WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Investment scams in Malaysia have surged to worrying new levels, with police confirming losses totalling over RM750 million in just the first half of 2025. According to data from the Bukit Aman Commercial Crime Investigation Department (CCID), this figure more than doubles the RM350 million lost during the same period in 2024.

Investment scams in Malaysia have surged to worrying new levels, with police confirming losses totalling over RM750 million in just the first half of 2025. According to data from the Bukit Aman Commercial Crime Investigation Department (CCID), this figure more than doubles the RM350 million lost during the same period in 2024.

CCID Director Datuk Rusdi Mohd Isa revealed that authorities have recorded 4,368 scam cases so far this year, compared to 2,715 cases over the same period last year. This sharp increase reflects a concerning trend as fraudsters continue to exploit new tactics and unsuspecting investors.

The police have identified three primary types of scams responsible for most of the losses: Clone Firm Investment Scams, High and Fast Money Forex Scams, and Ponzi Schemes.

In Clone Firm Investment Scams, criminals impersonate legitimate investment companies through social media advertisements. Once a victim engages, they are added to WhatsApp groups and guided by supposed “traders” who instruct them to use specific apps or websites. These platforms show fake profits to convince users to invest more. Victims are often told to transfer funds into mule accounts, including bank accounts registered under fake or unrelated company names. When victims attempt to withdraw their returns, they are met with constant excuses and delays.

High and Fast Money Forex Scams operate under a similar structure, where fraudsters pose as foreign-registered forex brokers. Victims are lured with promises of quick and sizeable returns. However, before any returns are paid out, victims are repeatedly asked to make additional payments for capital injections, broker fees, international transfer charges, and taxes. Once payments are made, the promised profits never arrive.

Ponzi Schemes often involve physical or virtual meetings held in professionally presented offices to build trust. Victims are persuaded to transfer funds, often in cryptocurrency such as USDT, into digital wallets controlled by the scam operators. At first, returns appear to be genuine, encouraging victims to invest more. But the scheme collapses as soon as new investor inflows dry up, leaving existing participants unable to recover their money.

To help the public avoid falling prey to these schemes, Rusdi encouraged the use of the “Take Five” method before investing. This includes taking a moment to assess the opportunity, conducting thorough research, asking the right questions, verifying documents, and using official tools to check the legitimacy of companies and bank accounts. He highlighted the Semak Mule portal (https://semakmule.rmp.gov.my) as a useful resource for verifying suspicious details.

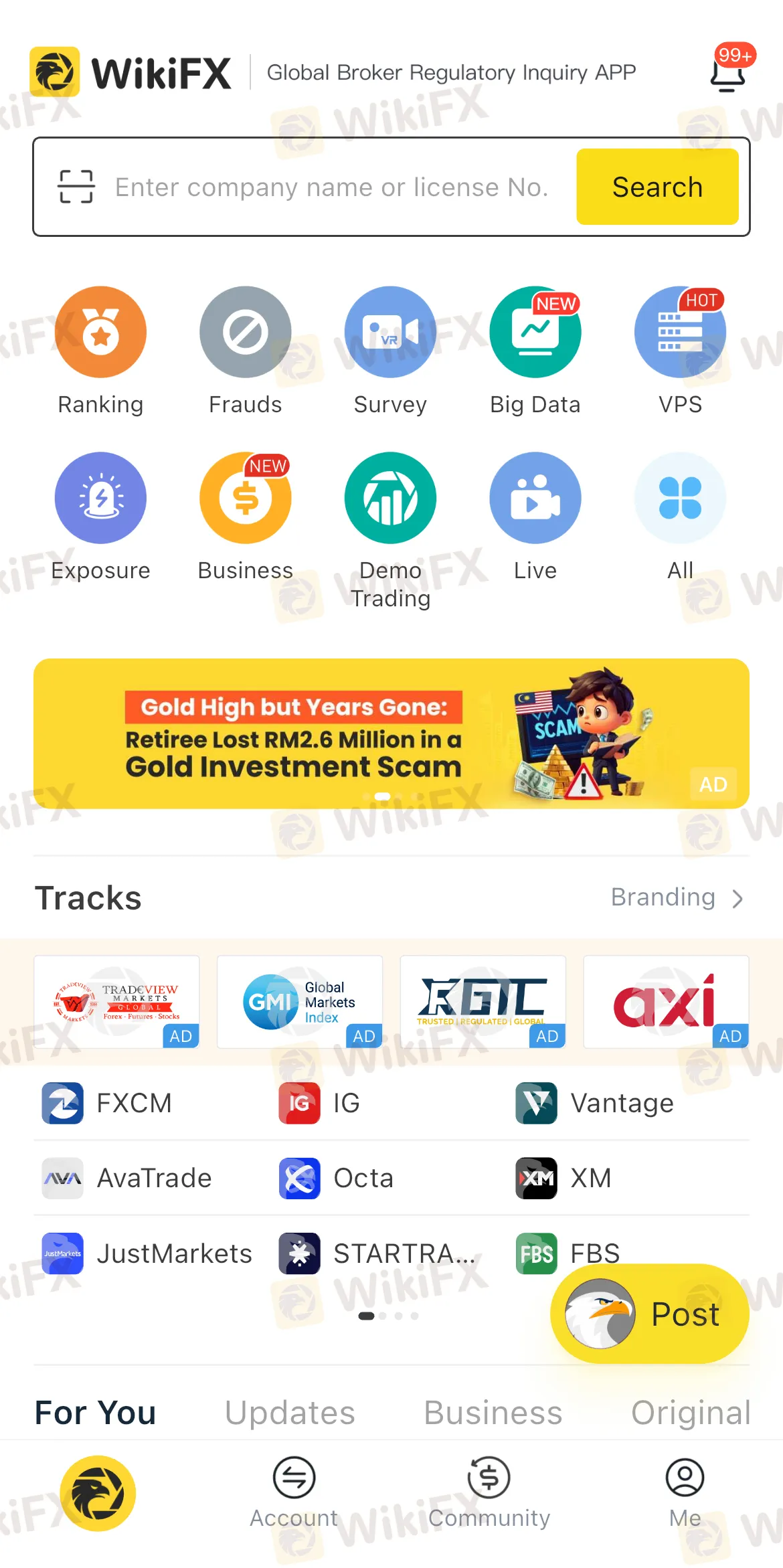

Additionally, he recommended the WikiFX mobile app, available on both Google Play and the App Store. This free tool provides users with detailed information on investment platforms, including regulatory status, customer reviews, and safety scores. With these insights, investors can make informed decisions and avoid falling into the trap of unlicensed brokers.

Authorities continue to urge the public to stay alert, especially when encountering high-return investment opportunities on social media. As scam tactics grow more convincing, critical thinking and proper verification remain the strongest defences.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.