WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

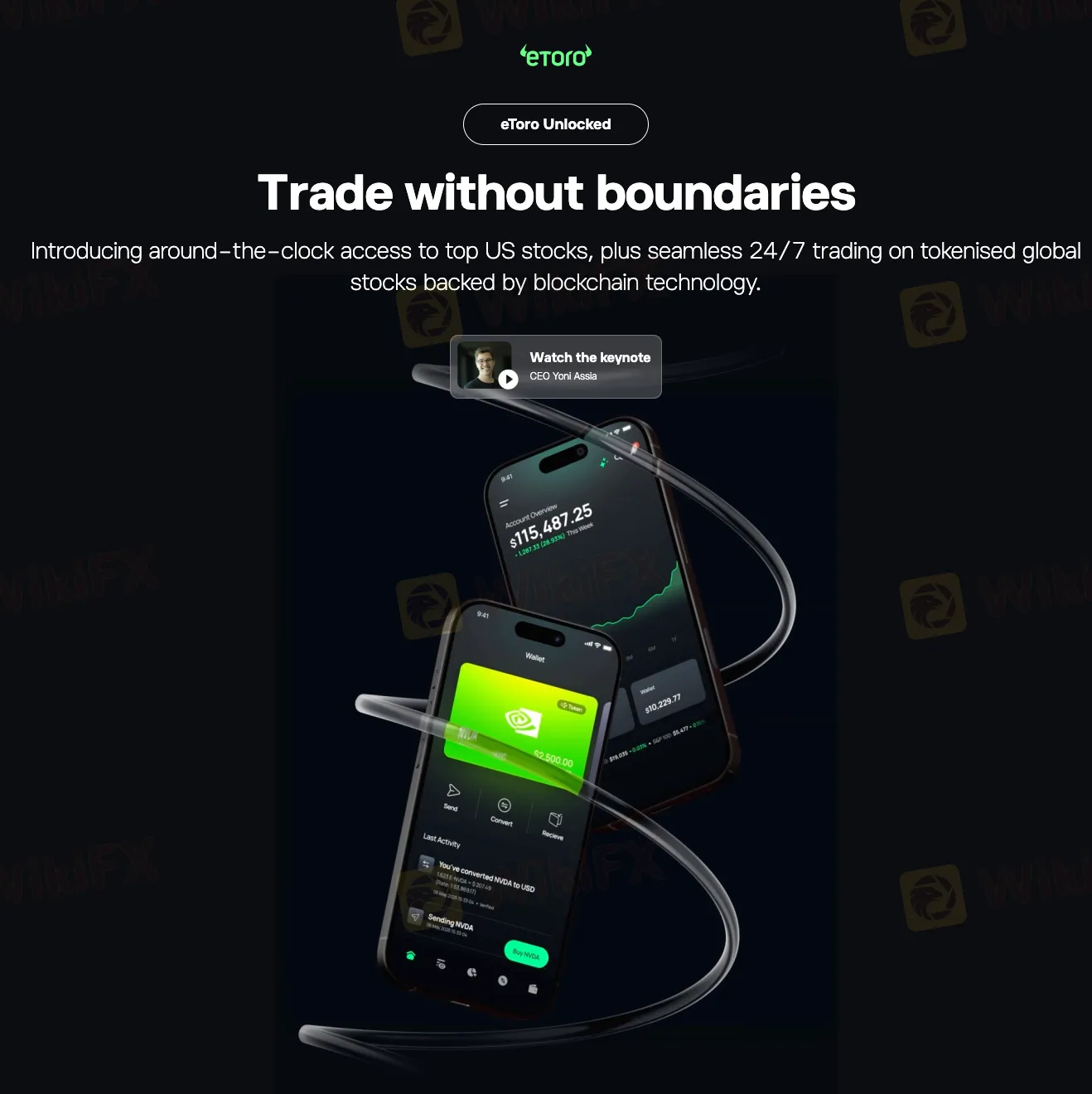

Abstract:eToro Group Ltd. has announced several updates to its product offering as part of its broader strategy to adapt to a tokenised financial system. Read this article to find out more, especially if you are eToro’s current user!

eToro Group Ltd., the online trading platform listed on Nasdaq, has announced several updates to its product offering as part of its broader strategy to adapt to a tokenised financial system. The announcements were made during a recent global webinar titled eToro Unlocked: Trade Without Boundaries, where the company outlined its direction in response to ongoing developments in blockchain regulation and technology.

According to the firm, the concept of tokenisation, which is the process of converting traditional financial assets into digital tokens recorded on a blockchain, is gaining traction as regulatory frameworks begin to form. New legislation, such as the Markets in Crypto-Assets (MiCA) regulation in the European Union and the Genius Act in the United States, is creating conditions under which digital representations of real-world assets can be issued in a regulated manner.

As part of its expansion, eToro will begin offering 24/5 trading on a selection of 100 widely traded US-listed stocks and ETFs. The move extends the platform's existing functionality beyond standard market hours, allowing users to respond to market developments outside traditional trading windows.

In parallel, the platform has introduced spot-quoted futures, developed in collaboration with CME Group. These contracts differ from standard futures by being priced directly against the spot market, and they feature longer expiry dates. Currently available in certain European markets, these instruments are intended to offer retail traders exposure to futures markets using a format more aligned with conventional pricing structures. eToro has indicated plans to make them available to a wider global user base.

eToro has also reiterated its ongoing work in the area of tokenisation. The company has been involved in this space since 2012, when its CEO co-authored a white paper on the use of blockchain for representing traditional assets. In 2019, it acquired the Danish blockchain firm Firmo, later launching tokenised versions of gold, silver, and selected fiat currencies.

The platform now plans to launch tokenised versions of US-listed equities using the ERC-20 standard on the Ethereum blockchain. These tokenised stocks will be linked to their real-world counterparts, and users will have the option to move them on-chain or redeem them back into traditional positions on the platform.

eToro views tokenisation as a step toward making financial markets more accessible across time zones and jurisdictions. The firm sees the process as a progression from extended trading hours to 24/5 access, and eventually, continuous 24/7 availability through blockchain integration. However, the wider adoption of such models may depend on how market participants, regulators, and infrastructure providers respond to these shifts.

While the concept of 24/7 trading and blockchain-based asset settlement introduces new possibilities, it also raises questions about custody, liquidity, and oversight. As platforms experiment with these technologies, broader industry response and regulatory clarity are likely to shape the long-term implications for retail and institutional investors alike.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.