Doctor loses RM285k in phone scam

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A 62-year-old retiree in Malaysia has reportedly lost RM2.33 million after falling victim to a fraudulent stock investment scheme promoted through a WhatsApp group.

A 62-year-old retiree in Malaysia has reportedly lost RM2.33 million after falling victim to a fraudulent stock investment scheme promoted through a WhatsApp group.

According to Johor police chief Commissioner Datuk M. Kumar, the victim stated in his police report that an unknown individual had introduced him to the investment opportunity. His phone number was subsequently added to a WhatsApp group, where he was directed to a linked website that purportedly allowed him to monitor profits and manage his investments.

The fraudulent scheme lured the retiree with promises of substantial returns, allegedly guaranteeing earnings of up to US$8 million (approximately RM32.2 million). Encouraged by these prospects, the victim proceeded to transfer RM2.33 million across four transactions to four different local bank accounts between 27 November 2024 and 4 March 2025.

Authorities have classified the case under Section 420 of the Penal Code, which deals with cheating and dishonestly inducing the delivery of property. Commissioner Kumar urged the public to exercise caution when presented with investment opportunities that appear too good to be true. He advised individuals to verify the legitimacy of such schemes with relevant financial authorities, including Bank Negara Malaysia and the Securities Commission, before making any commitments.

To further protect themselves from financial fraud, the public has been encouraged to stay informed about evolving scam tactics. Commissioner Kumar emphasised the importance of accessing reliable sources of information, such as the Commercial Crime Investigation Departments official social media channels on Facebook, Instagram, and TikTok, which provide updates on prevalent fraud schemes.

As investment scams continue to rise, digital verification tools such as WikiFX have become invaluable resources for investors seeking to assess the legitimacy of brokers and financial platforms. WikiFX maintains an extensive database of global broker profiles, offering insights into regulatory compliance, user reviews, and risk assessments. By leveraging such platforms, investors can identify unlicensed or suspicious entities and take proactive steps to protect their financial assets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

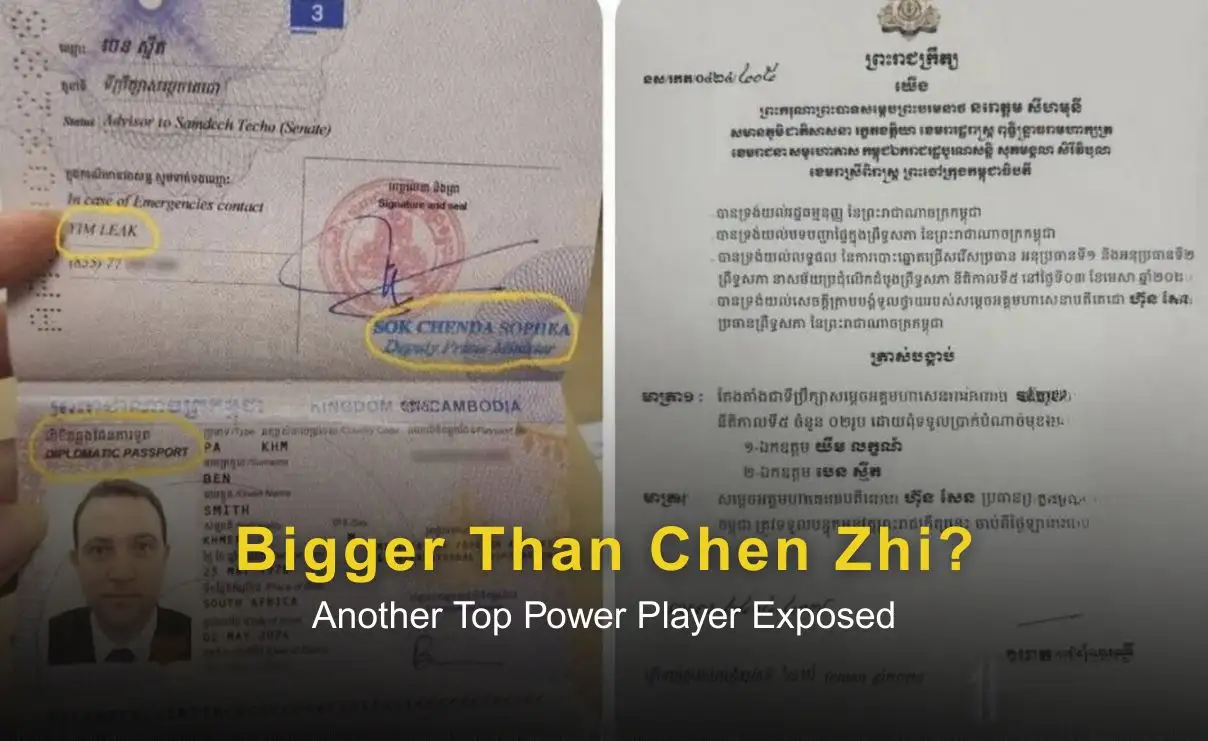

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.

A Kuching woman lost RM91,000 after being lured into a fake investment scheme advertised on Telegram, where scammers promised high returns but disappeared after receiving multiple bank transfers. Police are investigating the case under Section 420 for cheating and have warned the public to stay alert to online investment scams.

A Tan Sri was among two individuals detained by the MACC over an alleged RM300 million investment scam in Kuala Lumpur. Authorities say the unapproved schemes promised high returns and caused millions in losses nationwide, prompting renewed warnings for the public to verify investments and avoid offers that seem too good to be true.