education, coupled with its innovative trading tools, has earned it a solid reputation in the global trading community.

· Regulatory Bodies: GO Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) in Mauritius.

· WikiFX Rating: 8.98

· Leverage: Up to 1:30 (ASIC), up to 1:500 (FSC)

· Minimum Spreads: From 0.0 pips on major currency pairs (GO Plus+ account)

· Minimum Deposit: $200

· Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Access to educational resources, tight spreads, and various trading tools, including Autochartist and VPS hosting.

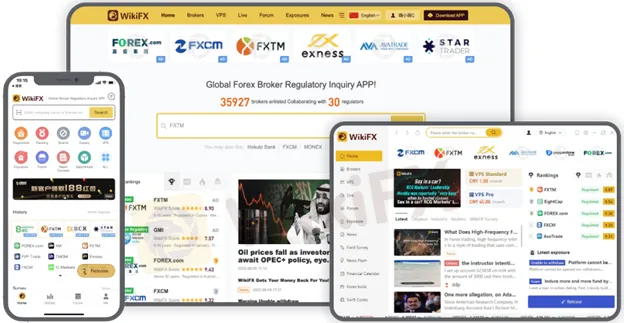

When choosing a reliable forex broker, the WikiFX App is your go-to tool. It offers real-time regulatory data, broker ratings, and user reviews, making it easier to find trustworthy options in the Forex market.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.