WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When it comes to online trading, the broker you choose can make or break your trading journey. A reputable and regulated broker offers a sense of security and accountability, while unregulated brokers often pose significant risks to traders. Aron Markets is one such broker that raises multiple concerns due to its lack of valid regulation and its registration in a high-risk offshore location.

When it comes to online trading, the broker you choose can make or break your trading journey. A reputable and regulated broker offers a sense of security and accountability, while unregulated brokers often pose significant risks to traders. Aron Markets is one such broker that raises multiple concerns due to its lack of valid regulation and its registration in a high-risk offshore location.

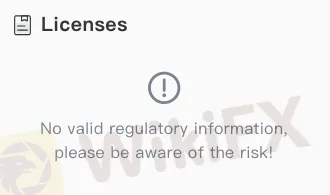

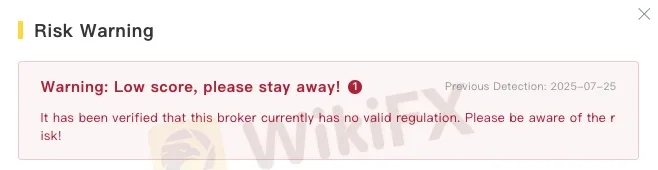

According to WikiFX, a leading global broker regulatory query platform, Aron Markets currently has no valid regulation. This means the broker operates without oversight from any recognized financial authority, leaving traders vulnerable in the event of disputes, withdrawal issues, or fraudulent activities.

Unregulated brokers are often associated with various scams in the trading industry. Without a regulatory framework to ensure fair operations, brokers like Aron Markets can potentially manipulate trading platforms, delay withdrawals, or impose unfair terms without facing consequences.

Another red flag is that Aron Markets is registered in the Marshall Islands, a jurisdiction notorious for its lack of clear financial regulation for forex or trading brokers. While setting up a business in such locations is legal, it is often a tactic used by brokers to avoid strict regulatory requirements.

The absence of rigorous oversight in offshore jurisdictions means traders have limited or no legal recourse if issues arise. In many cases, offshore brokers have been linked to trading scams, exploiting the lack of accountability to engage in unethical practices.

Aron Markets has a WikiScore of just 2.17/10, a rating derived from evaluating various factors such as regulatory status, licenses, trading environment, risk control measures, and overall business operations. This extremely low score highlights the potential dangers of trusting this broker with your capital.

Traders should take such warnings seriously. A low trust score, combined with the lack of regulation and offshore registration, is a classic combination of red flags that experienced traders associate with high-risk operations or possible scams.

With so many scams and fraudulent schemes targeting online traders, due diligence is non-negotiable. Aron Markets lack of regulation, coupled with its Marshall Islands registration, places it firmly in the high-risk category. Traders must exercise extreme caution and consider whether the potential rewards of trading with this broker outweigh the risks.

Choosing a regulated broker with a proven track record is always safer than entrusting your funds to a company that operates in a grey zone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.