Abstract:The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

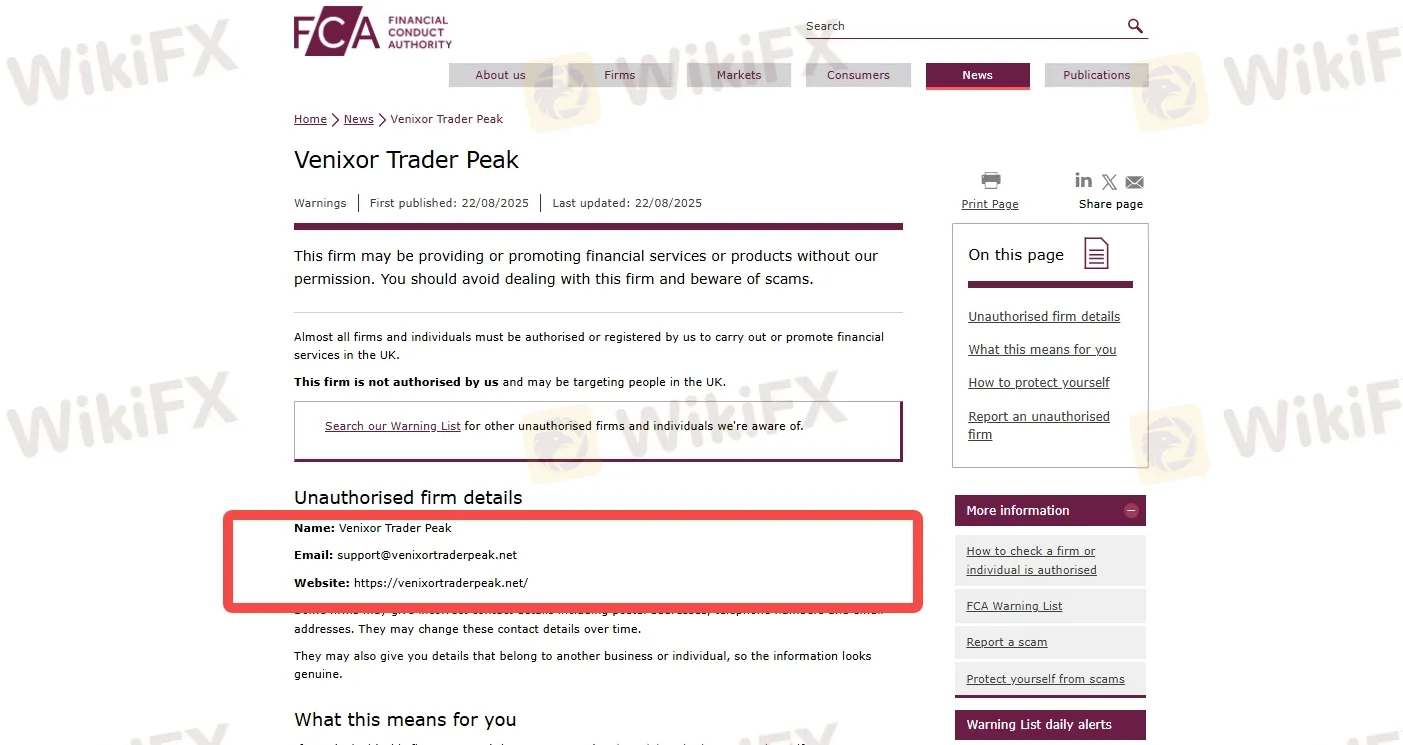

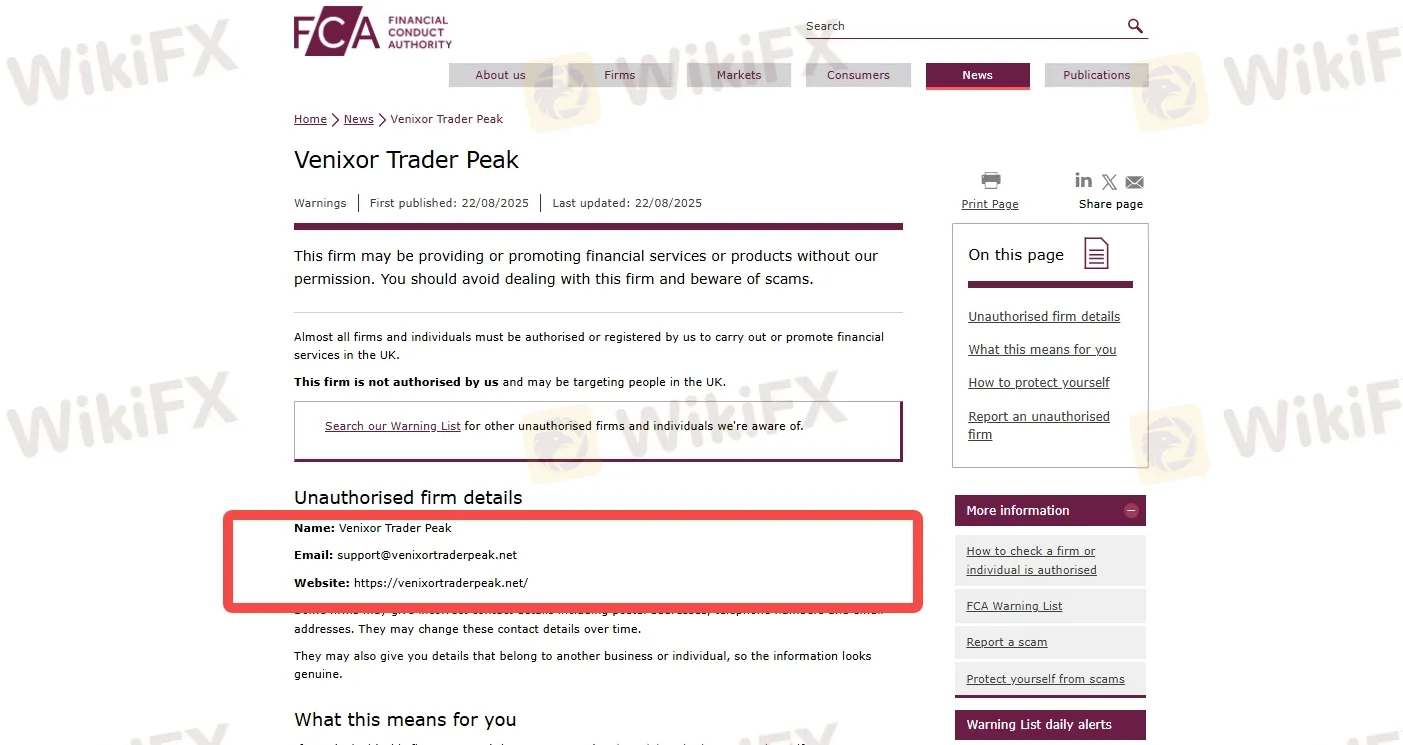

1. Name: Venixor Trader Peak

Email: support@venixortraderpeak.net

Website: https://venixortraderpeak.net/

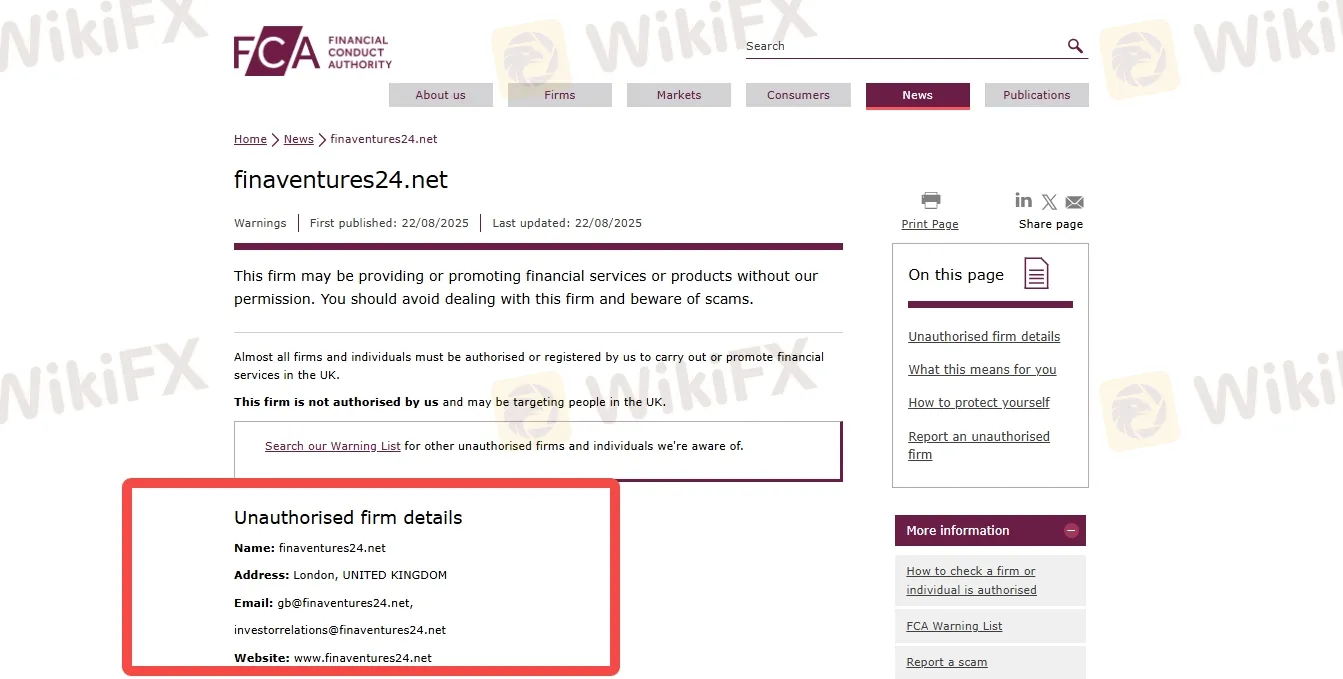

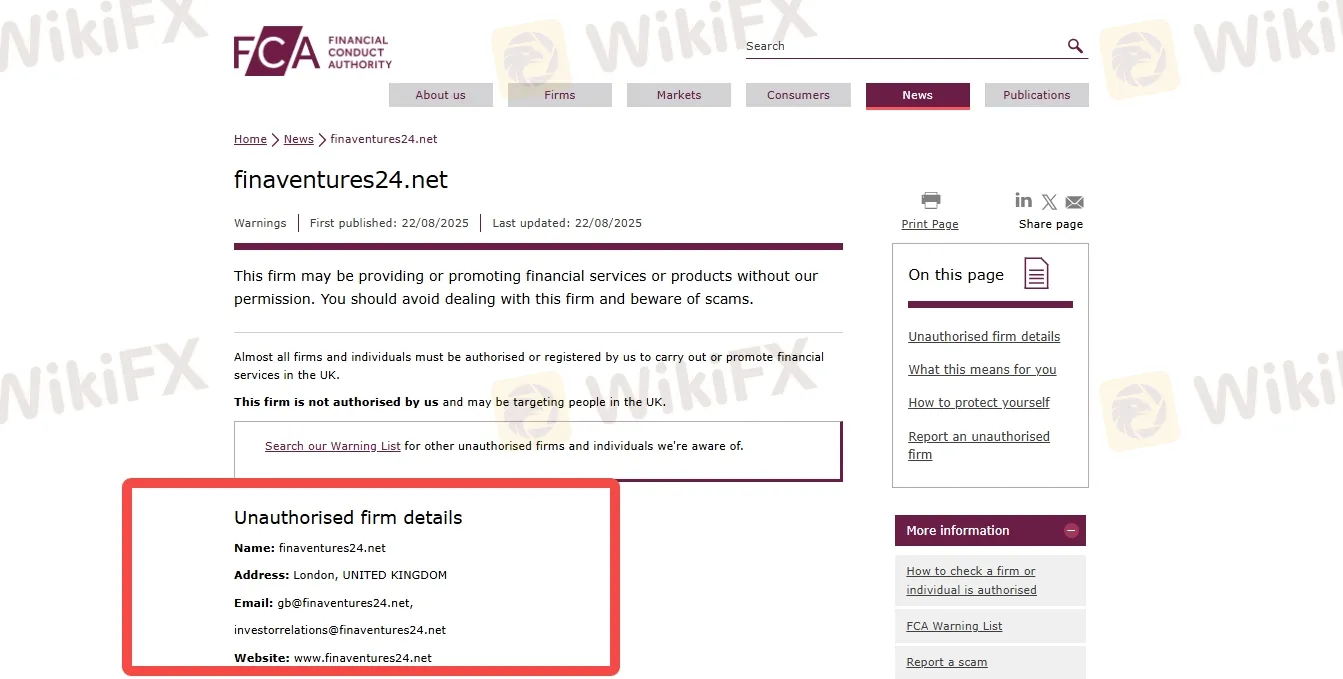

2. Name: finaventures24.net

Address: London, UNITED KINGDOM

Email: gb@finaventures24.net,

investorrelations@finaventures24.net

Website: www.finaventures24.net

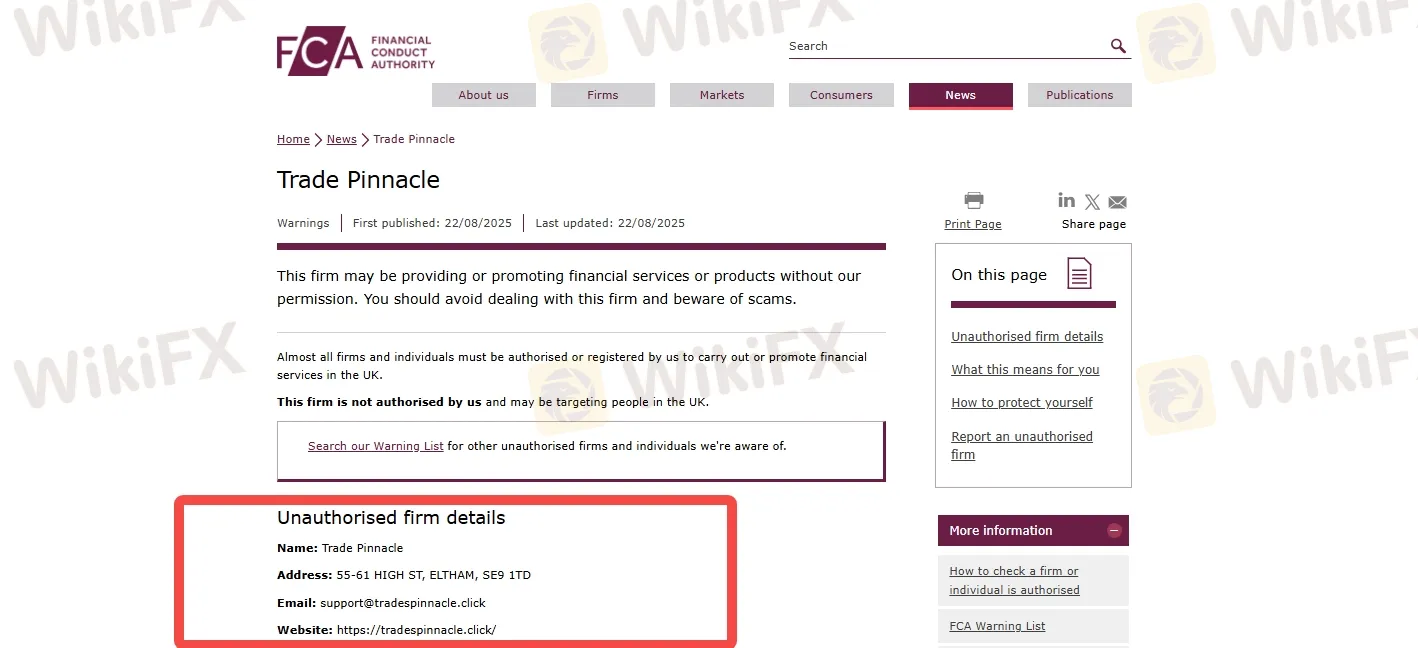

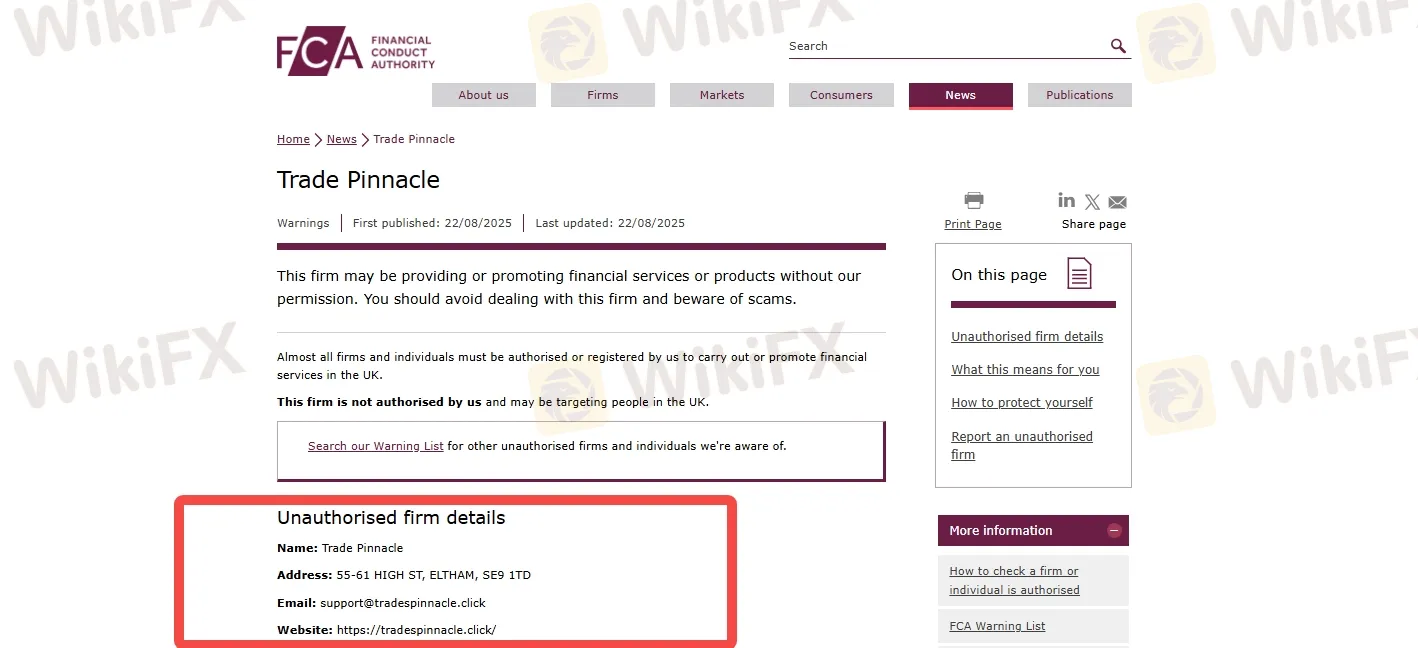

3. Name: Trade Pinnacle

Address: 55-61 HIGH ST, ELTHAM, SE9 1TD

Email: support@tradespinnacle.click

Website: https://tradespinnacle.click/

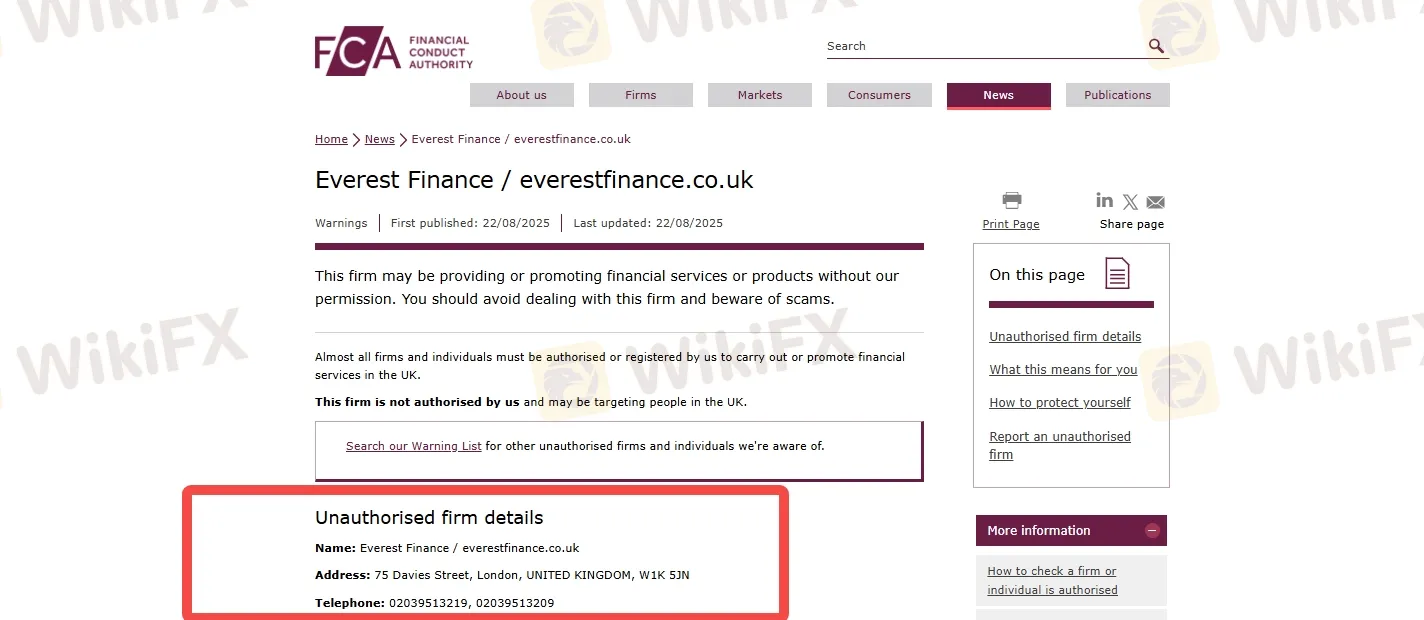

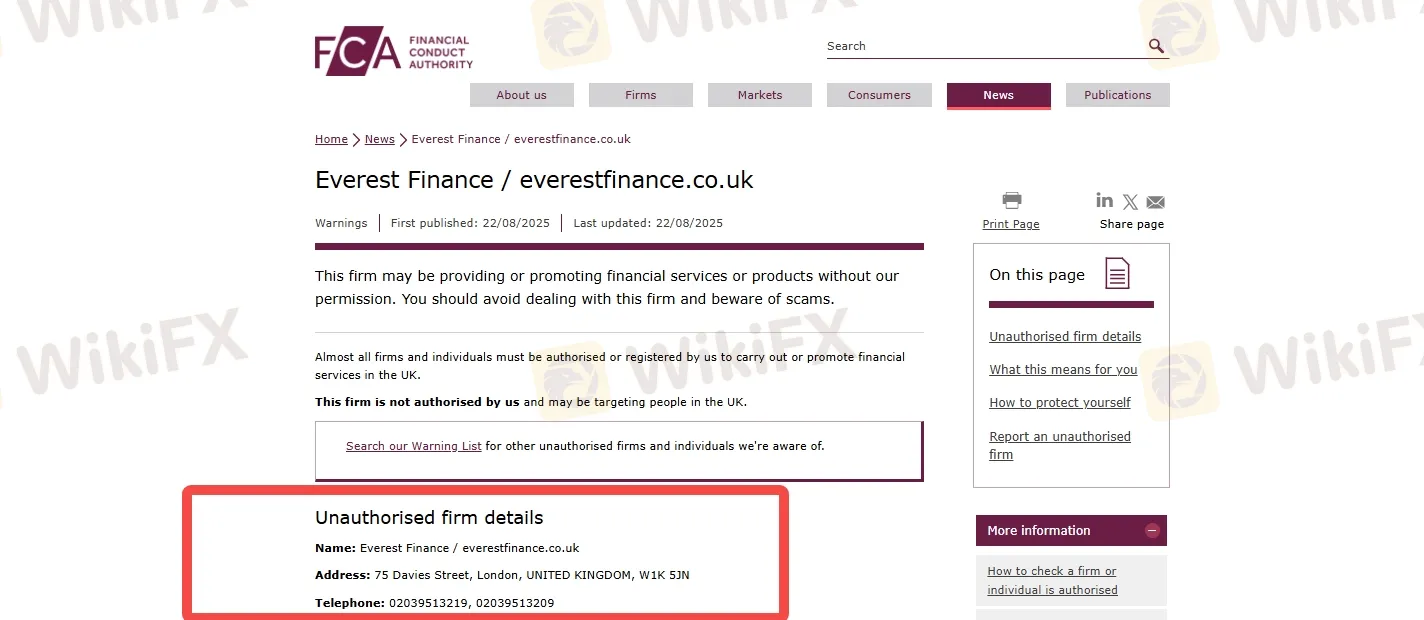

4. Name: Everest Finance / everestfinance.co.uk

Address: 75 Davies Street, London, UNITED KINGDOM, W1K 5JN

Telephone: 02039513219, 02039513209

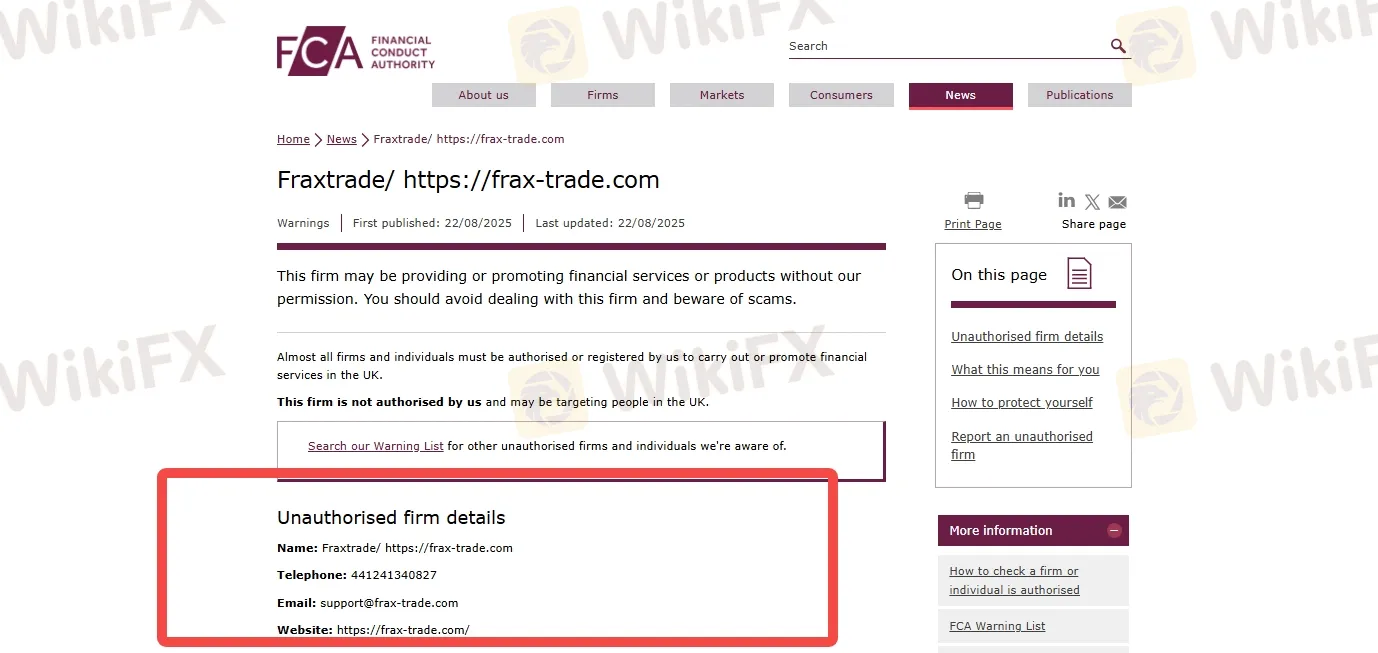

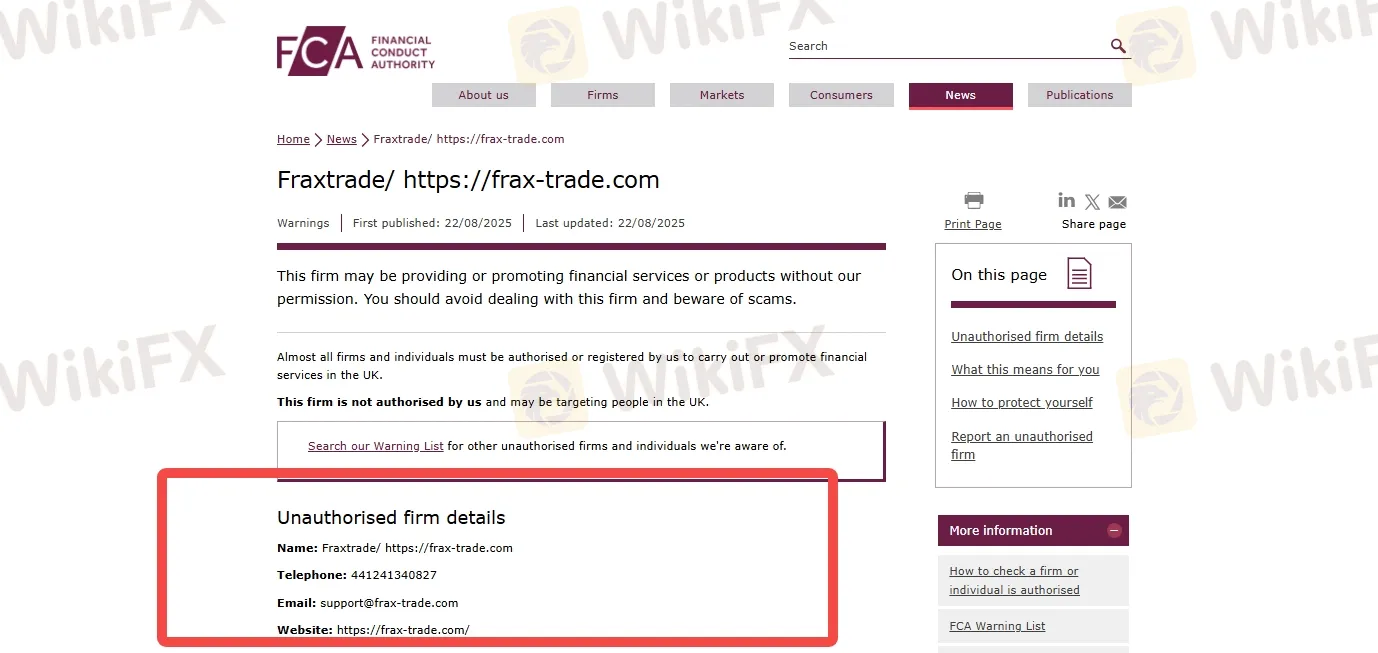

5. Name: Fraxtrade/ https://frax-trade.com

Telephone: 441241340827

Email: support@frax-trade.com

Website: https://frax-trade.com/

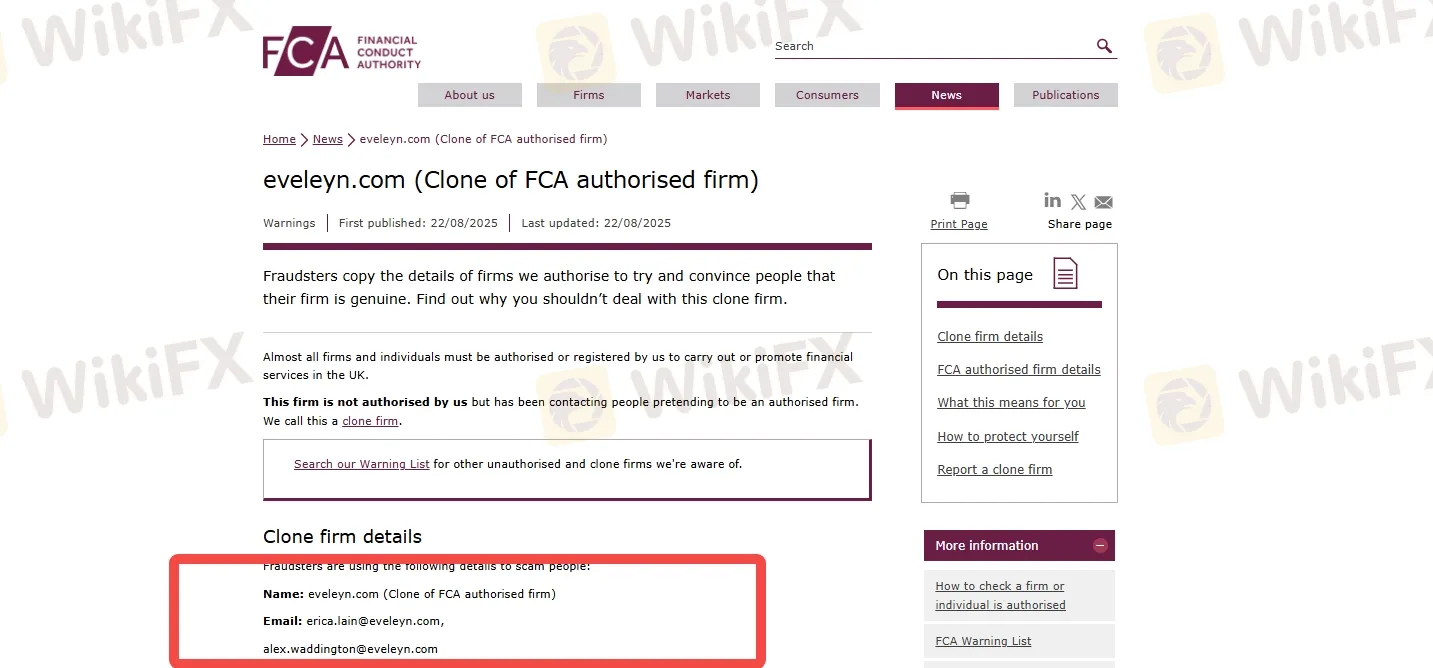

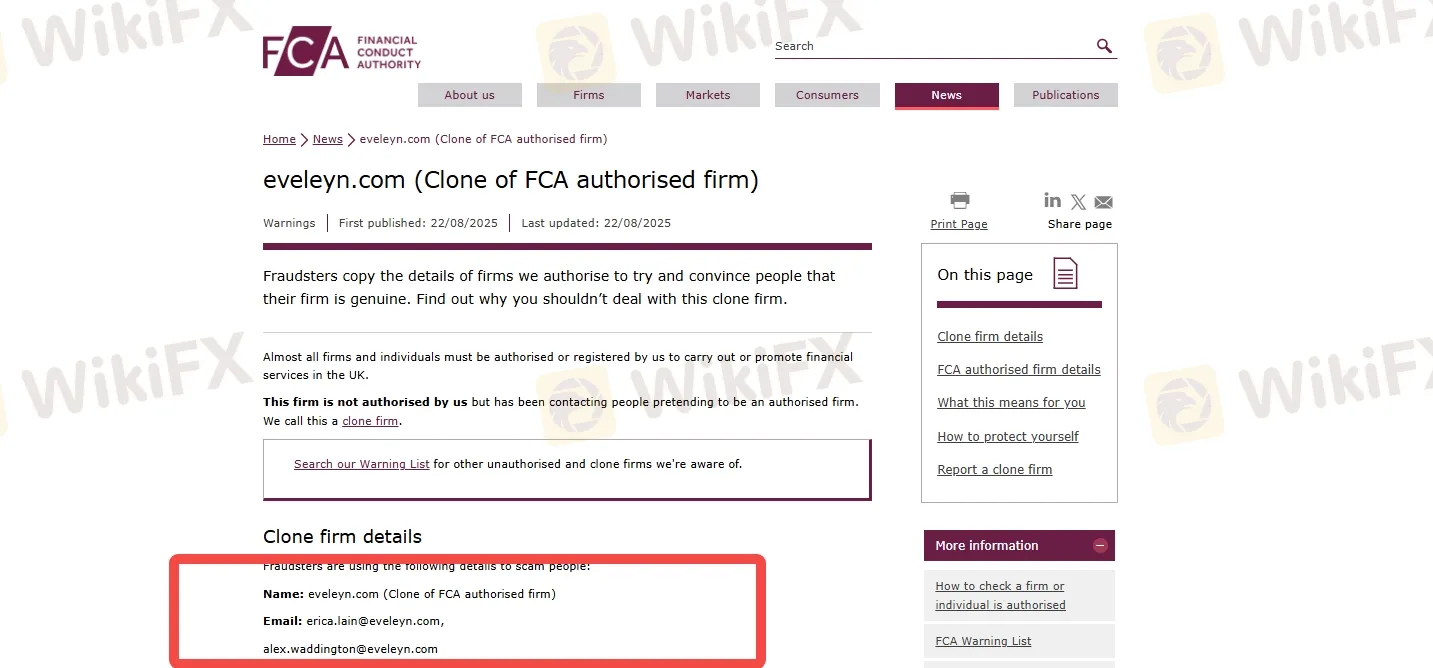

6. Name: eveleyn.com (Clone of FCA authorised firm)

Email: erica.lain@eveleyn.com,

alex.waddington@eveleyn.com

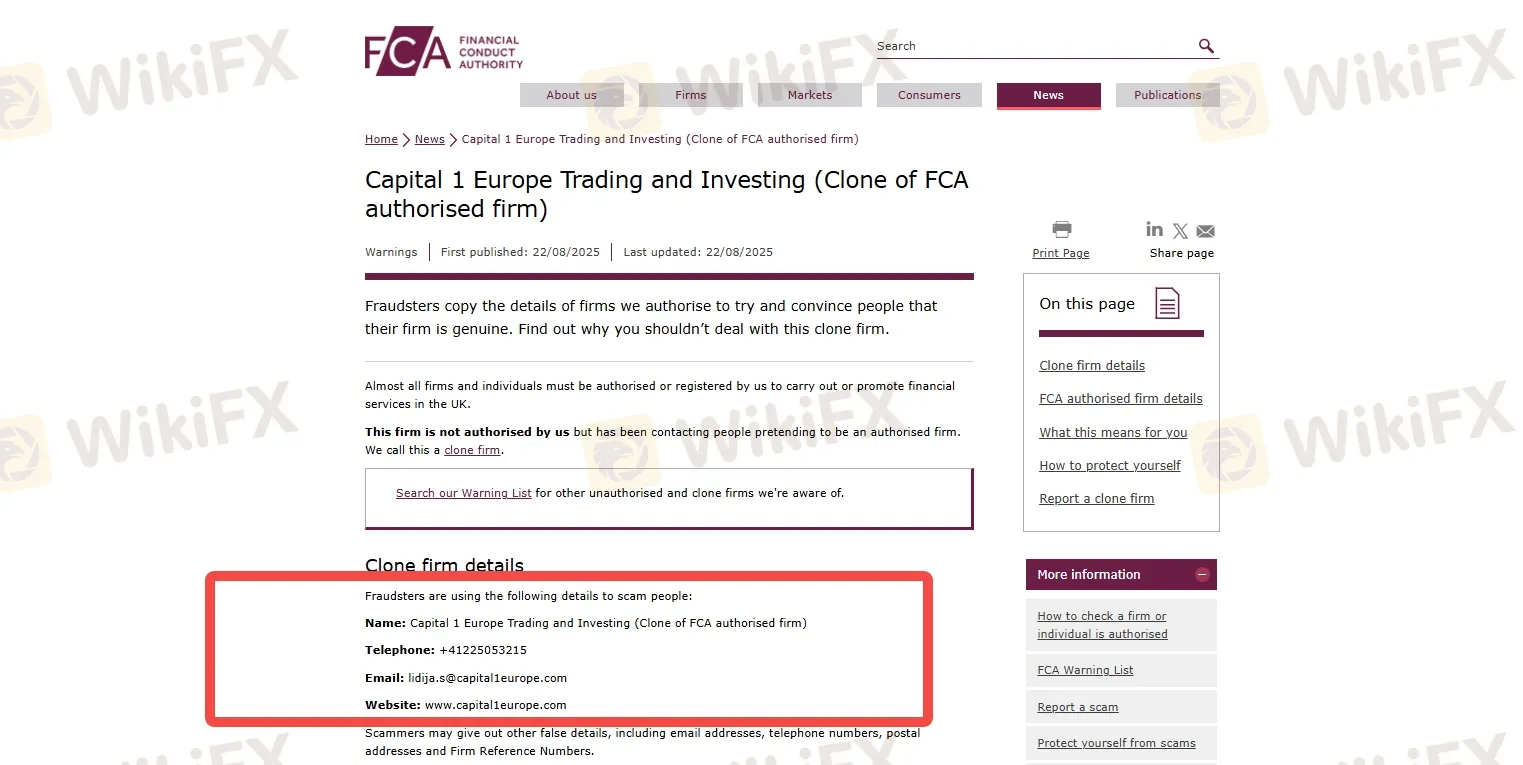

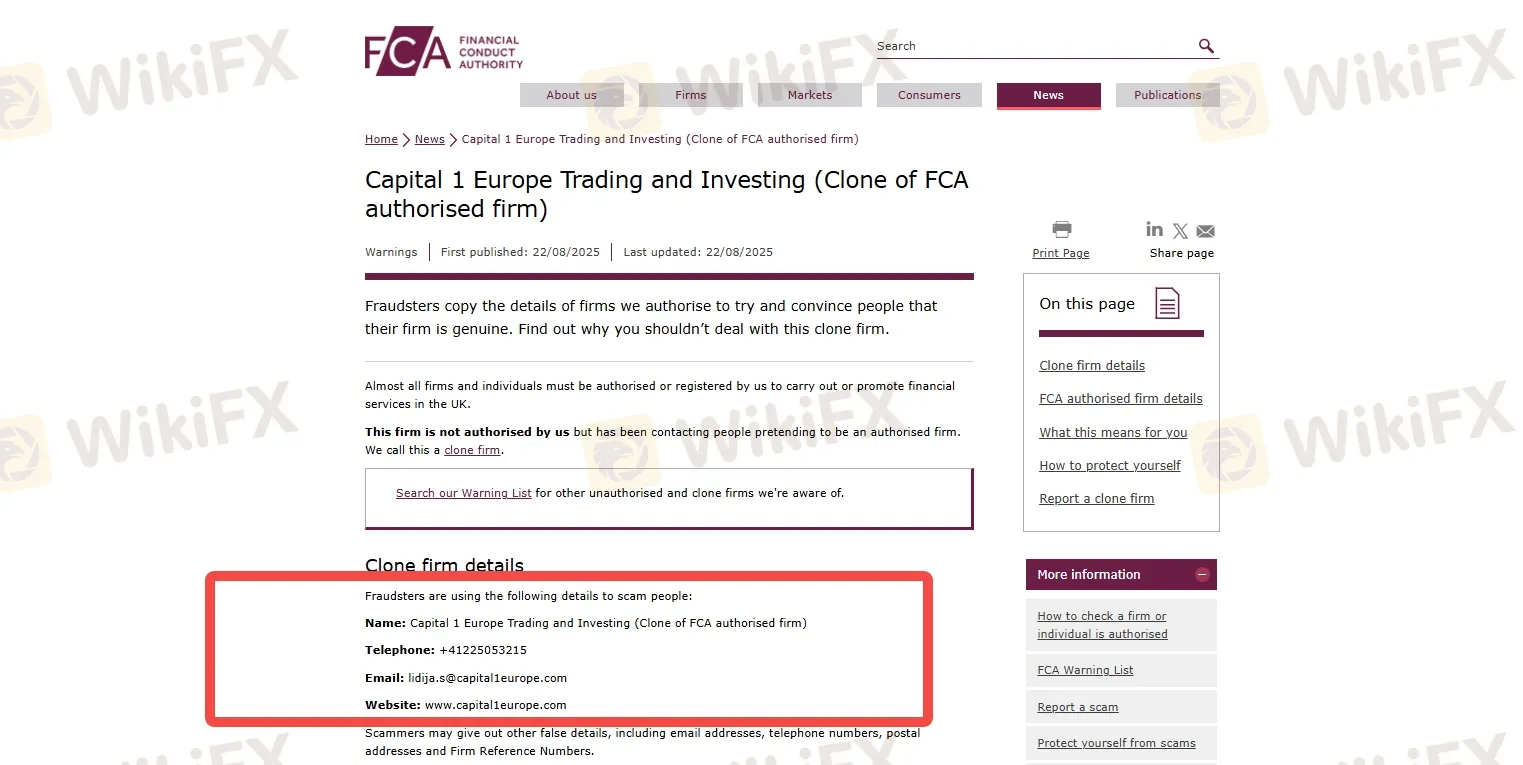

7. Name: Capital 1 Europe Trading and Investing (Clone of FCA authorised firm)

Telephone: +41225053215

Email: lidija.s@capital1europe.com

Website: www.capital1europe.com

FCA Warns the Public Against Unregulated Brokers

FCA regularly updates its warning list to help traders avoid fraudulent platforms posing as legitimate firms. If a forex broker is not listed on the FCA register or appears on the FCAs warning list, it's a red flag. Scam brokers typically use cloned websites, aggressive sales tactics, and unrealistic profit guarantees to trick investors. To stay safe in the forex market, conduct thorough due diligence, use regulated trading platforms, and stay informed about the latest scam alerts. Remember: if it sounds too good to be true, it probably is.

Why FCA Warning Matters?

An FCA (Financial Conduct Authority) warning is a serious alert that a broker or financial service is operating without proper authorization in the UK. The FCA is one of the worlds most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If a broker receives an FCA warning, it means:

1. The broker is not licensed or regulated by the FCA.

2. It is not allowed to offer financial services in the UK.

3. Your funds are not protected under UK financial laws.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

How to Protect Yourself from Scam Brokers?

1. Verify the License of the brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!