WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Zero spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

Zero‑spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

WikiFX Score: 9.10/10

Regulation: ASIC (Australia), CySEC (Cyprus)

Zero‑Spread Feature: Raw Spread accounts start from 0.0 pips on major currency pairs, with an average EUR/USD spread of 0.1 pips. A commission of USD 3.50 per lot per side applies, delivering ultra-tight pricing ideal for scalping and EAs.

Advantages of IC Markets

Platform Support: MT4, MT5, and cTrader available.

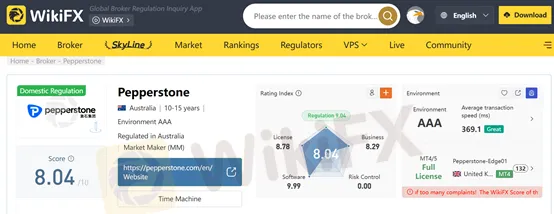

WikiFX Score: 8.04/10

Regulation: ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (UAE), CMA (Kenya), SCB (Bahamas)

Zero‑Spread Feature: Razor accounts offer raw spreads from 0.0 pips on forex pairs. Commission-based pricing begins at USD 3.50 per 100,000 units on MT4/MT5, ensuring transparent costs for high-frequency traders.

Advantages of Pepperstone

WikiFX Score: 8.93/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSA (Seychelles)

Zero‑Spread Feature: Raw accounts start from 0.0 pips on major FX pairs, with a commission of USD 3.00 per side per standard lot. Ideal for scalpers and algorithmic traders seeking minimal transaction costs.

About Tickmill

Education & Tools: Webinars, calculators, and signal center.

WikiFX Score: 8.88/10

Regulation: ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), FSC (Mauritius), SCB (Bahamas)

Zero‑Spread Feature: Raw accounts offer spreads from 0.0 pips on major pairs, with commissions starting at USD 3.00 per lot per side. Leverage up to 1:500 enhances flexibility for active traders.

About FP Markets

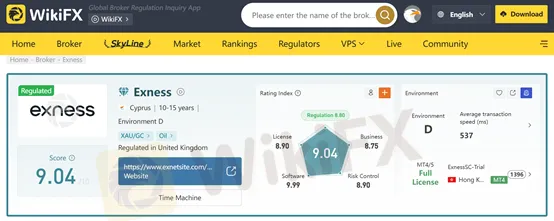

WikiFX Score: 9.04/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CBCS (Curacao & Sint Maarten)

Zero‑Spread Feature: Zero accounts deliver 0.0 pip spreads on the top 30 instruments, with commissions from USD 0.05 per side per lot. Market execution with no requotes ensures precision.

Why Choose Exness?

Diverse Instruments: Forex, metals, crypto, energies, indices, stocks.

What are the advantages of a zero‑spread account?

Zero‑spread accounts provide cost certainty, tighter entries, and ideal conditions for scalping and high-frequency trading, as spreads start from 0.0 pips.

Are zero‑spread accounts suitable for beginners?

While the tight pricing benefits all traders, beginners should understand commission models and practice risk management to avoid overleveraging.

Can I use automated trading on zero‑spread accounts?

Yes. All five brokers support EAs and algorithmic strategies on MT4/MT5, with Tickmill and IC Markets offering particularly fast execution.

Choosing a zero‑spread broker with high WikiFX ratings and robust regulation can significantly enhance trading efficiency and risk management. IC Markets, Pepperstone, Tickmill, FP Markets, and Exness each offer compelling zero‑spread accounts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.