WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we will conduct a comprehensive examination of FXBTG, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of FXBTG, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2008, FXBTG is an online brokerage specializing in the trading of exchange-traded CFDs. It was originally established in Hong Kong, where it focused on business development across the Asia-Pacific region, including mainland China.

In 2012, FXBTG became a legally registered company in New Zealand (Registration Number: 3896796).

By 2016, FXBTG had expanded its presence by opening independent local offices in Kuala Lumpur.

FXBTG Markets offers a wide range of tradable assets, including currency pairs, cryptocurrency CFDs, indices, commodities, precious metals, futures, and stocks.

The company also features an Introducing Broker (IB) program, allowing individuals and businesses to earn commissions by referring new clients to FXBTG.

However, it's important to note that FXBTG does not currently provide services to residents of Afghanistan, Hong Kong, Belgium, Japan, and the United States.

Types of Accounts:

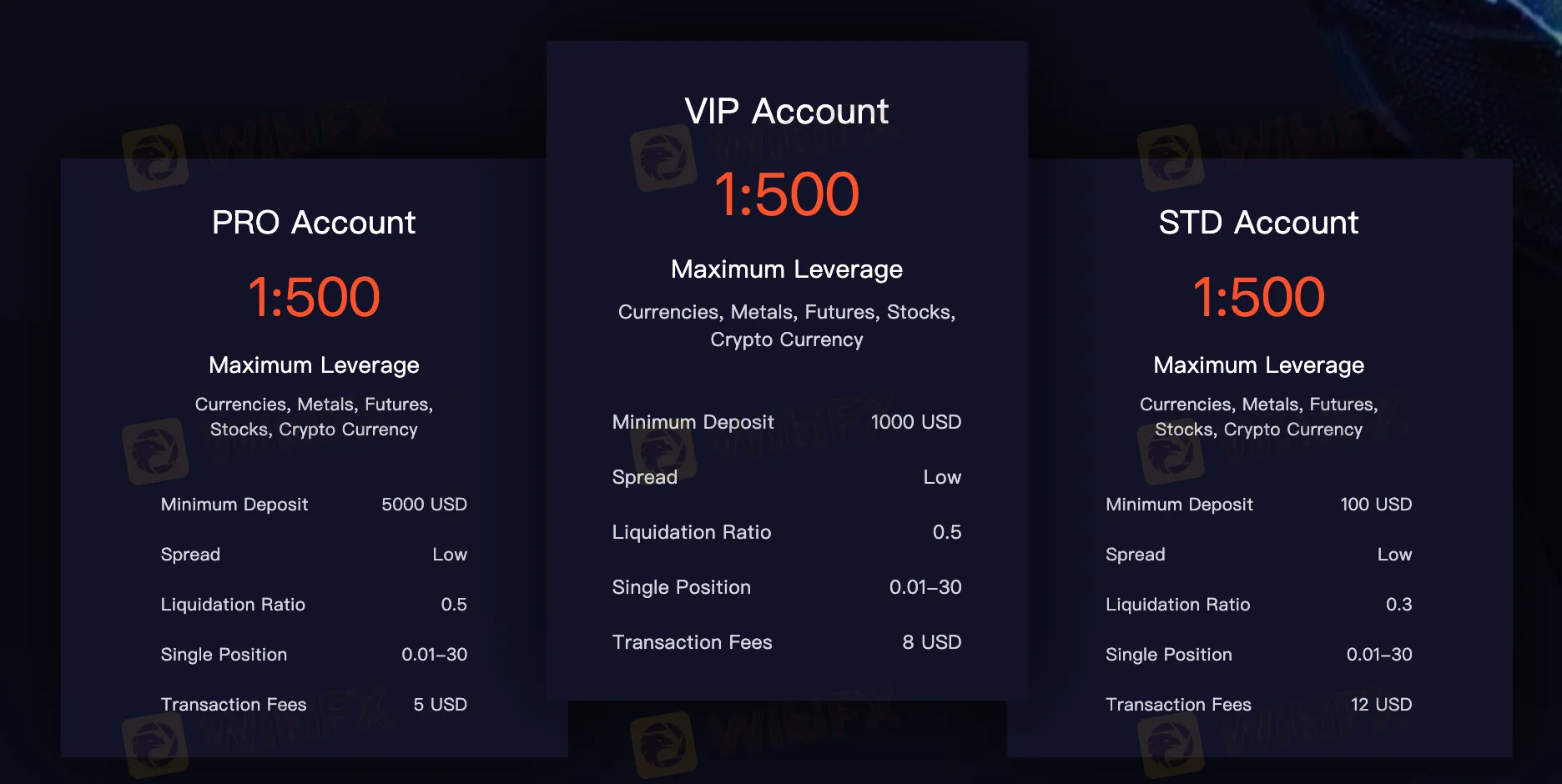

FXBTG offers several account options: the STP Account, the Pro Account, and the VIP Account.

Please refer to the attached images below for more detailed information on each corresponding account.

Deposits and Withdrawals:

FXBTG offers a variety of payment options, including CLICKPAY, PayTrust88, PAY, BipiPAY, Tether (USDT), Huobi, and Binance.

The minimum withdrawal amount in RMB is equivalent to 100 USD. For amounts below 100 USD, withdrawals must be made using digital currencies.

Exchange rates are based on real-time market fluctuations.

The company asserts that withdrawals will generally be processed within 1–2 business days after the request is approved. Processing may be delayed on non-working days.

There is no handling fee for the first two withdrawals each month. From the third withdrawal onward, a USD 20 handling fee will apply to each transaction.

Trading Platforms:

FXBTG provides the MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

FXBTG also provides its own in-house mobile application. The app allows users to access the official website with a single tap and log in to their CRM for account-related operations at any time.

Research and Education:

FXBTG offers an ‘FXBTG Financial Group x IZ FOREX ACADEMY’ section that provides educational resources for beginner, intermediate, and advanced traders in the form of articles. Online classes are held every Tuesday, Thursday, and Sunday from 8:00 PM to 9:00 PM for registered FXBTG traders.

Customer Service:

FXBTG provides 24/5 customer service support in Chinese and English. Clients can also reach out to the broker's support team through email at cs@fxbtg-bank.com.

Conclusion:

To summarize, here's WikiFX's final verdict:

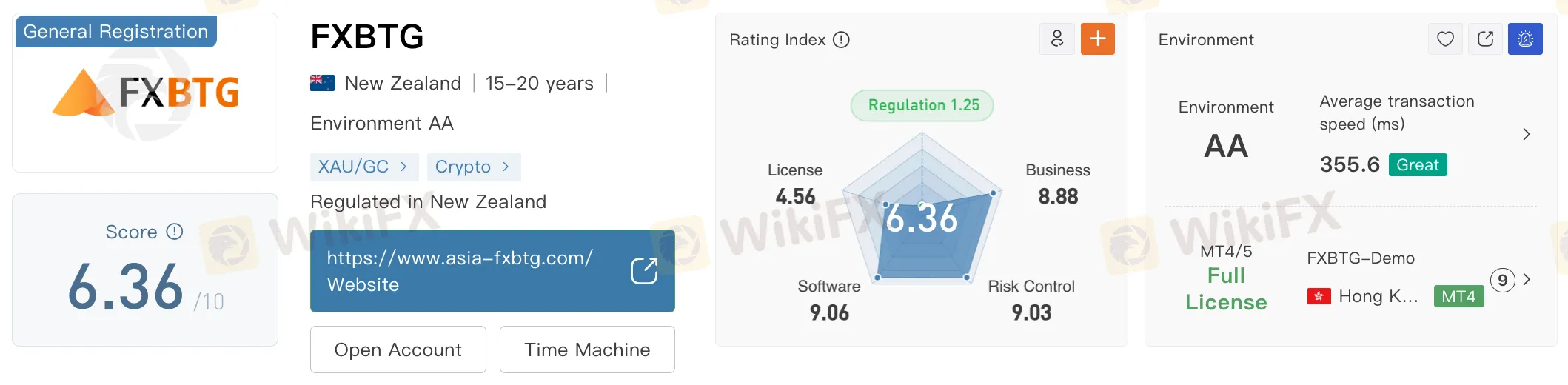

WikiFX, a global forex broker regulatory platform, has assigned FXBTG a WikiScore of 6.36 out of 10.

Upon reviewing FXBTG's licensing credentials, WikiFX confirmed that the broker is regulated by the New Zealand's Financial Markets Authority. WikiFX has verified the authenticity of this license.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.