Saracen Markets Review: Regulated or Scam Alert?

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Master the basics of easy forex trading with practical beginner tips, reviews, safe methods, and simple profit strategies. Start learning and trading in one hour.

Currency trading—better known as forex—has grown into the largest marketplace on the planet, moving more than $7 trillion in daily transactions. While those numbers can look intimidating, dont mistake forex for a game strictly reserved for seasoned professionals. Anyone with access to a credible broker and a trading platform can enter the market. With the right framework, you can grasp the basics and start practicing trades in less than an hour.

This guide cuts through the noise and focuses on easy forex trading—a way to step confidently into forex without getting lost in overly technical charts and complex trading systems. Think of it as a simple forex guide written for beginners: practical steps, tested strategies, and reliable safety measures that help you start small yet steady.

Simply put, easy forex trading is learning to approach the market with clarity and restraint. It strips trading down to the essentials:

Instead of diving into a sea of indicators and financial jargon, the goal is to use straightforward methods that let you place a trade confidently while keeping risk under control.

If you‘re curious about how to start easy forex trading, here’s a structured one-hour plan that sets the foundation:

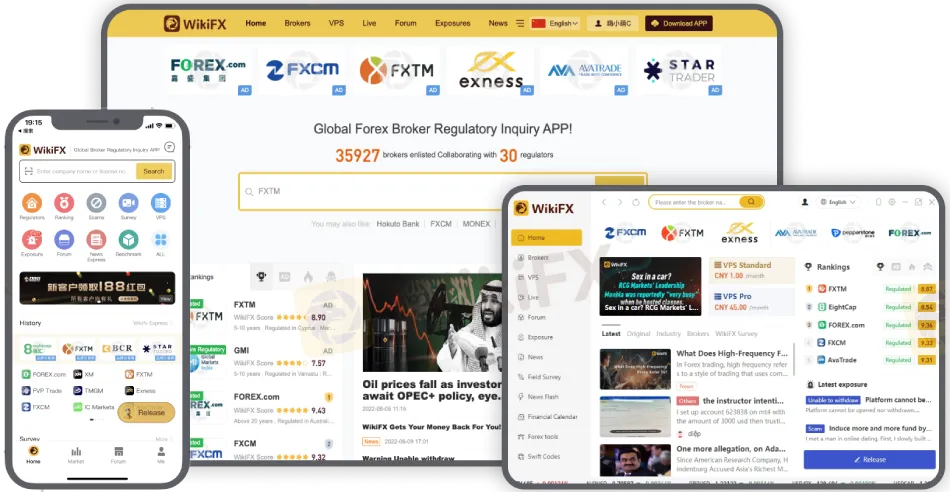

Step 1: Select a Broker You Can Trust

Your broker is your direct connection to the forex market, so choose wisely. Look for:

Step 2: Set Up an Account

Opening an account is usually straightforward—upload your ID, confirm some details, and get verified. Once approved, you can deposit a modest sum (though its smart to begin in demo mode).

Step 3: Explore Your Platform

Dedicate 15–20 minutes to clicking around the trading platform. Learn how to:

This step is crucial—understanding the mechanics ensures you dont make costly clicks later.

Step 4: Place a Practice Trade

Before diving into live money, enter a demo trade on a major currency pair (like EUR/USD). Stick to a micro lot so movement remains small, and add both a stop-loss and take-profit. This gives you the experience of placing a “complete” trade from start to finish.

In just under 60 minutes, youll have exposure to every fundamental stage of a trade.

Starting forex doesnt mean reckless risk-taking. The most consistent traders succeed because they follow habits that may seem simple but are critical for survival. Here are some beginner forex tips every new trader should know:

When it comes to strategies, remember: fewer is better. Beginners dont need 10 indicators crowding the screen. Here are some easy forex profit strategies that are simple to apply:

1. Follow the Trend

Markets move in patterns. One of the lowest-stress strategies is to trade with the trend rather than against it. You might use a moving average to confirm direction:

2. Breakout Trading

Markets occasionally “break out” of tight ranges. Beginners can take advantage of these moments by:

3. Quick Scalps

For those who want a fast-paced approach, scalping involves banking several small profits within a short window. Its suited for traders who can focus for short bursts and use brokers with tight spreads.

Choosing the Best Forex Brokers and Platforms

One overlooked aspect of success in forex is the quality of your broker and platform. The best forex brokers support traders with:

Your forex trading platform is the engine for your trades, so it must be stable and intuitive. Platforms like MT4 and MT5 remain popular because of their balance between functionality and beginner usability.

Every profitable trader remembers losses more than wins—because risk is what shapes longevity. New traders should adopt safe forex trading methods from the outset:

Theres a reason so many people search for easy forex trading for beginners: complexity kills confidence. By simplifying trading into manageable steps, newcomers learn:

This approach acknowledges reality: forex trading isnt a get-rich-quick scheme, but it is a legitimate opportunity for those who treat it with patience and method.

Getting started in forex doesnt require months of theory before taking your first step. In fact, with a structured plan, you can open an account, understand your trading platform, and place a safe practice trade in under an hour.

The essence of easy forex trading lies in three things:

If you follow these principles, that first hour can become the start of a disciplined, lifelong trading journey.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.

When people who invest ask, "Is Arena Capitals safe or a scam?" the proof shows we need to be very careful. This broker works without proper rules from top financial authorities, gets very low safety scores from independent financial watchdogs, and many users have serious complaints about them. The information available to everyone suggests that giving your capital to this company could lead to losing it all. This analysis doesn't guess - it looks at these important warning signs. We will look at real facts, study actual user reviews that show big problems with taking out funds, and give a clear answer based on evidence about whether Arena Capitals can be trusted. This article gives you the facts you need to make a smart choice and keep your funds safe from an unregulated, high-risk business.

When traders are choosing a brokerage, the most important questions are always about safety and whether the company is legitimate. When it comes to Arena Capitals, the verdict is clear and immediate based on extensive public data and regulatory checks. This company operates without oversight from any top-tier financial authority, putting it firmly in the high-risk category. Our analysis shows a consistent pattern of warning signs that potential investors must consider. The key findings are clear: verification platforms mark Arena Capitals with a "No Regulation" status, its company registration is in an offshore location known for its lack of financial oversight, and a growing number of user reports detail significant problems, especially with withdrawing funds. This article provides a complete, evidence-based breakdown of these facts to help you make an informed decision and protect your capital. The conclusion is that Arena Capitals presents a high potential risk to investors.