简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Eightcap Fees: Spread and Other Cost Explained for Standard and Raw Pricing

Abstract:Understand Eightcap fees at a glance: Spread & other cost by account (Standard vs Raw), commissions, overnight financing, and how to check real-time pricing and specs.

What Pricing Does Eightcap Use?

Eightcap offers two core pricing models: Standard (spread-only, no commission) and Raw (tighter spreads from 0.0 pips plus a per-lot commission). Spreads are variable and differ by symbol, session, and entity. Overnight financing (swap) may apply to positions held past market close.

Risk first: CFDs are leveraged products. Actual trading cost is the combined effect of spread + commission + swap/financing (and, where relevant, currency conversion). Always validate symbol-level specs before trading.

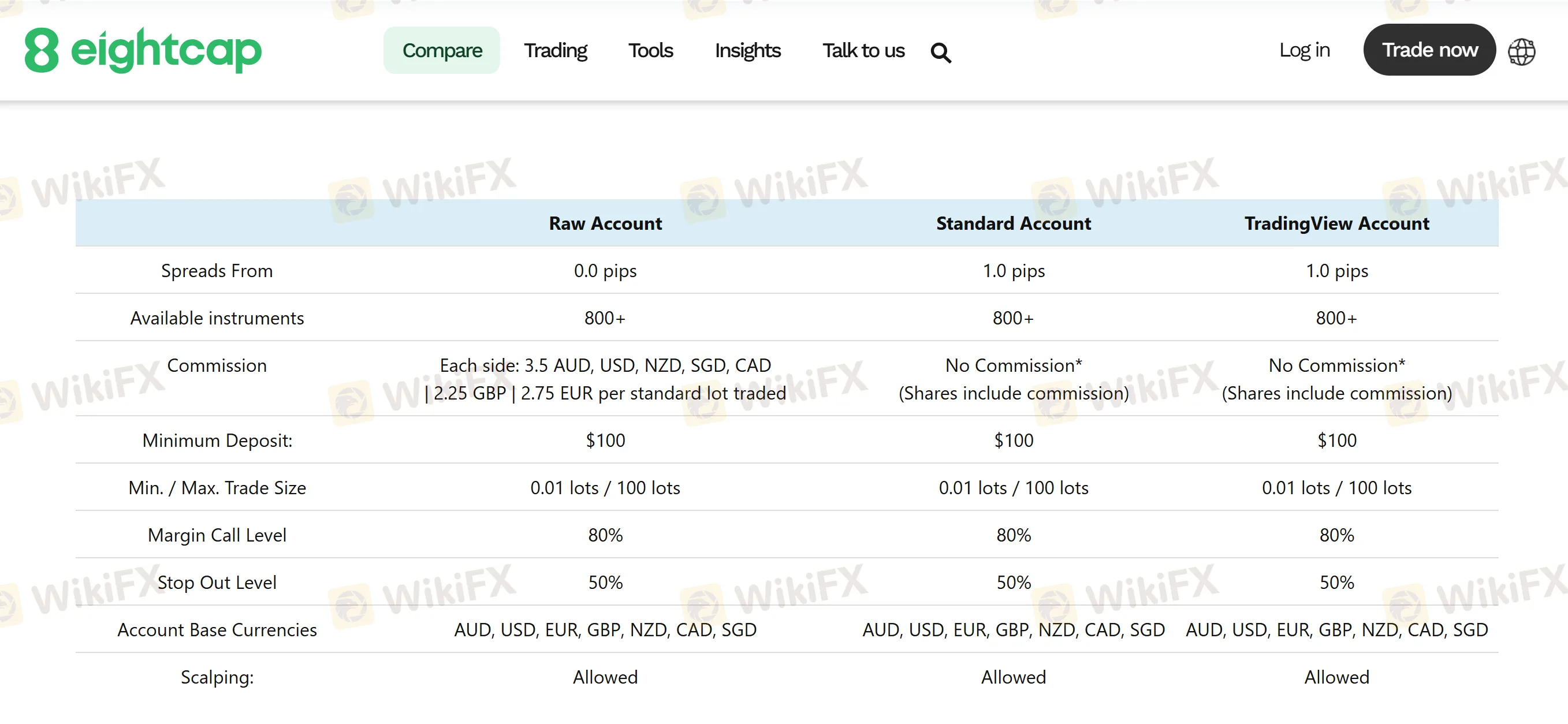

How Do Eightcap Accounts Differ on Spread & Commission?

The matrix below summarises headline pricing features. For instrument-level details (min spreads, step size, contract values, any commission notes), consult Eightcaps instrument/specification resources.

| Item | Standard | Raw |

| Pricing model | Spread-only | Spread + commission |

| Commission | None | Per-lot commission (varies by instrument/entity) |

| Spreads (from) | as low as 1.0 pips (indicative) | from 0.0 pips (indicative) |

| Execution venues & platforms | MT4 / MT5 / TradingView | MT4 / MT5 / TradingView |

| Notes on costs | Spread reflects total trading cost (ex-swap) | Combine tight spread with commission for all-in cost |

Other Fees & Operational Costs to Consider

- Overnight financing (swap): Applied to open positions held past the platforms rollover; varies by symbol and day (e.g., triple-swap rules).

- Account setup fee:None; opening a live account is free.

- Funding/withdrawal charges: Eightcap states no internal fees; payment providers or banks may charge their own fees (incl. FX conversion).

- Minimum deposit: Typically $100 (or equivalent) for first funding; limits and currencies vary by entity/region.

How to Verify Live Cost?

- In-platform view: In MT4/MT5, enable the Spreads column in Market Watch to observe real-time spreads during the intended trading hours.

- Official cost pages: Cross-check Trading Costs and symbol pages; many list minimum spreads and commission notes, with downloadable specifications.

FAQs — Eightcap Fees

- Whats the main difference between Standard and Raw on cost?

Standard embeds Cost in the spread (no commission). Raw shows tighter spreads and adds a per-lot commission, which can be preferable for spread-sensitive strategies.

- Are spreads fixed or variable?Variable. Displayed “from” values are indicative minimums; live spreads depend on market conditions, liquidity, and timing. Check platform quotes and the specs sheet.

- Does Eightcap charge trading fees on FX/CFDs?

Eightcap notes no broker fees on FX/CFD products beyond the pricing model; overnight financing may apply to held positions.

- Where can symbol-level cost & spread be confirmed?

On the instrument/specification PDF and individual product pages (e.g., Forex, Crypto). These list minimum spreads (Standard vs Raw) and relevant contract details.

- Are there costs to open an account?

No. Account opening is free; trading costs arise from spread, commission (Raw), and swap/financing where applicable.

- Do payment fees affect overall cost?

Eightcap doesnt charge internal funding/withdrawal fees, but providers may. If deposits/withdrawals involve currency conversion, external charges can increase total cost.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator