Abstract:Malaysia’s financial regulator has issued a warning to investors regarding two trading platforms, namely InstaForex and InstaTrade.

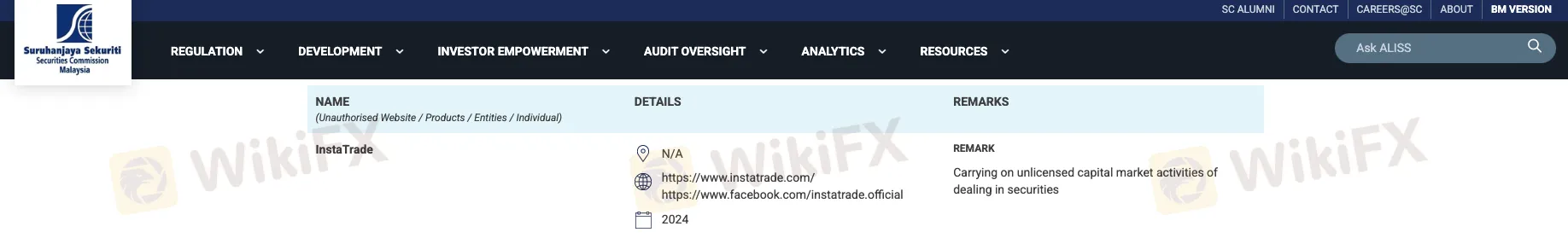

Malaysia‘s financial regulator has issued a warning to investors regarding two trading platforms, namely InstaForex and InstaTrade. Both brands, operating under the InstaFintech Group, have been added to the Securities Commission Malaysia’s (SC) investor alert list for conducting unlicensed capital market activities within the country.

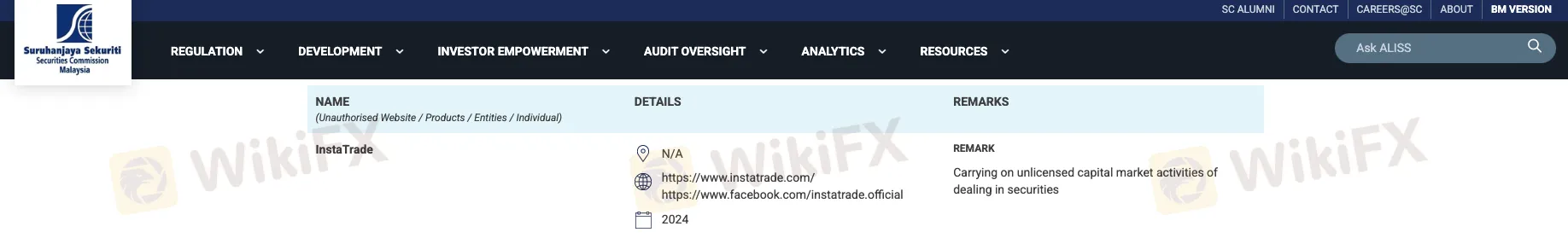

According to the SC, InstaForex and InstaTrade have been offering securities-related services without the necessary regulatory approval, thereby breaching Malaysia‘s capital market laws. The regulator’s statement points to unauthorised dealings in securities as the reason for their inclusion on the warning list.

InstaForex, in particular, has gained significant recognition in the retail trading space, offering services in foreign exchange (forex) and contracts for difference (CFDs) across various global markets. InstaTrade, a lesser-known affiliate, operates under the same corporate umbrella. Despite their international visibility and expansive user base, the SCs move suggests that neither platform has met the licensing standards required to operate legally in Malaysia.

The investor alert list maintained by the SC serves as a protective measure to help the public identify entities that may pose a risk to their investments. By flagging InstaForex and InstaTrade, the commission aims to raise awareness and discourage Malaysian investors from engaging with platforms that fall outside of regulatory oversight.

This development follows a broader pattern where international trading firms, regardless of their global standing, face increased scrutiny when operating without local authorisation. The SC has previously issued similar warnings against other high-profile brokers, reinforcing its message that popularity does not equate to compliance.

Malaysias securities watchdog has made it clear that investor protection is a priority, and it encourages members of the public to conduct due diligence before committing funds to any online trading platform. The SC also provides dedicated channels for reporting suspicious or unlicensed financial activity, further underlining its proactive stance against unauthorised services.

For traders and investors in Malaysia, this warning serves as a critical reminder to verify the regulatory status of any broker, particularly those offering complex and high-risk products like forex and CFDs. While InstaForex and InstaTrade may appear credible on the surface, the SCs alert indicates that their operations do not meet the legal requirements set out under Malaysian law.

As the online trading industry continues to expand, regulators are stepping up efforts to ensure that platforms entering their markets adhere strictly to licensing rules, placing investor safety at the forefront.

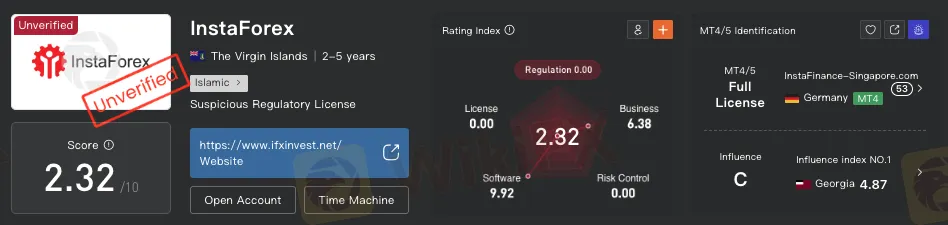

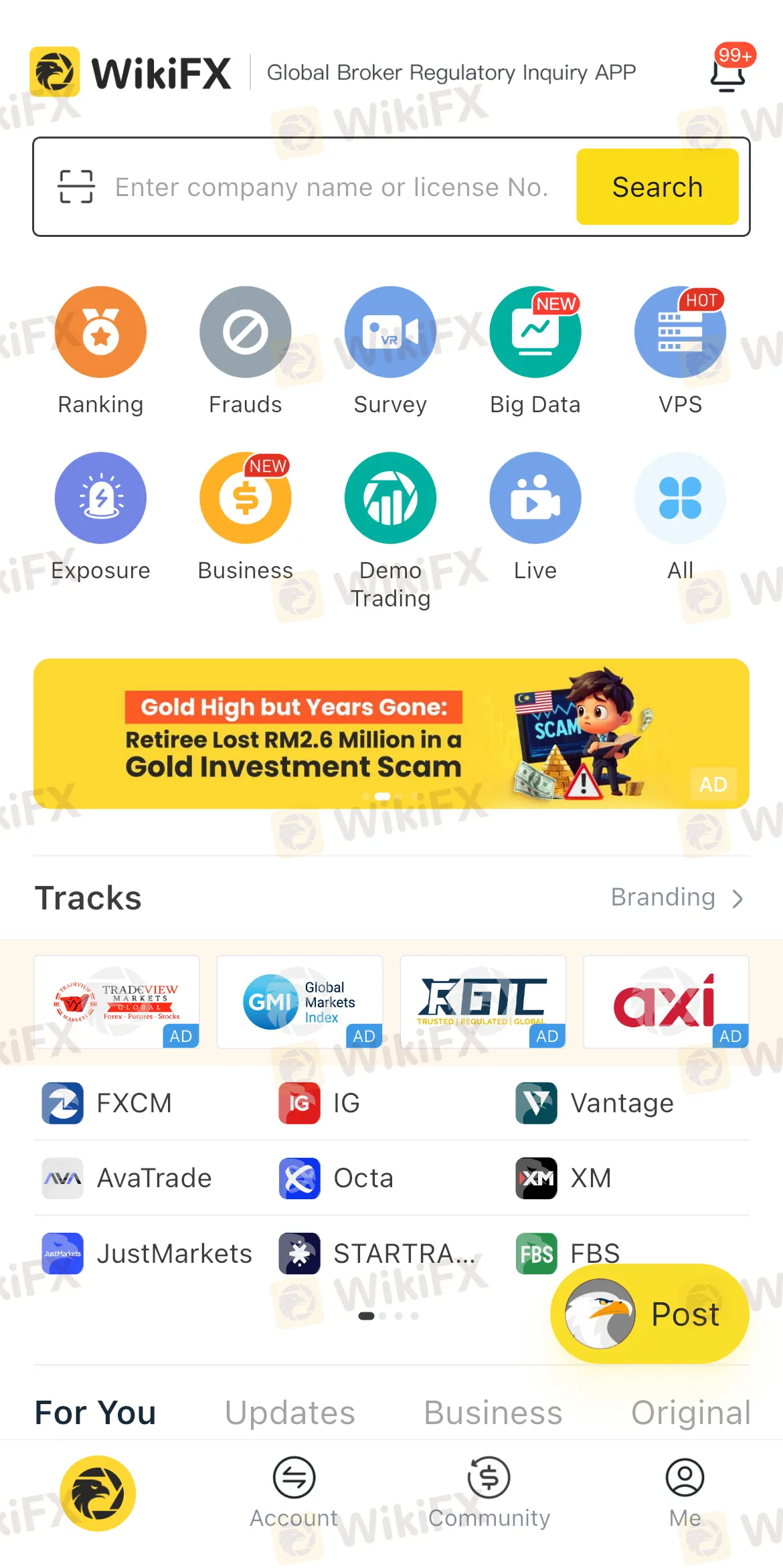

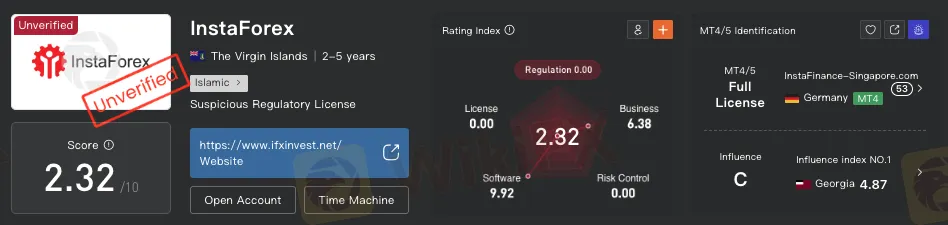

Traders and investors can also use a free mobile application called WikiFX, which plays a crucial role in verifying the legitimacy of brokers and financial platforms. WikiFX provides an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors identify red flags and avoid potential scams. By leveraging tools like WikiFX to research a brokers background, individuals can safeguard their savings and minimise the risk of falling victim to fraudulent schemes.