Abstract:Behind the glossy image of brokers, there are hidden disadvantages that potential investors should be aware of before committing their capital. Trade Pinnacle is one such broker that raises several red flags. This article sheds light on the lesser-known risks and limitations of trading with Trade Pinnacle.

Behind the glossy image of brokers, there are hidden disadvantages that potential investors should be aware of before committing their capital. Trade Pinnacle is one such broker that raises several red flags. This article sheds light on the lesser-known risks and limitations of trading with Trade Pinnacle.

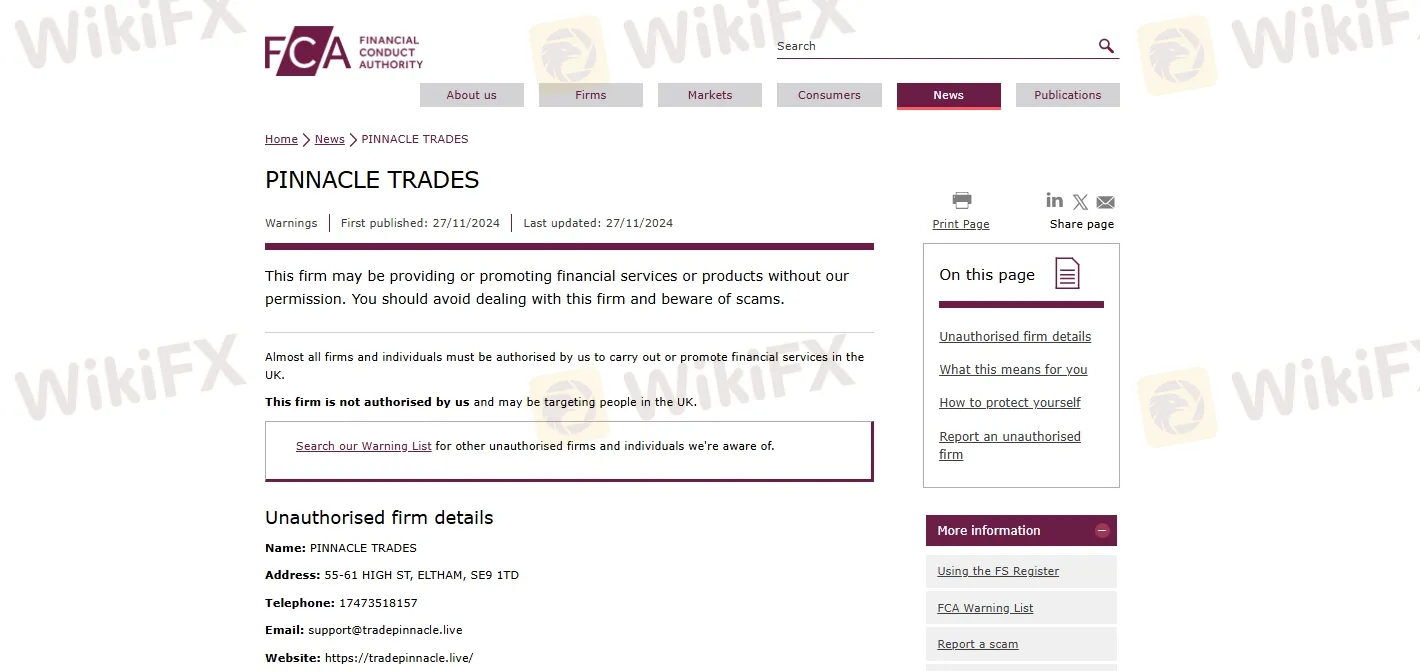

1. Operates Without Regulation

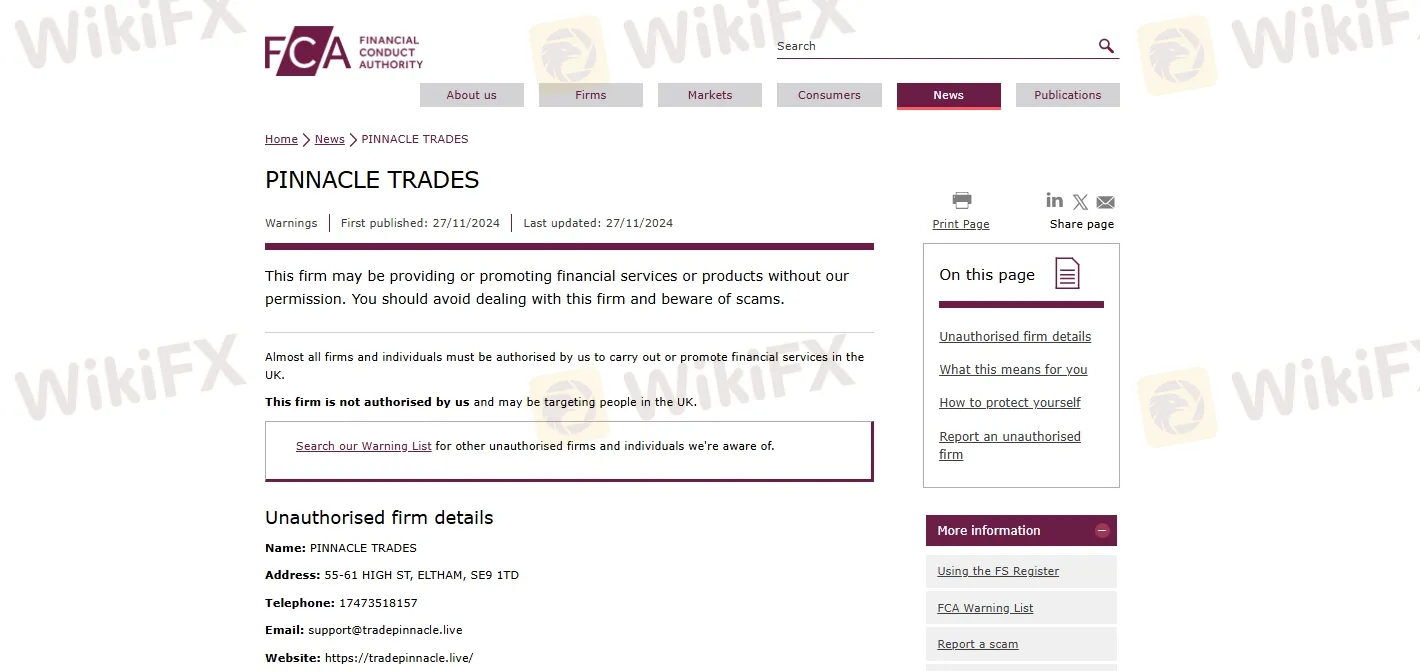

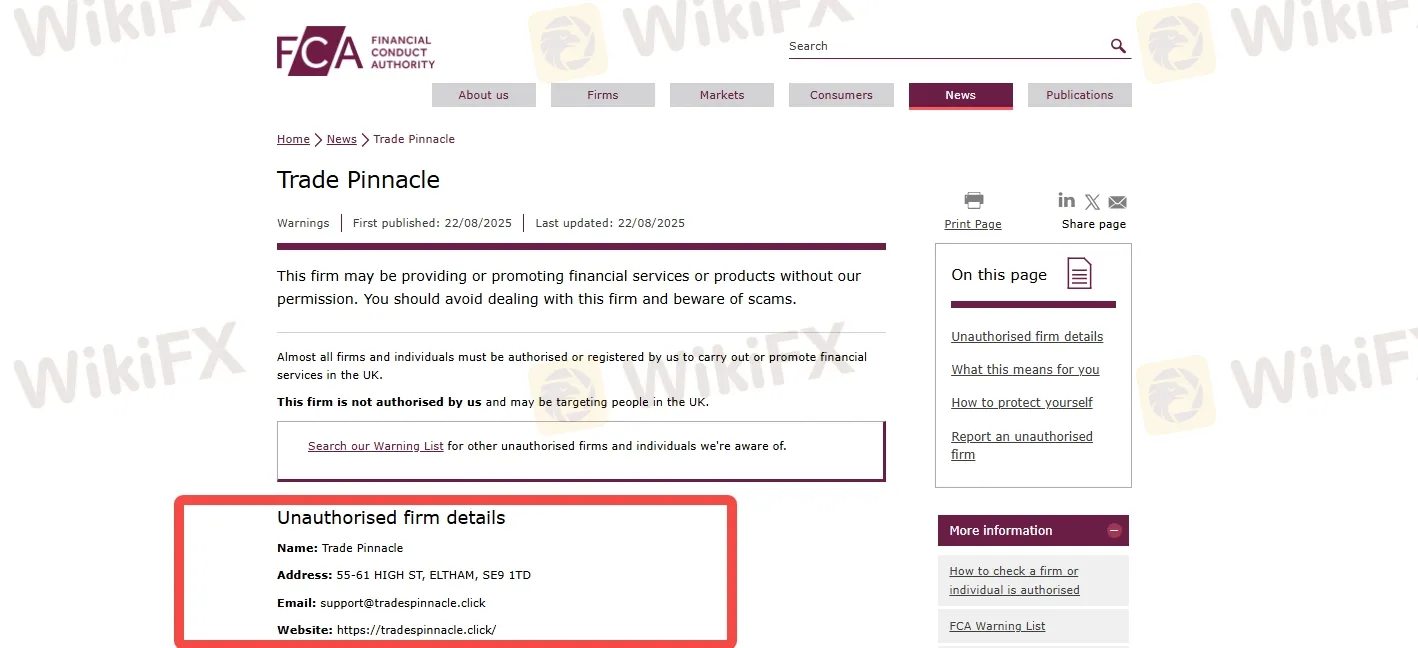

Trade Pinnacle is not a regulated financial company. According to the Financial Conduct Authority (FCA) the UKs financial regulator, Trade Pinnacle is an unauthorized firm and is listed on their warning list. This means it is operating illegally without the required license to offer financial services.

Dealing with an unregulated broker is very risky. If the company fails, you will not be protected by investor safety nets like the Financial Services Compensation Scheme (FSCS). Also, since there's no regulator involved, you wont have access to the Financial Ombudsman Service if you have a complaint leaving you with almost no way to recover your money.

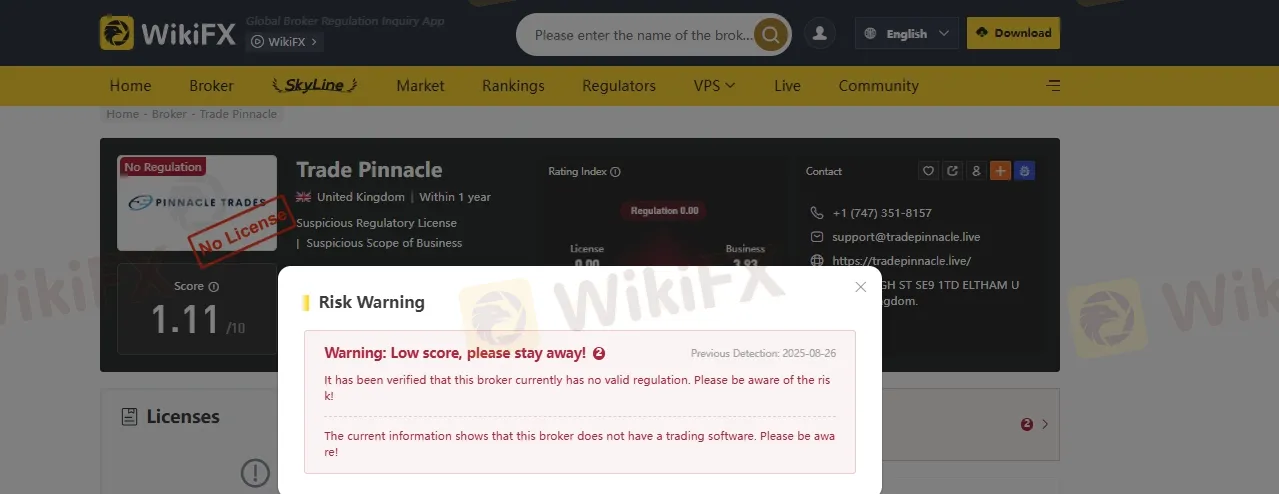

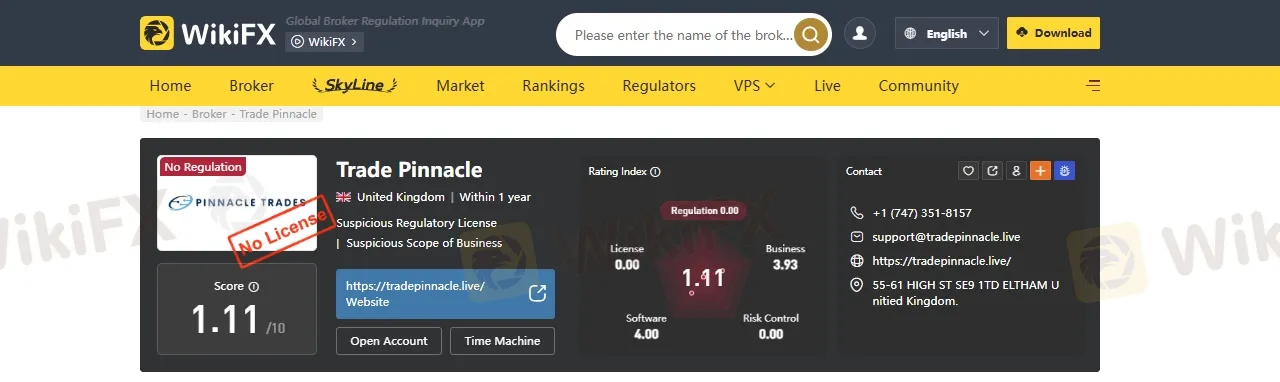

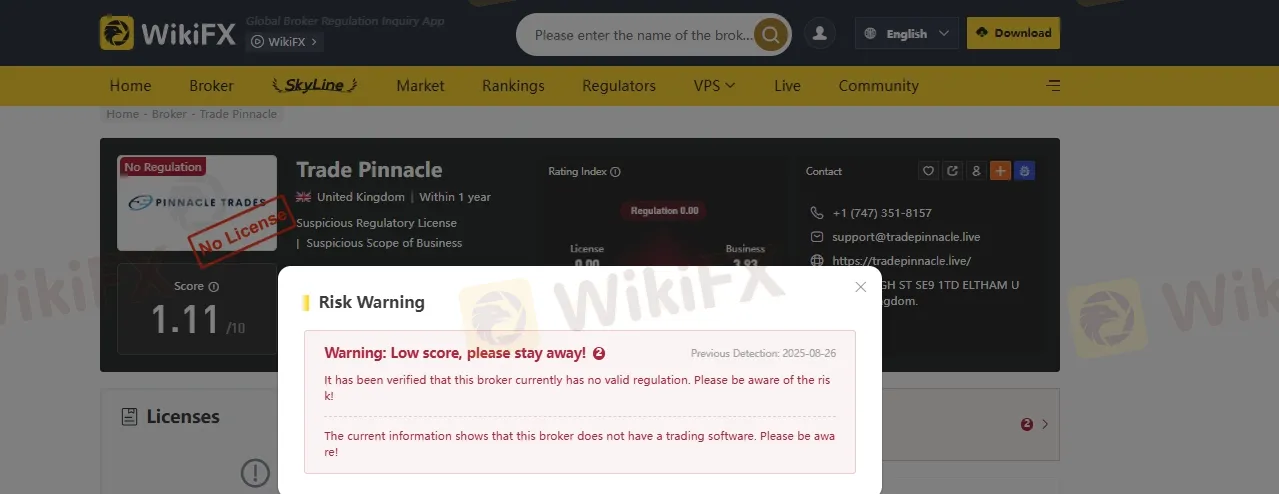

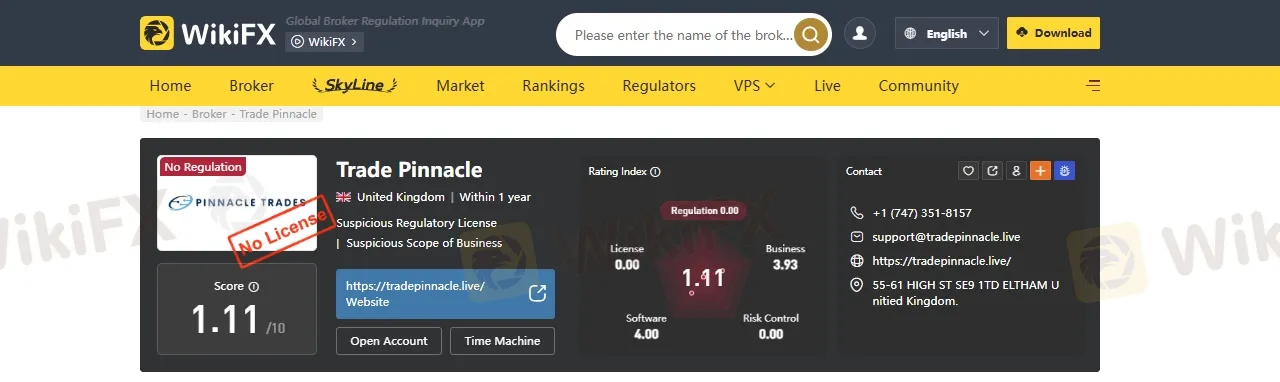

2. WikiFX Warning

Further checks show even more red flags. WikiFX a popular platform that reviews forex brokers, has also issued a warning against Trade Pinnacle. Their alert clearly says:

“Warning: Low score, please stay away!”

This kind of warning suggests serious issues with the broker's trustworthiness.

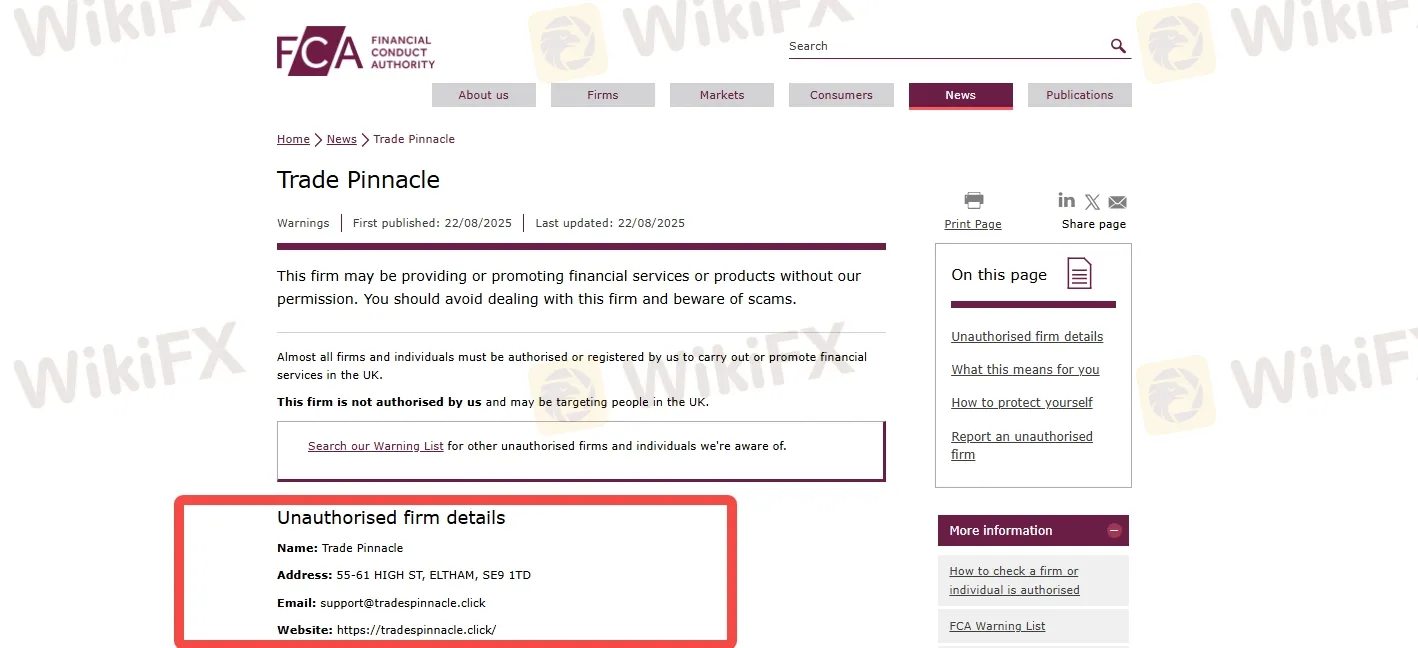

3. FCA Warnings in 2024 & 2025

Financial Conduct Authority (FCA) has issued multiple warnings about companies using the names “Trade Pinnacle”* and “Pinnacle Trades”.

-On November 27, 2024, a firm named Pinnacle Trades was added to the FCA's unauthorized firms list

-Again, on August 22, 2025, the FCA issued another warning about a firm called Trade Pinnacle, saying it was not authorized and might be targeting UK residents.

These warnings are serious. They mean that customers who deal with these firms are not protected** by the FSCS or the Financial Ombudsman Service. The FCA strongly advises people to avoid these companies and only use brokers that are officially registered and authorized.

4. Low Score

Trade Pinnacle has a very poor reputation. On trusted broker review websites, it has a score of just 1.11 out of 10. This is an extremely low and worrying rating, showing that many users have had bad experiences with the company.

5. Website & Access Problems

Trade Pinnacle‘s website is unreliable and has many issues. In most cases, it either doesn’t load or shows error messages, making it difficult or impossible to access important information.

A good, trustworthy broker always keeps a working and professional website. A broken site suggests poor management and raises serious doubts about whether the company is genuine. It also makes it harder for users to get support or understand what the company is offering.

Tips to Protect Yourself from Scams?

1. Verify the License of the brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

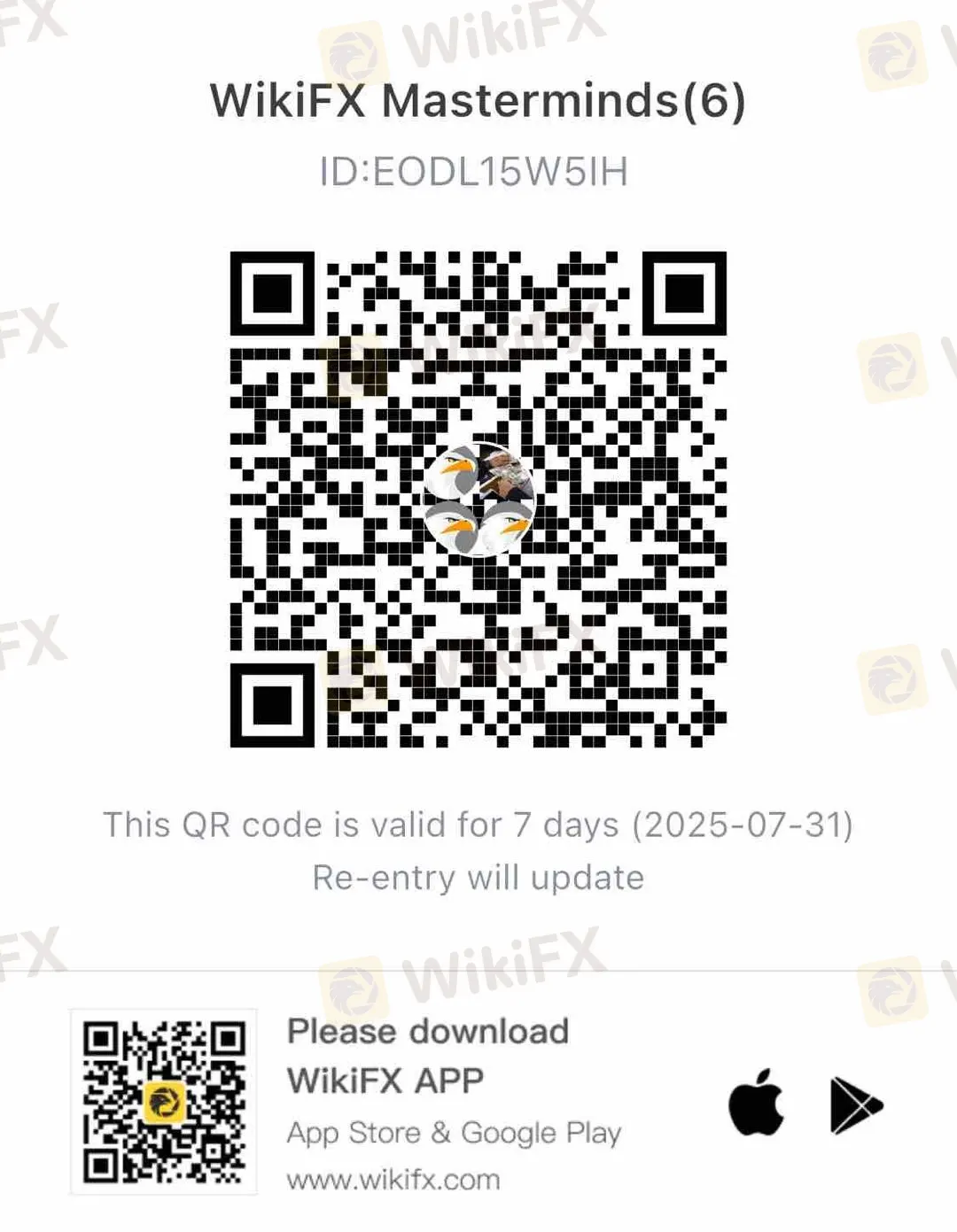

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!