Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:StoneX is a FCA-regulated broker, but despite this, investors are losing interest. What are the key reasons behind this shift in investor sentiment?

StoneX is a FCA-regulated broker, but despite this, investors are losing interest. What are the key reasons behind this shift in investor sentiment?

1. Regulatory Actions Against StoneX

StoneX, like many large financial institutions, has faced penalties from regulatory bodies.

• In September 2023, the Commodity Futures Trading Commission (CFTC) charged StoneX Markets LLC for not disclosing thousands of Pre Trade Mid Market Marks (PTMMM) in swap transactions. The company also failed to supervise this compliance properly.

• The result: a $650,000 civil monetary penalty, plus a requirement to fix compliance processes and send remediation reports to the CFTC. CFTC

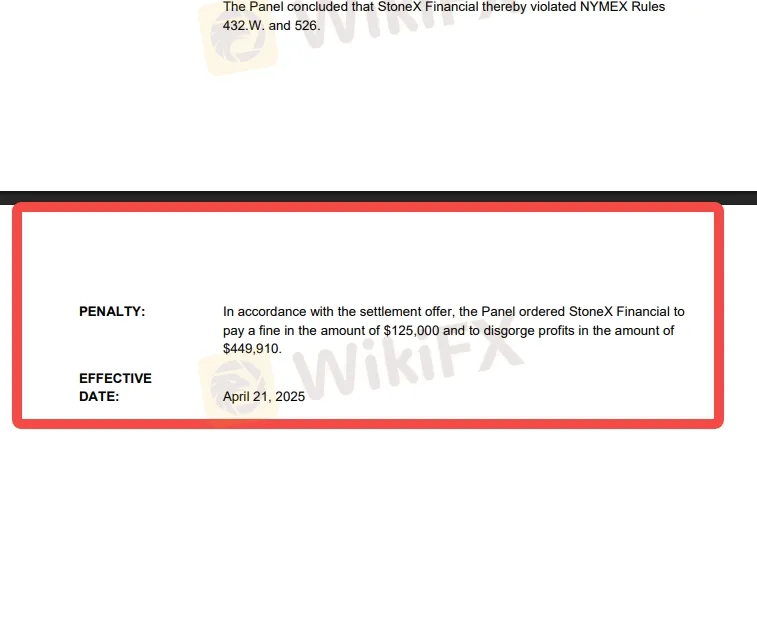

2. CME Group Sanctions in 2022 – 2025 for Pre-Hedging Violations

• According to a CME Group disciplinary notice, StoneX Financial Inc. was fined $125,000 in 2025, and ordered to disgorge $449,910 in profits earned from improper pre-hedging.

• The violations dated from April to August 2022 and involved rules related to block trades in crude oil, ULSD, RBOB, and platinum futures. The firm neither admitted nor denied the violations.

2. Allegations of Misconduct

Reports from investor-focused law firms and regulatory records show that StoneX has faced arbitration claims and customer complaints. These have included allegations of unauthorized trading, misrepresentation, and failure to supervise brokers. While these are not necessarily indicators of a systemic problem, a pattern of such complaints can raise concerns about the firm's supervision of its registered representatives and the overall client experience.

3. Financial Performance & Market Perception

Despite the regulatory issues, StoneX Group's financial performance has been generally strong, with reported growth in revenues and net income. This provides a counterpoint to the negative headlines. The company's stock has also performed well, with analysts providing “buy” or “strong-buy” ratings. This presents a nuanced picture for investors, who must weigh the company's profitability against its compliance history.

4. Insider Stock Sales

A key point of interest for investors is insider activity. Regulatory filings have revealed that certain company insiders, including the CEO, have sold significant amounts of company stock. While such sales can be for personal financial planning and aren't always a negative signal, large-scale or frequent insider sales can sometimes be interpreted by the market as a lack of confidence in the company's future prospects.

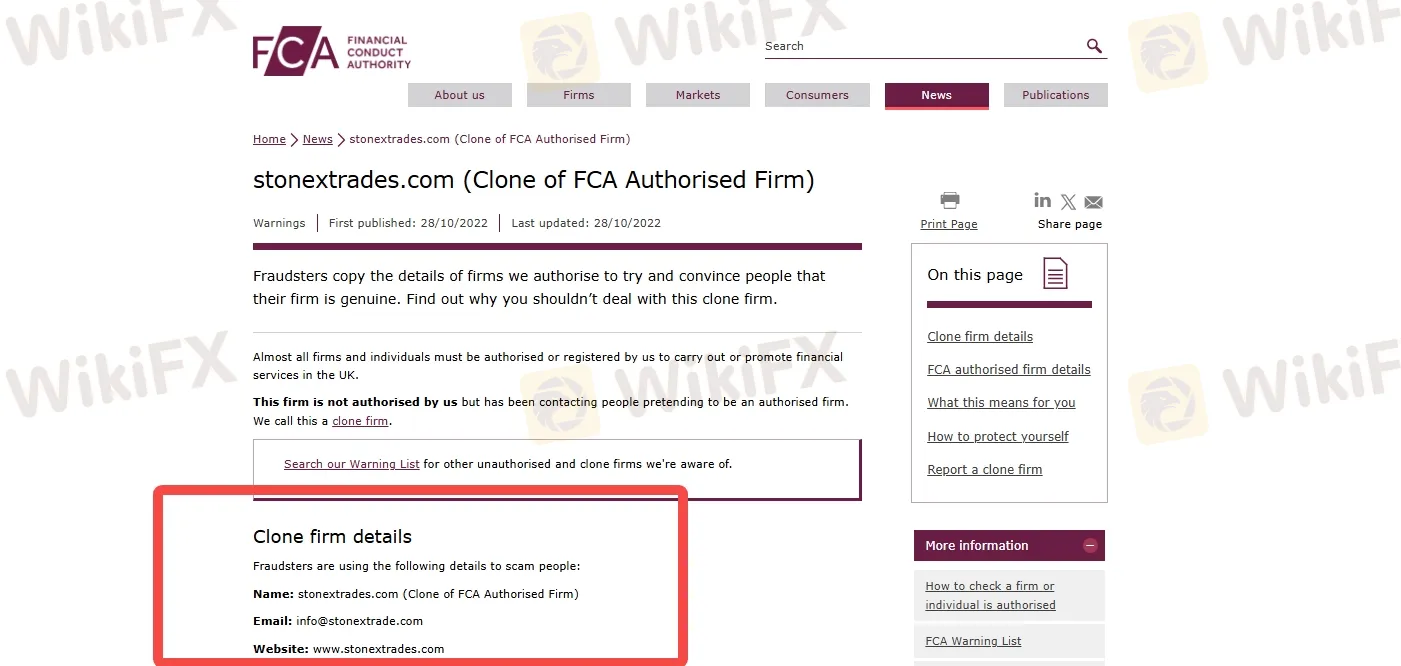

5. Cybersecurity & Fraud Concerns

StoneX has publicly warned about scammers impersonating its representatives to defraud clients. While the company offers detailed advice to avoid falling victim, the presence of these warnings alongside fraudulent clone firms flagged by regulators does contribute to investor unease about the safety of their funds and personal data.

6. Complex Business Model and Acquisitions

StoneX has a diverse business model spanning various segments, including commercial, institutional, retail, and payments. The company has also engaged in strategic acquisitions to expand its offerings. While this diversification can be a source of strength, the complexity can make it challenging for some investors to fully understand and evaluate the company's operations and associated risks. This can contribute to a sense of uncertainty.

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Mastering forex broker regulation ensures you avoid pitfalls and select trustworthy platforms. We’ll cover regulator types, license details, the distinction between licensed and registered, and practical steps.

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!