简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

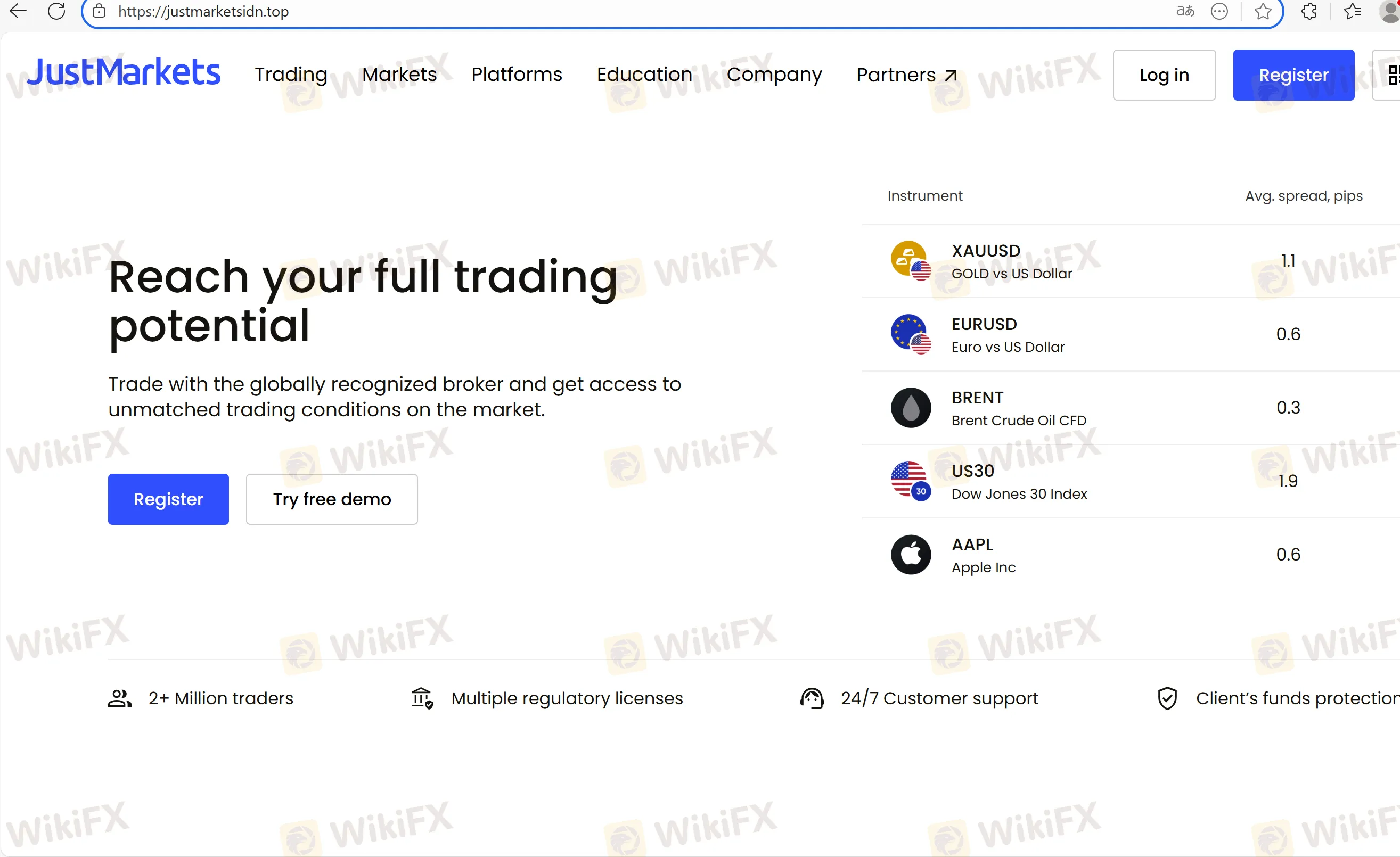

JustMarkets Review — Broker Deep Dive for Active Traders

Abstract:Expert review of JustMarkets broker: platforms (MT4/MT5), markets, account structure, fees, funding flow, and regulatory snapshot—balanced pros and cons.

Our Analyst Perspective

We evaluated JustMarkets as a multi-asset CFD broker centered on MT4/MT5. Instrument coverage is broad (forex, indices, commodities, stocks, crypto). Account structure is clear: Standard/Standard Cent ($10 min) and Pro/Raw ($200 min). Stated max leverage is up to 1:3000. That headline leverage demands discipline; I manage risk with small position sizes, hard stops, and staged funding.

Regulation Snapshot

- Regulated Country: Seychelles

- Regulator: Seychelles Financial Services Authority (FSA)

- Current Status:Unverified

- Regulated Entity:Just Global Markets Ltd.

- License Type: Retail Forex License

- License No.:SD088

I treat “Unverified” status as a material risk. It impacts how much capital I allocate and how quickly I test deposits/withdrawals. I document everything and keep exposure modest.

What Are the Pros & Cons of JustMarkets?

| Pros (why I might use it) | Cons (what I watch out for) |

| MT4 & MT5 across desktop, web, and mobile | Regulatory line item marked Unverified (Seychelles FSA, SD088) |

| Wide market coverage: forex, commodities, indices, stocks, crypto | Offshore regulation offers limited investor protections vs. Tier-1 regimes |

| Structured accounts: $10 entry (Standard/Cent), $200 for Pro/Raw | Regional restrictions apply (Australia, Canada, Japan, the United Kingdom, the United States of America); availability varies by country |

| Raw account with 0.0-style spreads + transparent commission | |

| Web trading available for quick access |

Who Is This Broker Best for?

From my tests and checklist reviews, I place JustMarkets for:

- MT4/MT5 users who need both terminals and a familiar workflow.

- Cost-sensitive traders who want a $10 entry path (Standard/Cent) before moving to Pro/Raw.

- Methodical learners wholl start on demo, validate withdrawals early, and run strict risk controls.

I do not consider it a match for anyone seeking top-tier investor protections or for long-only investors wanting bonds/ETFs/options access.

My Risk Controls When Using It

- Fund small. Test withdrawal before scaling.

- Cap leverage well below the maximum.

- Use stop-losses and daily loss limits.

- Keep an audit trail of all funding and support chats.

Trust & transparency: Facts above reflect your provided sources and your regulatory line item (Seychelles FSA — Unverified — SD088). Opinions are mine, based on how I operationalize risk on CFD brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Yen Surges on Talk of Joint US-Japan Intervention; PM Takaichi Gambles on Snap Election

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Currency Calculator