Abstract:If you want to be an informed investor or trader in the forex market and avoid scams, you must read this article. This is the latest scam alert about SecureFX, which reveals the red flags of SecureFX. Check out the 5 major risks associated with SecureFX and stay alert.

If you want to be an informed investor or trader in the forex market and avoid scams, you must read this article. This is the latest scam alert about SecureFX, which reveals the red flags of SecureFX. Check out the 5 major risks associated with SecureFX and stay alert.

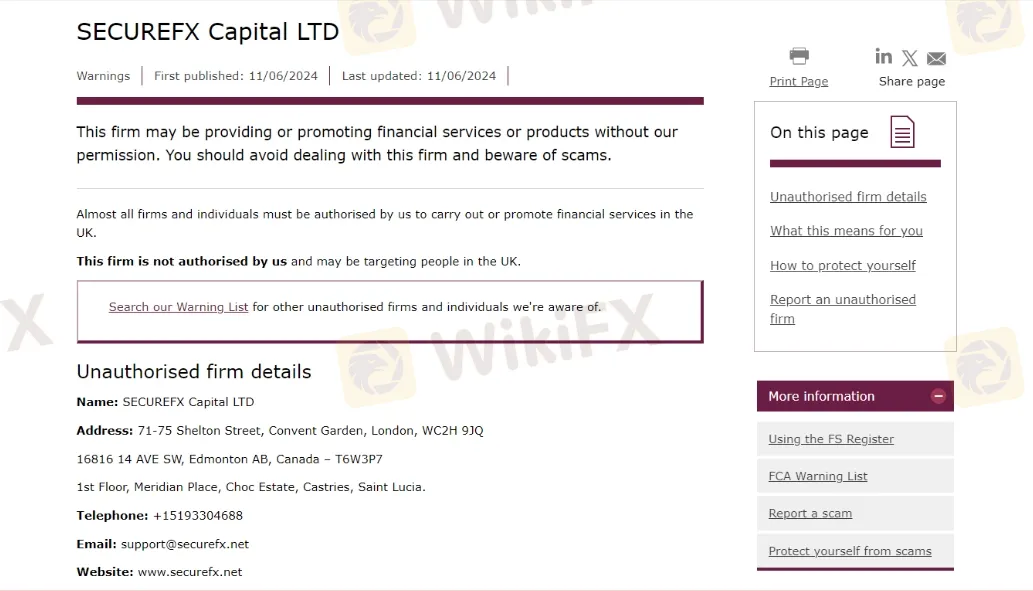

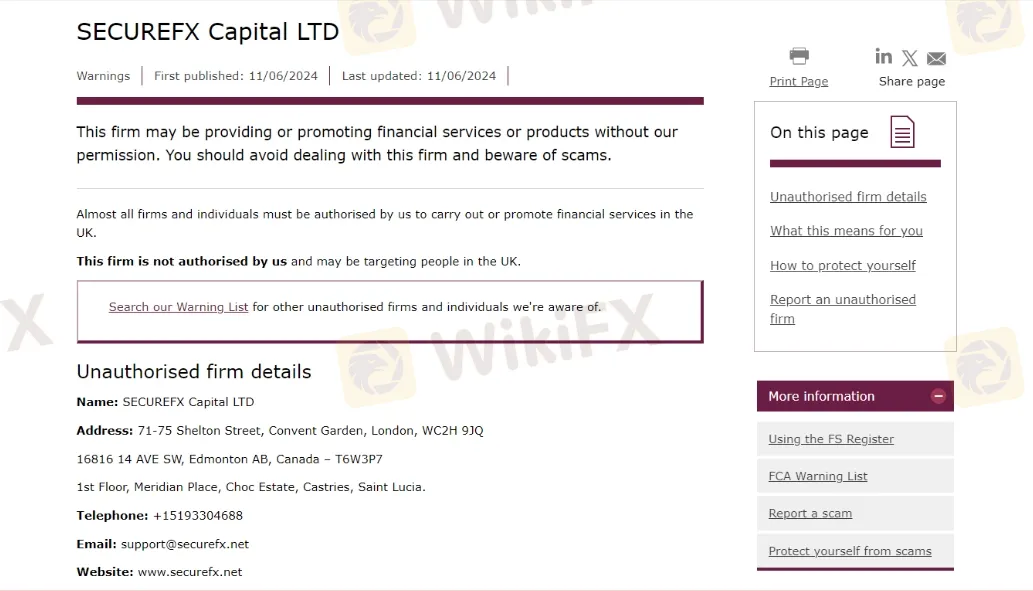

1. Official Warning of FCA in 2014

The UKs Financial Conduct Authority (FCA) issued a public warning against SecureFX in 2014, stating that the company was providing financial services or products in the UK without authorization. FCA is one of the most trusted financial regulators globally. If a broker is flagged by the FCA, it's a major red flag indicating non-compliance with strict financial standards.

Unauthorised firm details

Name: SECUREFX Capital LTD

Address: 71-75 Shelton Street, Convent Garden, London,WC2H 9JQ

16816 14 AVE SW, Edmonton AB, Canada - T6W3P7

1st Floor, Meridian Place, Choc Estate, Castries, SaintLucia.

Telephone: +15193304688

Email: support@securefx.net

Website: www.securefx.net

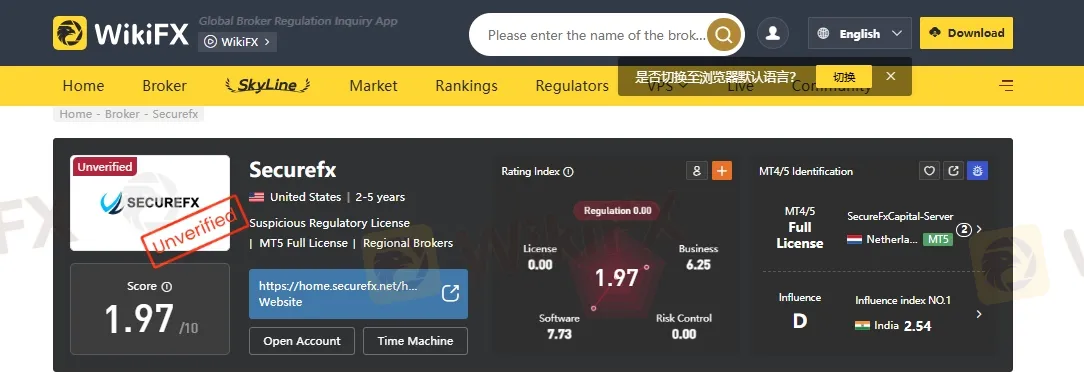

2. Lack of Regulation by Top-Tier Authority

SecureFX Options is not regulated by any top-tier financial authority like FCA (UK), ASIC (Australia), or SEBI (India). Trading with unregulated brokers exposes you to high risk, as there's no legal recourse in case of disputes, fund mismanagement, or fraud. Reputable brokers always operate under recognized and enforced financial regulations to ensure trader safety.

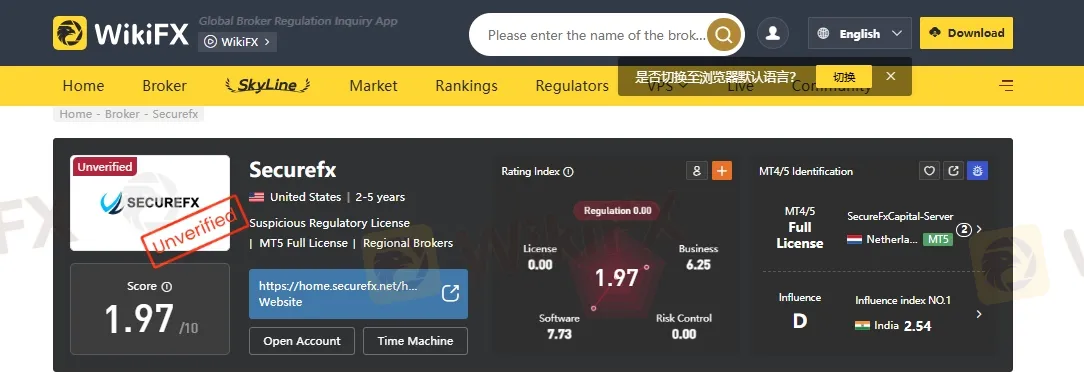

3. Extremely Low Trust Score – 1.97 Out of 10

According to multiple independent review platforms, SecureFX Options has an alarmingly low trust score of just 1.97 out of 10. This rating indicates extremely poor credibility, user satisfaction, and platform transparency. Any broker scoring this low should be approached with extreme caution. A low rating is often a clear reflection of unresolved user complaints, lack of regulation, and questionable business practices.

Read this Important Article too- www.wikifx.com/en/newsdetail/202508213724780226.html

4. Accessibility Issues

SecureFX‘s website suffers from serious quality and accessibility issues. In many cases, the site either fails to load or displays error messages, making it impossible for users to access essential information. A trustworthy broker maintains a professional, fully functional online presence to ensure transparency and user trust. The lack of a working website not only signals poor technical maintenance but also raises concerns about the broker’s legitimacy and intent.

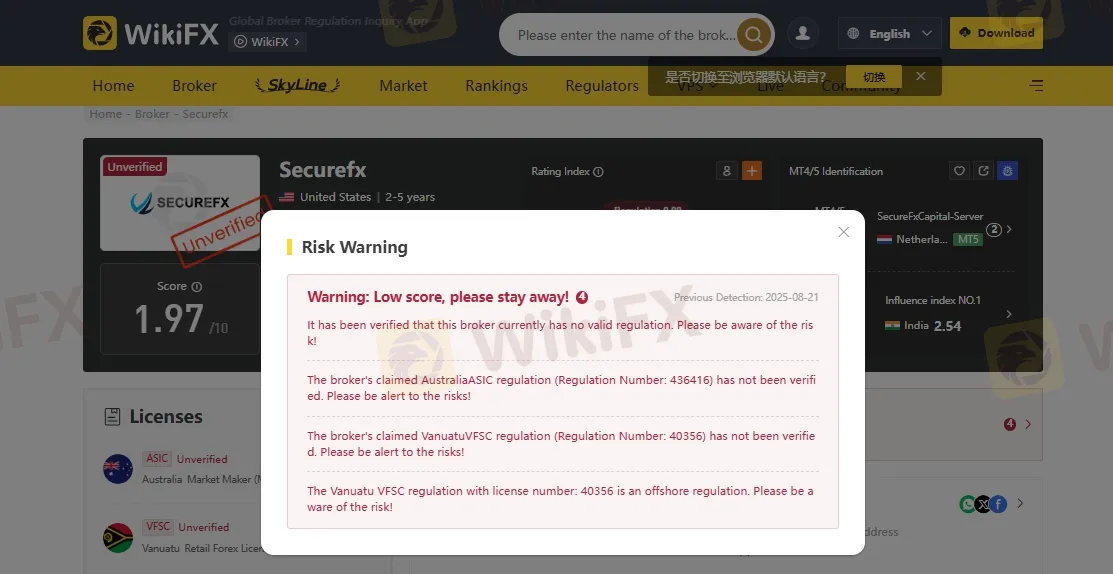

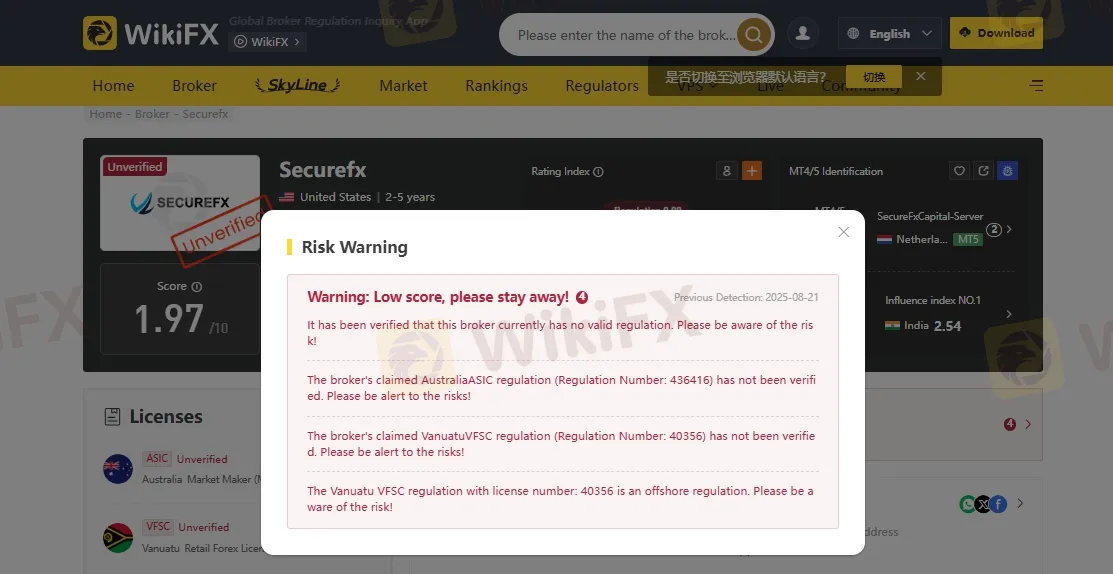

5. WikiFX Warning Issued

A serious warning has been issued by WikiFX, a well-known global forex broker review platform. Their message is direct:

“Warning: Low score, please stay away!”

WikiFX has also verified that SecureFX Options has no valid regulatory license at the moment. This means your funds are not protected by any financial authority, increasing the risk of fraud or unethical practices. Traders are strongly advised to avoid any broker that lacks verified regulation.

Conclusion

Based on its extremely low trust score, multiple warnings from regulators like WikiFX and FCA, and lack of valid regulation, SecureFX Options appears to be a high-risk, untrustworthy platform. Traders are strongly advised to look for well-regulated brokers with a proven track record to ensure the safety of their investments.