Abstract:Philippine SEC enforces new CASP Rules, prompting major ISPs to block access to unregistered crypto exchanges and raising concerns on internet censorship.

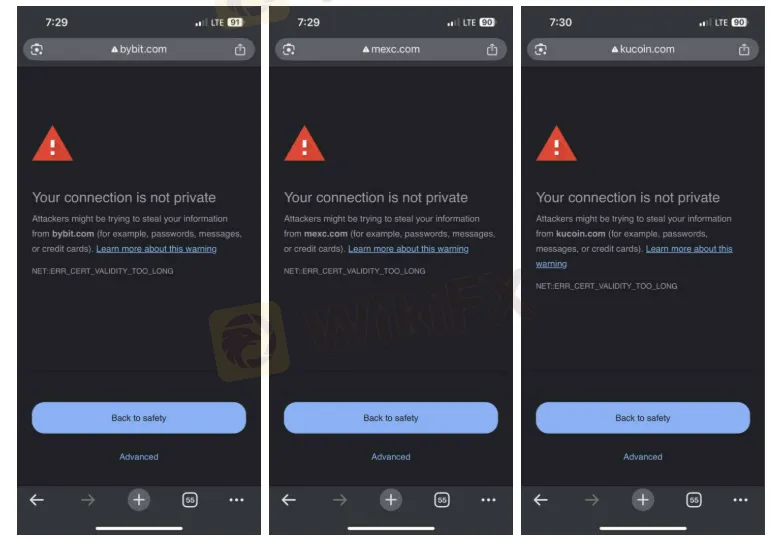

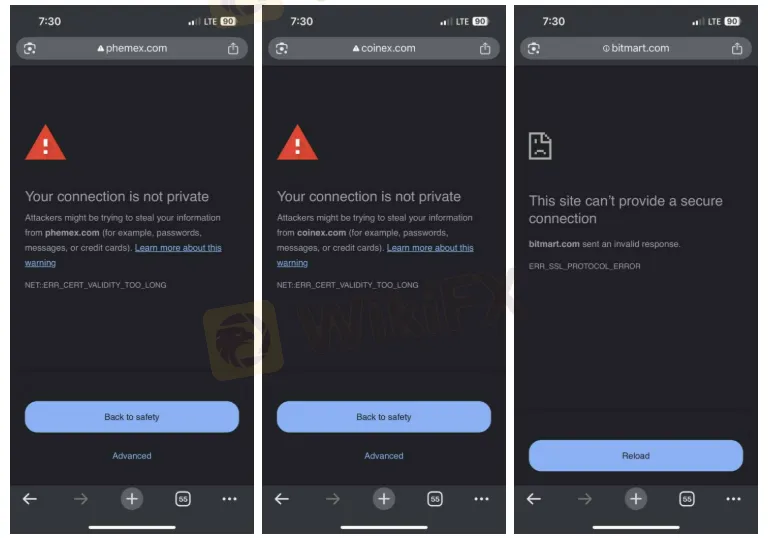

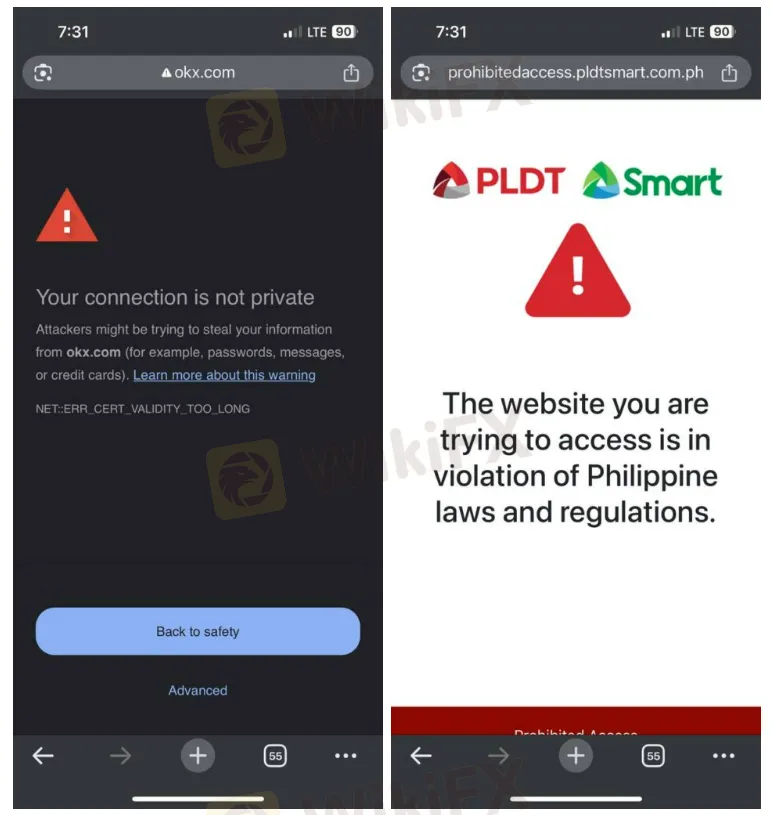

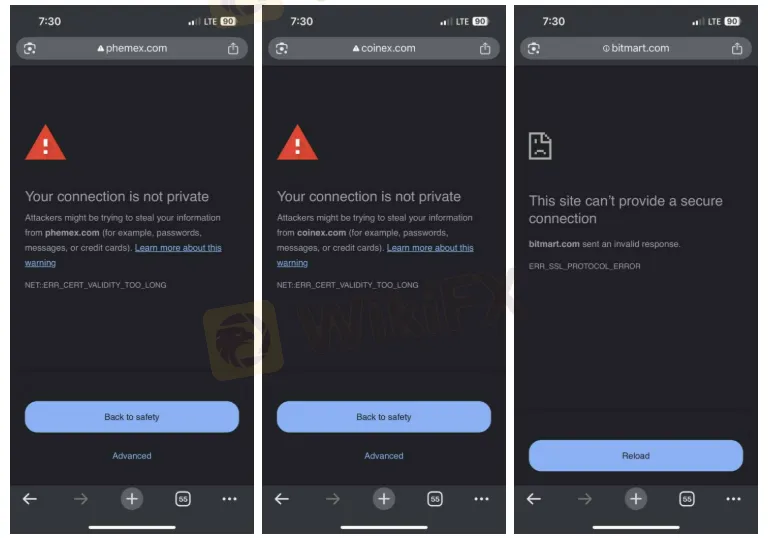

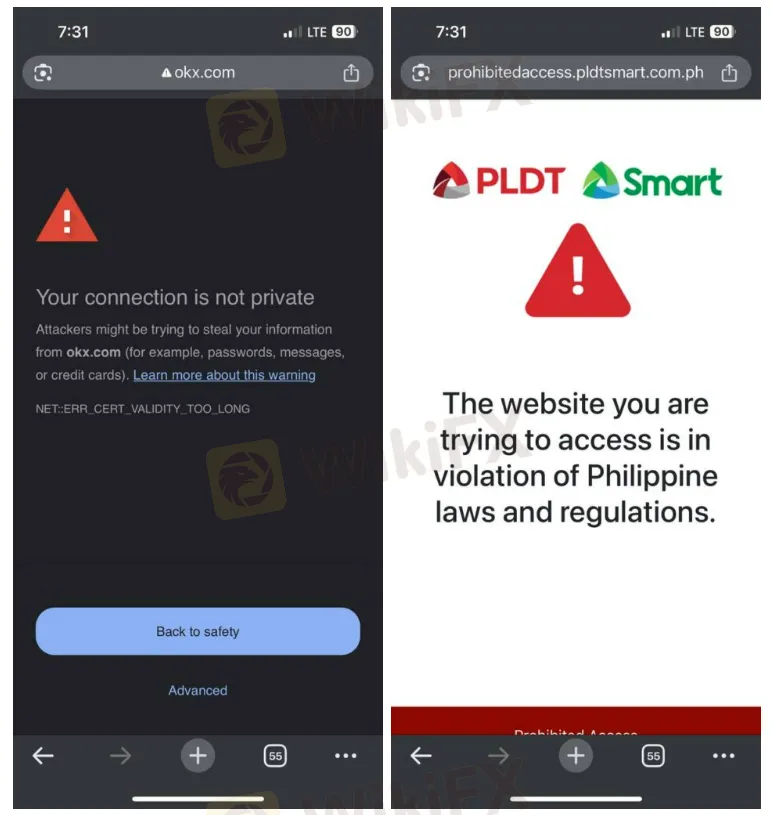

The Philippine Securities and Exchange Commission (SEC) has ramped up its measures to protect investors by cracking down on unregistered crypto exchanges, a move that has sent ripples across the digital asset industry. Major internet service providers (ISPs), including PLDT and Smart, have now blocked access to leading cryptocurrency platforms such as OKX, Bybit, KuCoin, and Kraken, pursuant to the latest regulatory directives.

This sweeping action follows a newly issued advisory from the SEC, which flagged at least ten unregistered crypto exchanges for operating in the country without proper licenses. The regulators warning highlights the risks Filipino investors face when transacting with unauthorized platforms, including potential total fund loss and limited legal recourse.

Under its newly implemented Crypto Asset Service Provider (CASP) Rules—embodied in SEC Memorandum Circulars No. 4 and 5 (Series of 2025)—the SEC now requires all entities offering crypto services in the Philippines to secure proper registration, maintain a physical office, and meet robust compliance standards. These rules also put forth anti-money laundering and investor protection measures, aiming to bring much-needed transparency and oversight to the flourishing sector.

The intensified SEC campaign coincides with instructions from the National Telecommunications Commission (NTC) directing Philippine ISPs to implement DNS-level blocking of unlicensed crypto exchange websites. This directive gives the government enhanced centralized control over which online platforms are accessible, marking a significant development in how authorities leverage technology for financial regulation.

While industry observers commend the SEC‘s intent to safeguard the public, the move reignites longstanding debates about internet censorship and website accessibility in the Philippines. Critics point to growing concerns about the implications for digital freedom, noting the country’s history of blocking various websites under different government orders, often citing security risks or regulatory violations.

As the Crypto Asset Service Provider (CASP) Rules take hold, all platforms—both foreign and domestic—must navigate the new landscape or risk facing regulatory action, further blocks, and app store takedowns. For Filipino crypto users, these developments underscore the importance of checking SEC registration and understanding the evolving compliance environment before choosing a platform.

The SEC reaffirmed its commitment to continued surveillance, making clear that any unregistered entity offering crypto services remains at risk of enforcement action. As the Philippines shapes its digital asset policy, the balancing act between investor protection and internet freedom is set to be a defining issue in the coming years.

Don't miss out on the latest news and updates on the Philippines' Crypto regulation. Scan the QR code below to download and install the WikiFX app on your smartphone.