简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETRADE Account Options and Fees Explained

Abstract:Discover ETRADE account types, associated fees, and minimum deposits. Learn how account features impact trading costs and investment strategies.

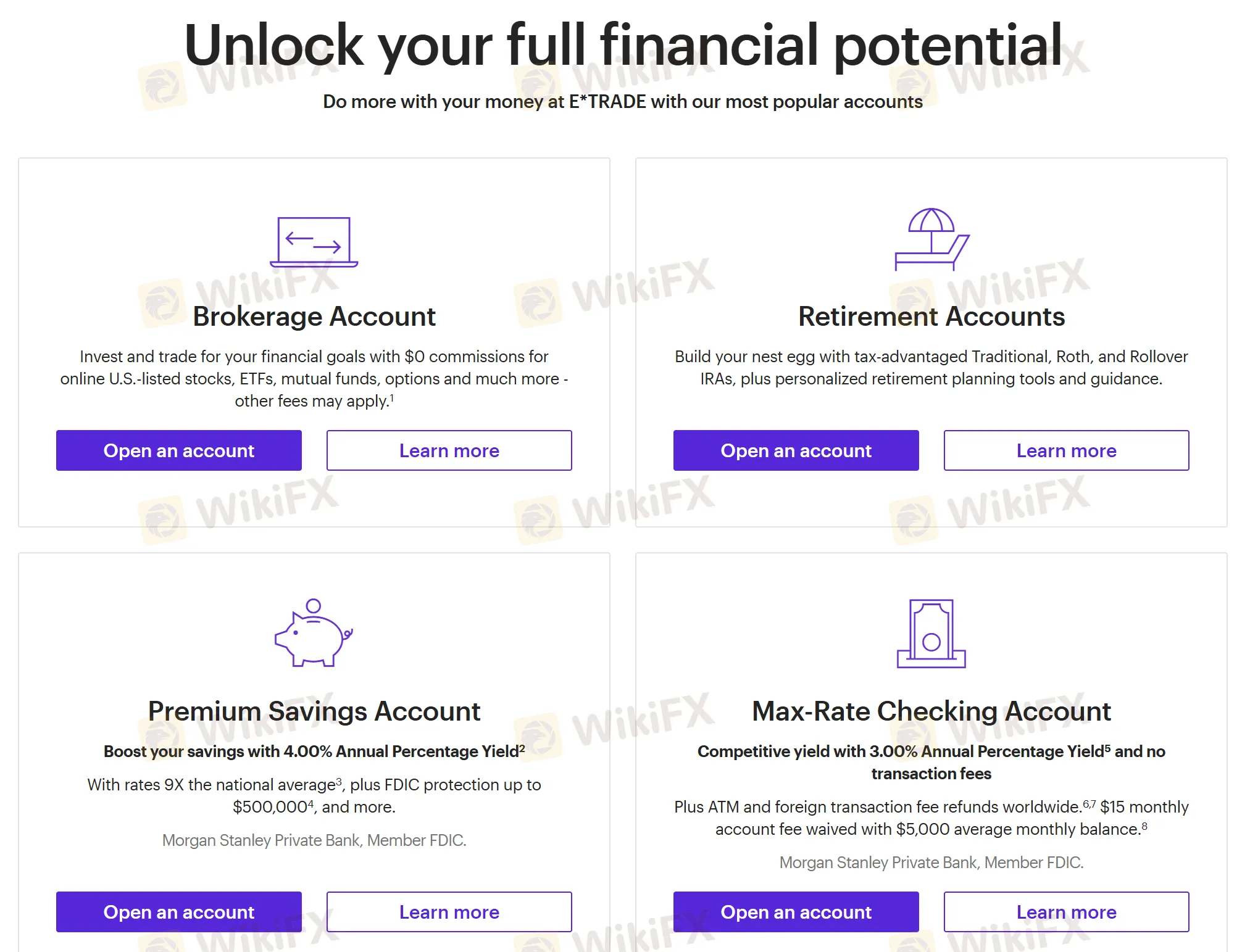

Account Options Provided by E*TRADE

E*TRADE offers diverse account types covering brokerage, retirement, and banking needs. From my experience, each account provides flexible trading and investment management with a transparent fee structure.

Comparison of E*TRADE Account Types

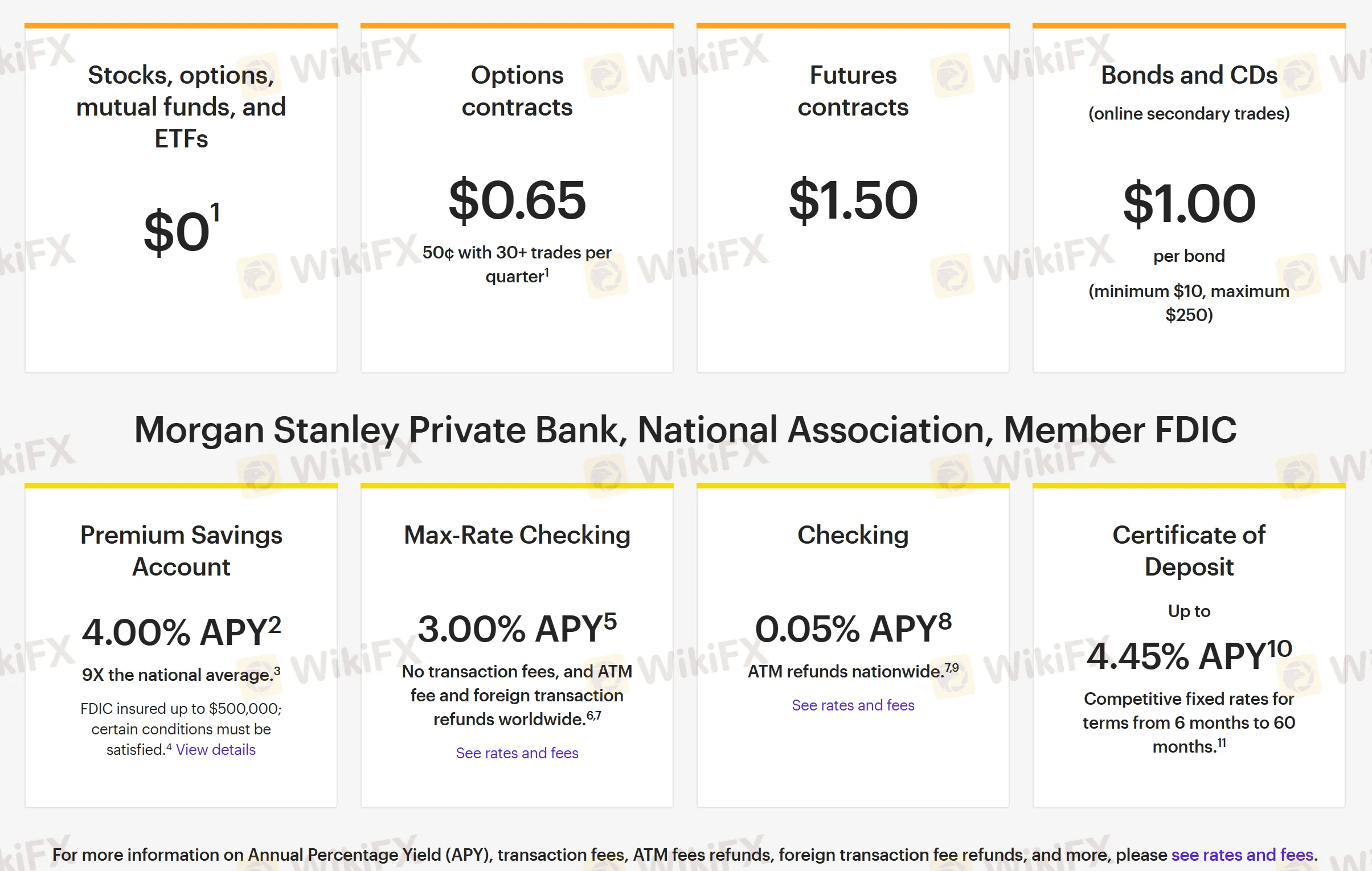

| Account Type | Minimum Deposit | Fees | Features |

| Brokerage Account | $0 | $0 per trade (stocks/ETFs) | Standard trading account for stocks, ETFs, options, and mutual funds |

| Retirement Account (IRA) | $0 | $0 per trade | Traditional, Roth, or Rollover IRA with tax advantages |

| Core Portfolios | $500 | 0.30% advisory fee | Automated investment management with diversified portfolios |

| Bank Account | $0 | No monthly fees | Savings and checking accounts with FDIC insurance |

FAQs about E*TRADE Account Type & Fees

- What is the minimum deposit for a brokerage account?

$0, making it accessible to new investors.

- Are there trading fees for stocks and ETFs?

No, standard online stock and ETF trades are free.

- What are the fees for options trading?

$0.65 per contract, reduced to $0.50 for more than 30 trades per quarter.

- Does E*TRADE charge for mutual fund trades?

Some no-load mutual funds are commission-free; others may have fees.

- Are there hidden account maintenance fees?

No, the fee structure is transparent.

- Can investment and banking accounts be linked?

Yes, integration allows seamless portfolio and cash management.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Currency Calculator