Abstract:One of the Reputed Authority, the Financial Conduct Authority (FCA), has issued a warning against seven illegal brokers . These brokers are offering financial services to people with the intention to commit fraud.

One of the Reputed Authority, the Financial Conduct Authority (FCA), has issued a warning against seven illegal brokers who are operating without license. These brokers are offering financial services to people with the intention to commit fraud. They are promoting their services just to swindle people out of their money.

LIST OF SCAM BROKERS

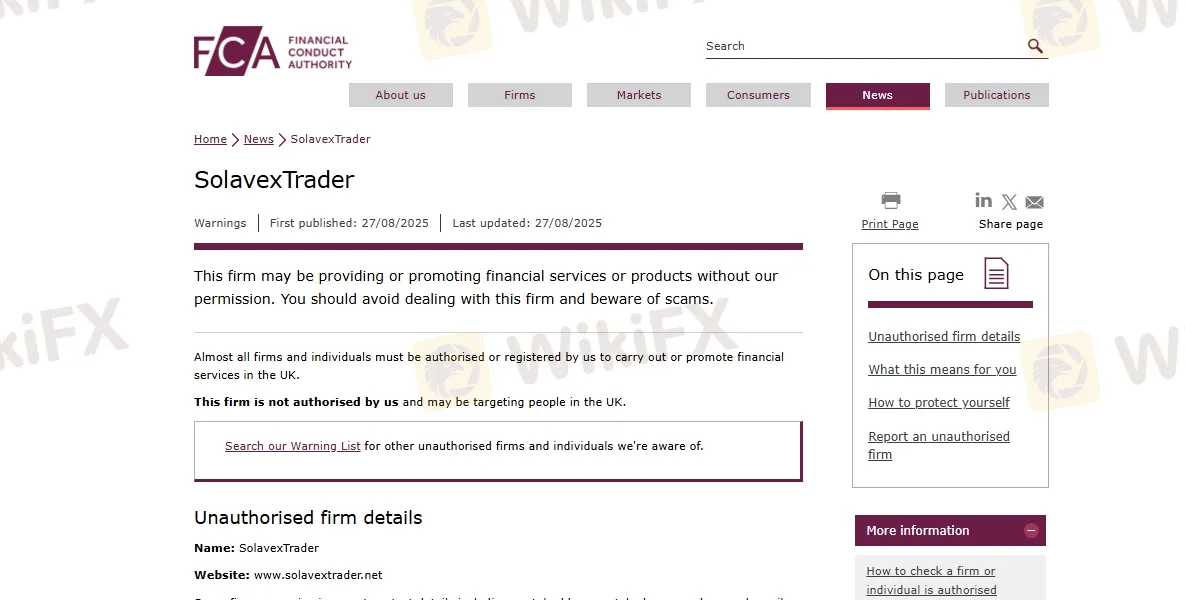

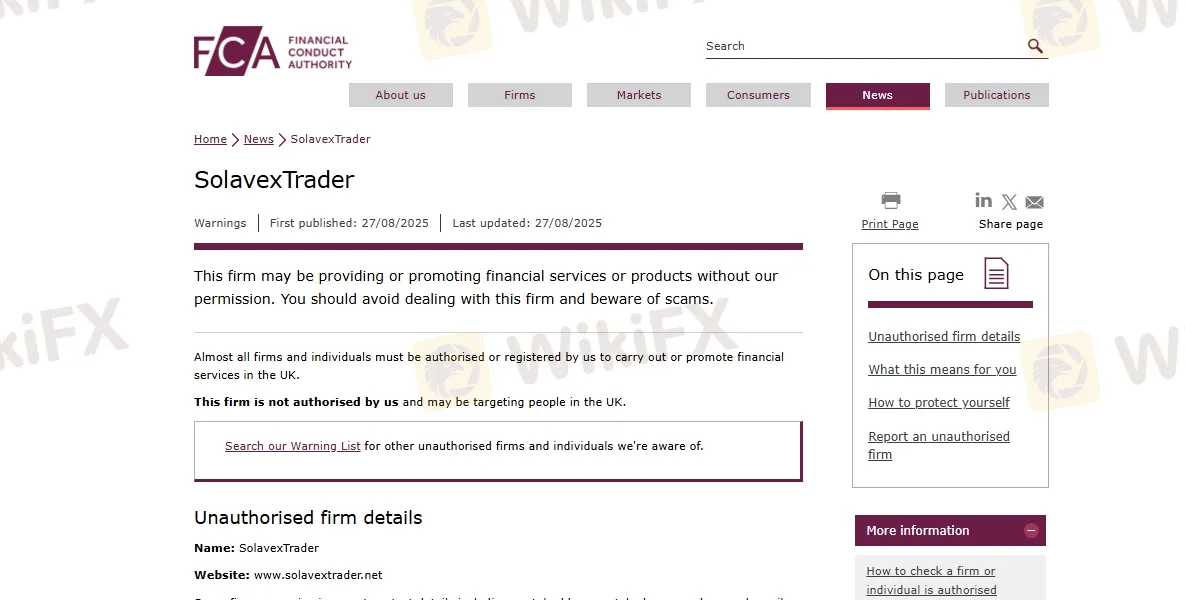

Name: SolavexTrader

Website: www.solavextrader.net

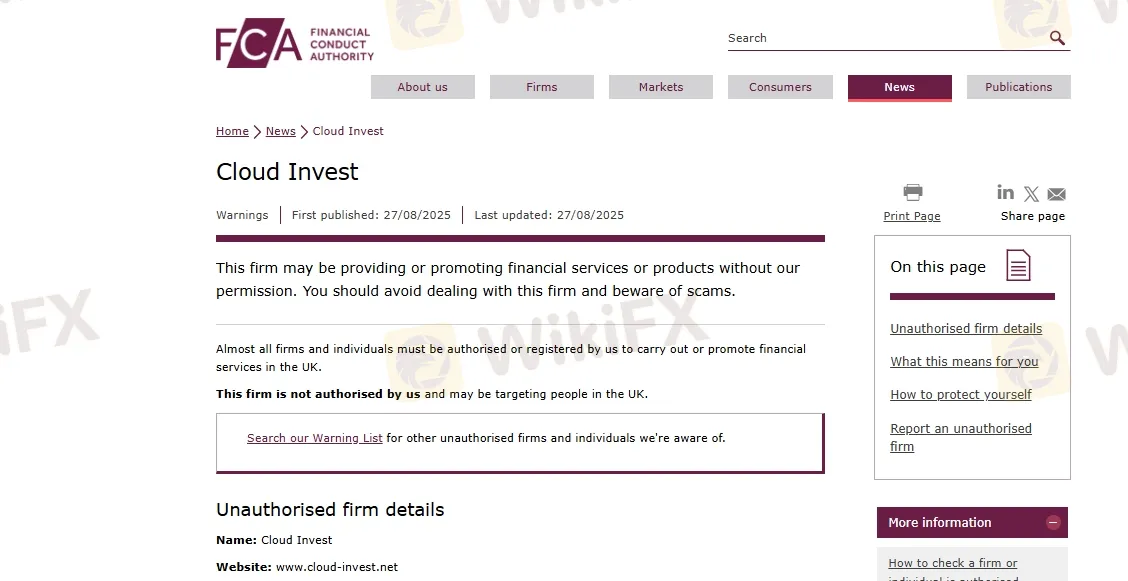

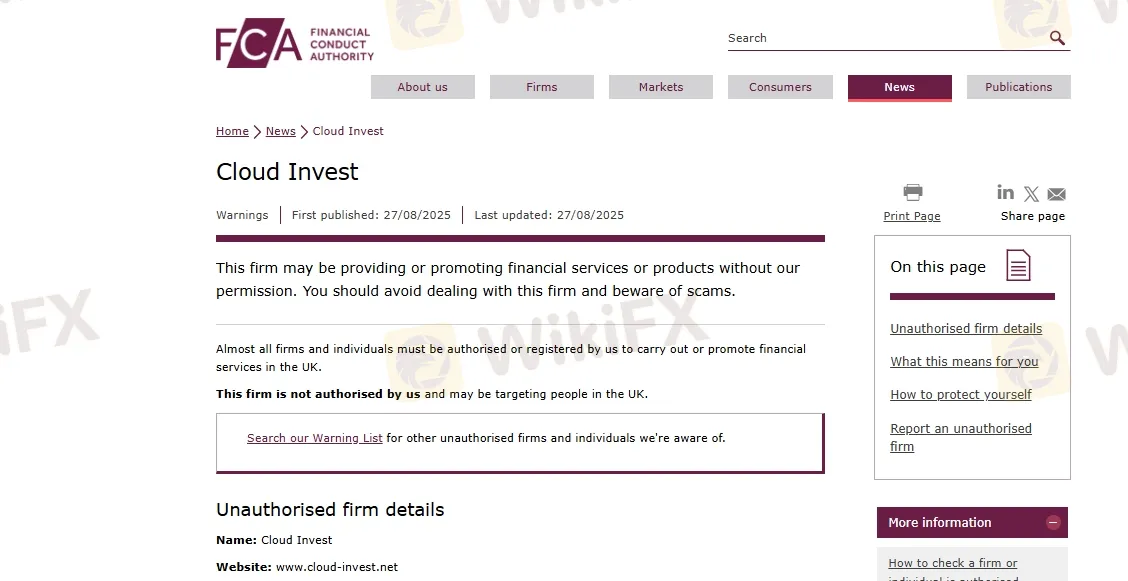

Name: Cloud Invest

Website: www.cloud-invest.net

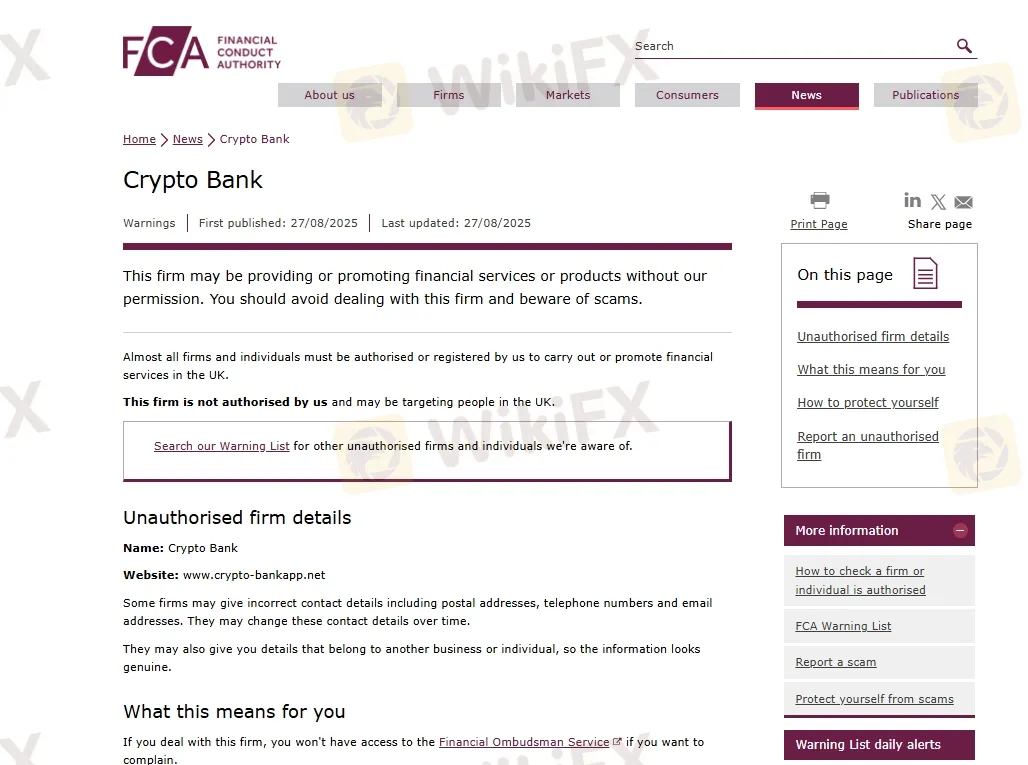

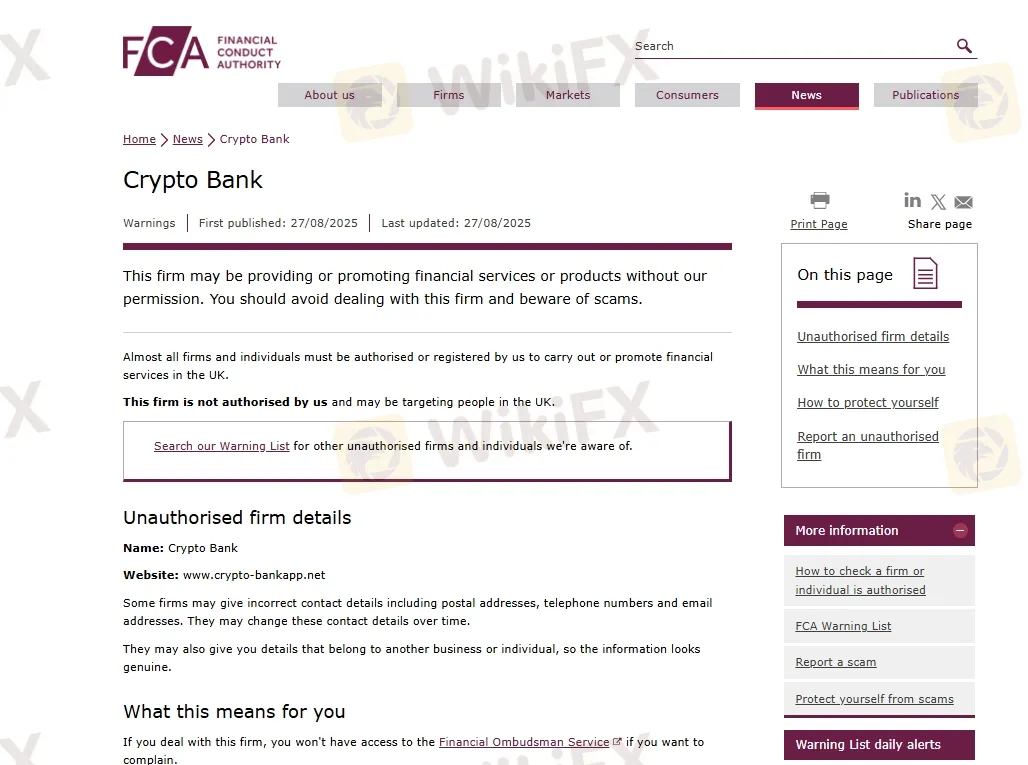

Name: Crypto Bank

Website: www.crypto-bankapp.net

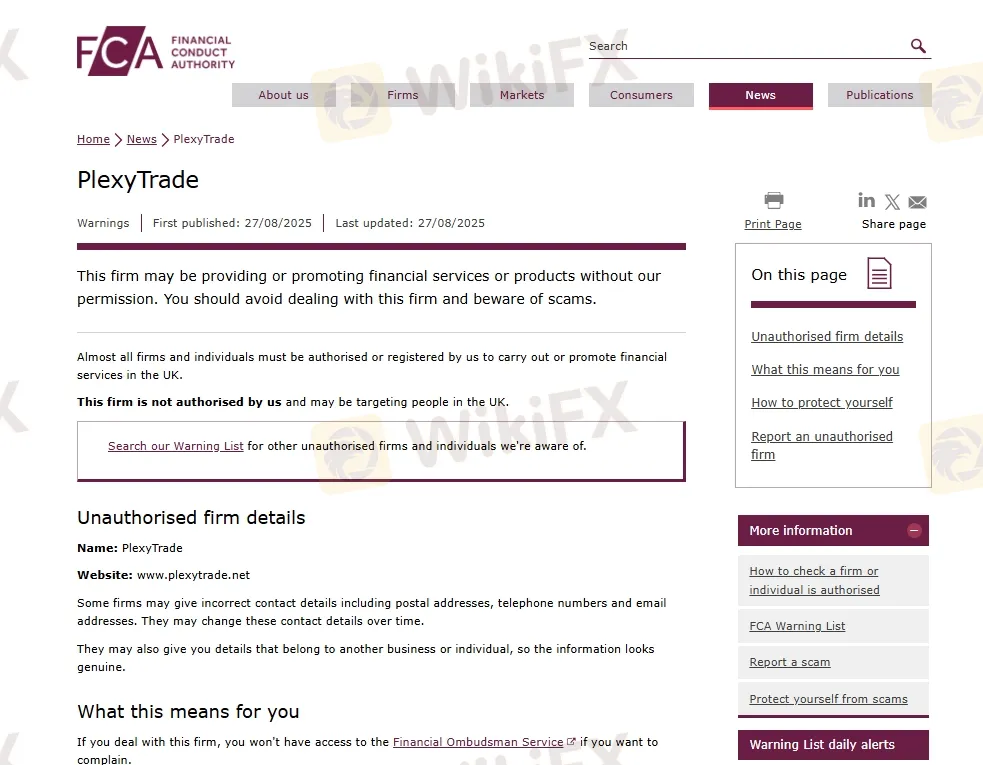

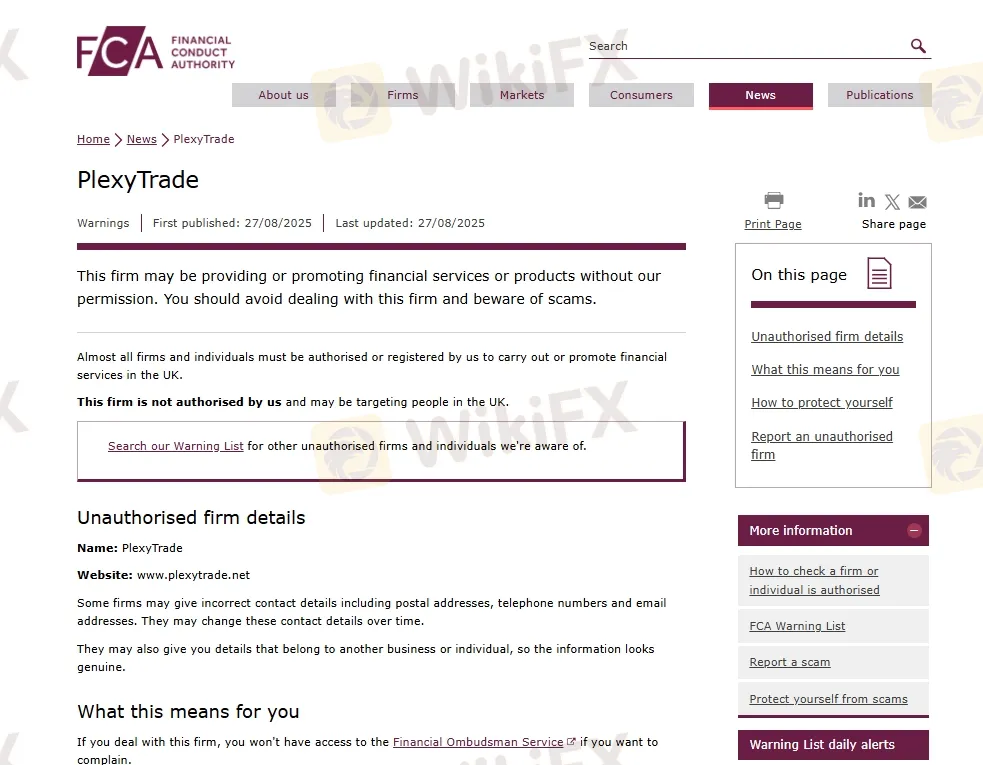

Name: PlexyTrade

Website: www.plexytrade.net

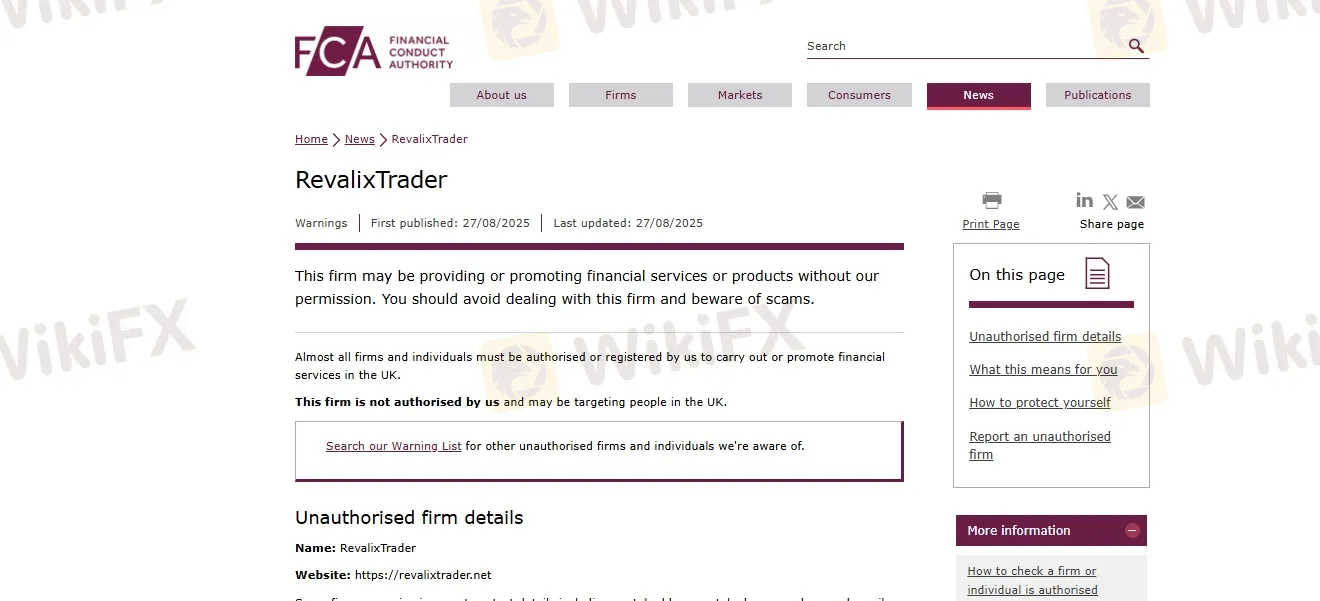

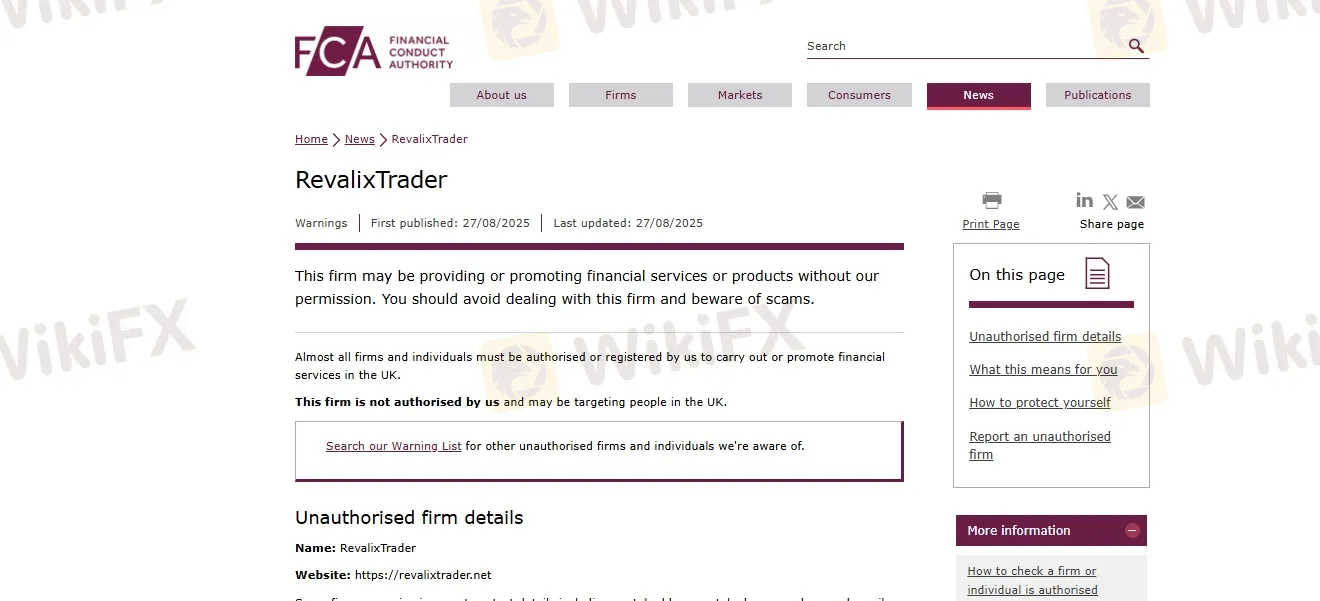

Name: RevalixTrader

Website: https://revalixtrader.net

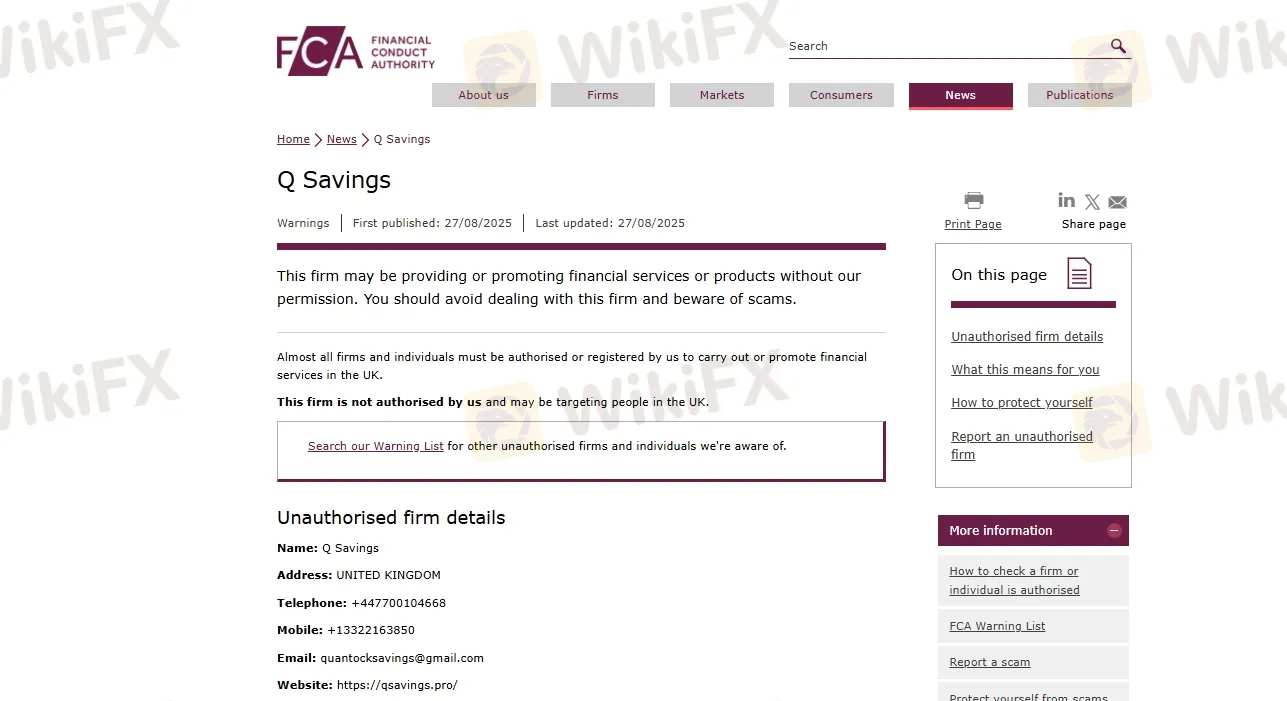

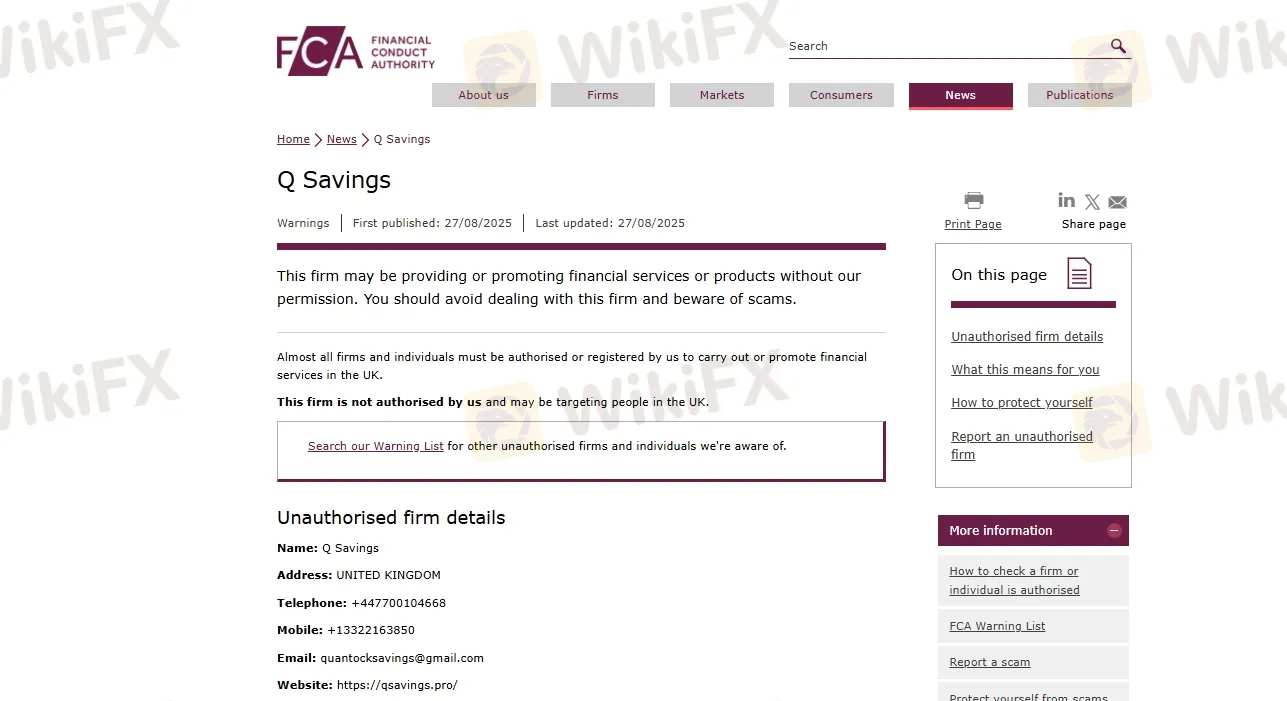

Name: Q Savings

Address: UNITED KINGDOM

Telephone: +447700104668

Mobile: +13322163850

Email: quantocksavings@gmail.com

Website: https://qsavings.pro/

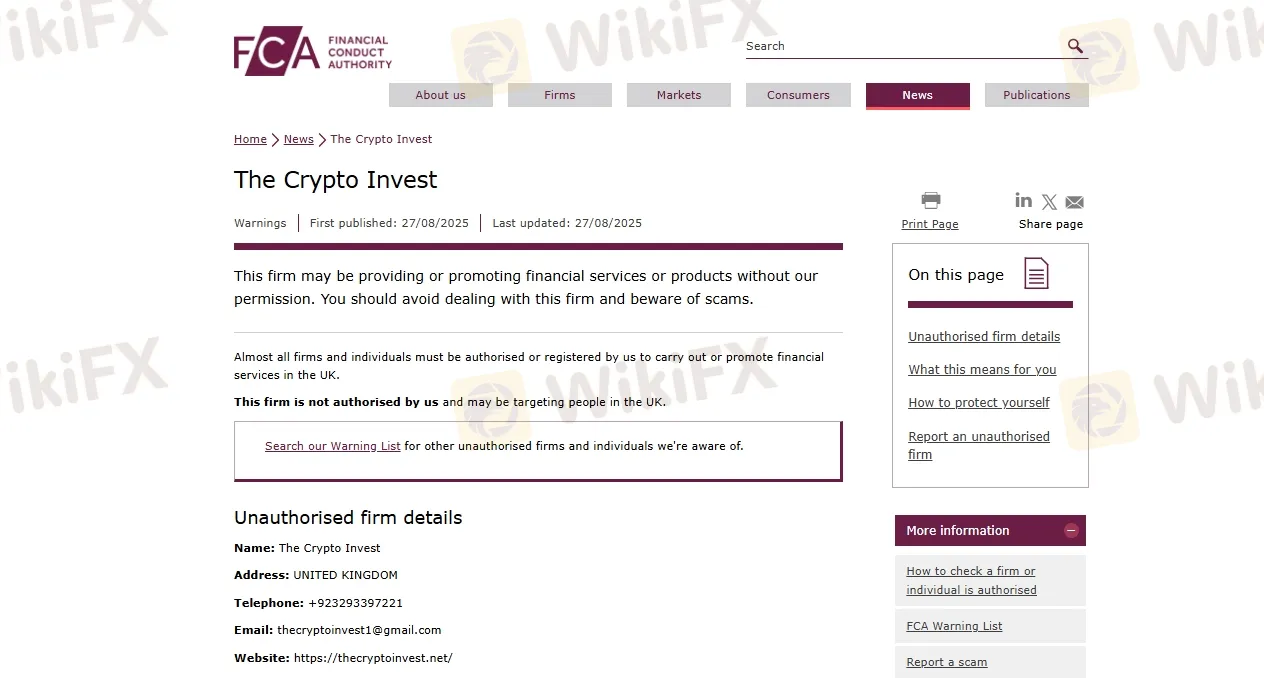

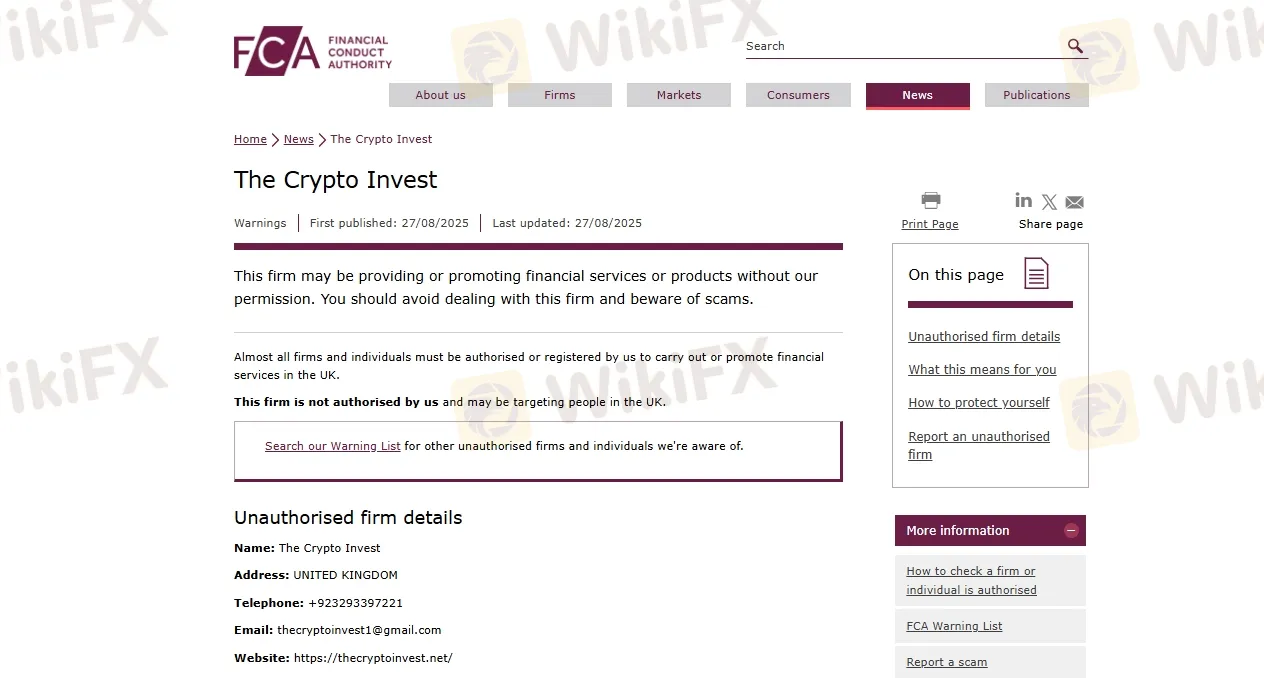

Name: The Crypto Invest

Address: UNITED KINGDOM

Telephone: +923293397221

Email: thecryptoinvest1@gmail.com

Website: https://thecryptoinvest.net/

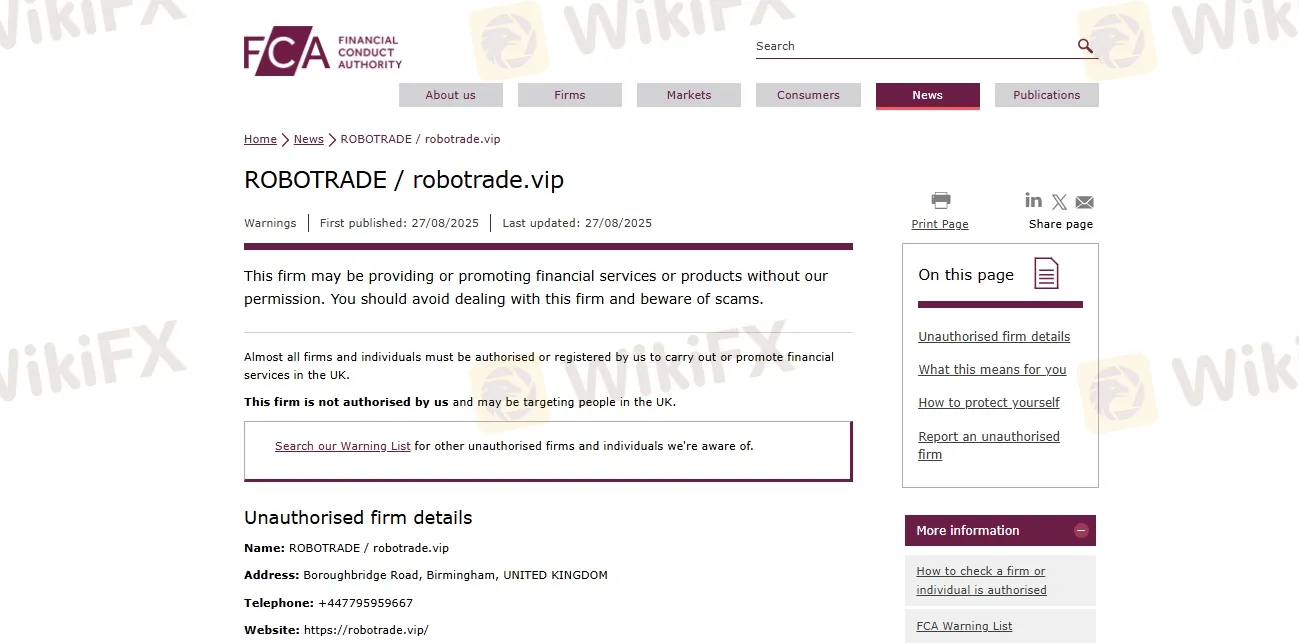

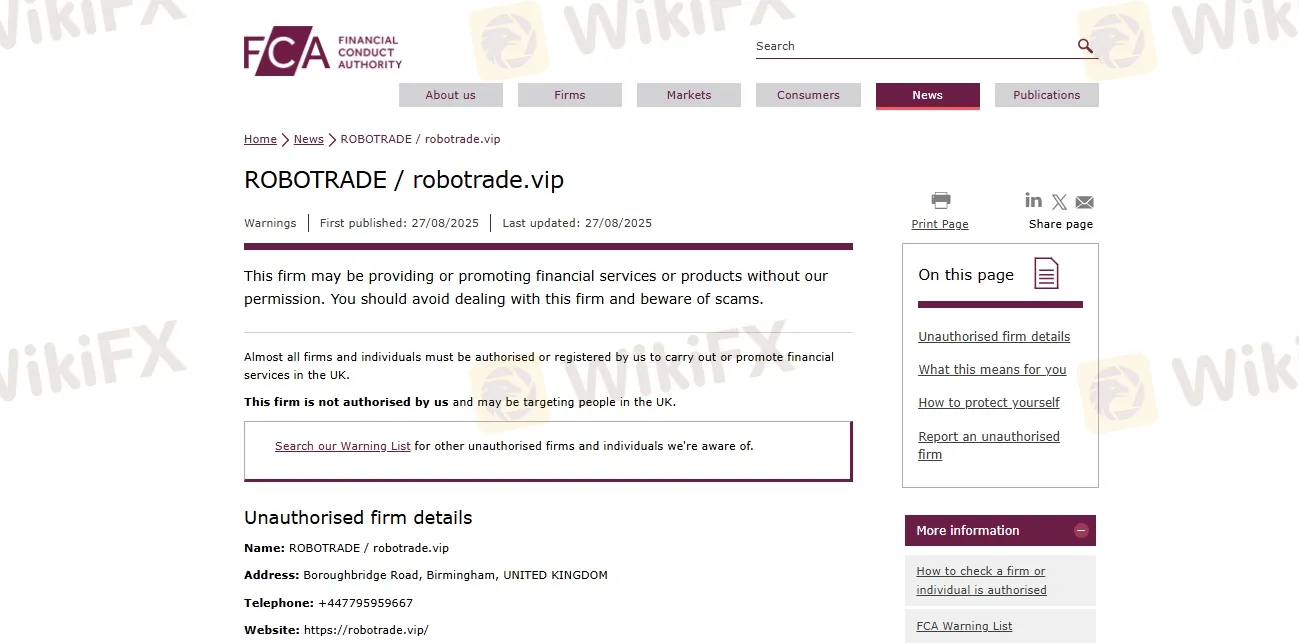

Name: ROBOTRADE / robotrade.vip

Address: Boroughbridge Road, Birmingham, UNITED KINGDOM

Telephone: +447795959667

Website: https://robotrade.vip/

What Is FCA ?

The Financial Conduct Authority (FCA) is the United Kingdom‘s independent financial regulatory body responsible for overseeing financial markets and firms. FCA’s core responsibilities include protecting consumers, maintaining the integrity of the UK financial system, and promoting healthy competition within financial markets.

Why FCA Warning Matter?

An FCA (Financial Conduct Authority) warning is a serious alert that a broker or financial service is operating without proper authorization in the UK. The FCA is one of the worlds most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If a broker receives an FCA warning, it means:

1. The broker is not licensed or regulated by the FCA.

2. It is not allowed to offer financial services in the UK.

3. Your funds are not protected under UK financial laws.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

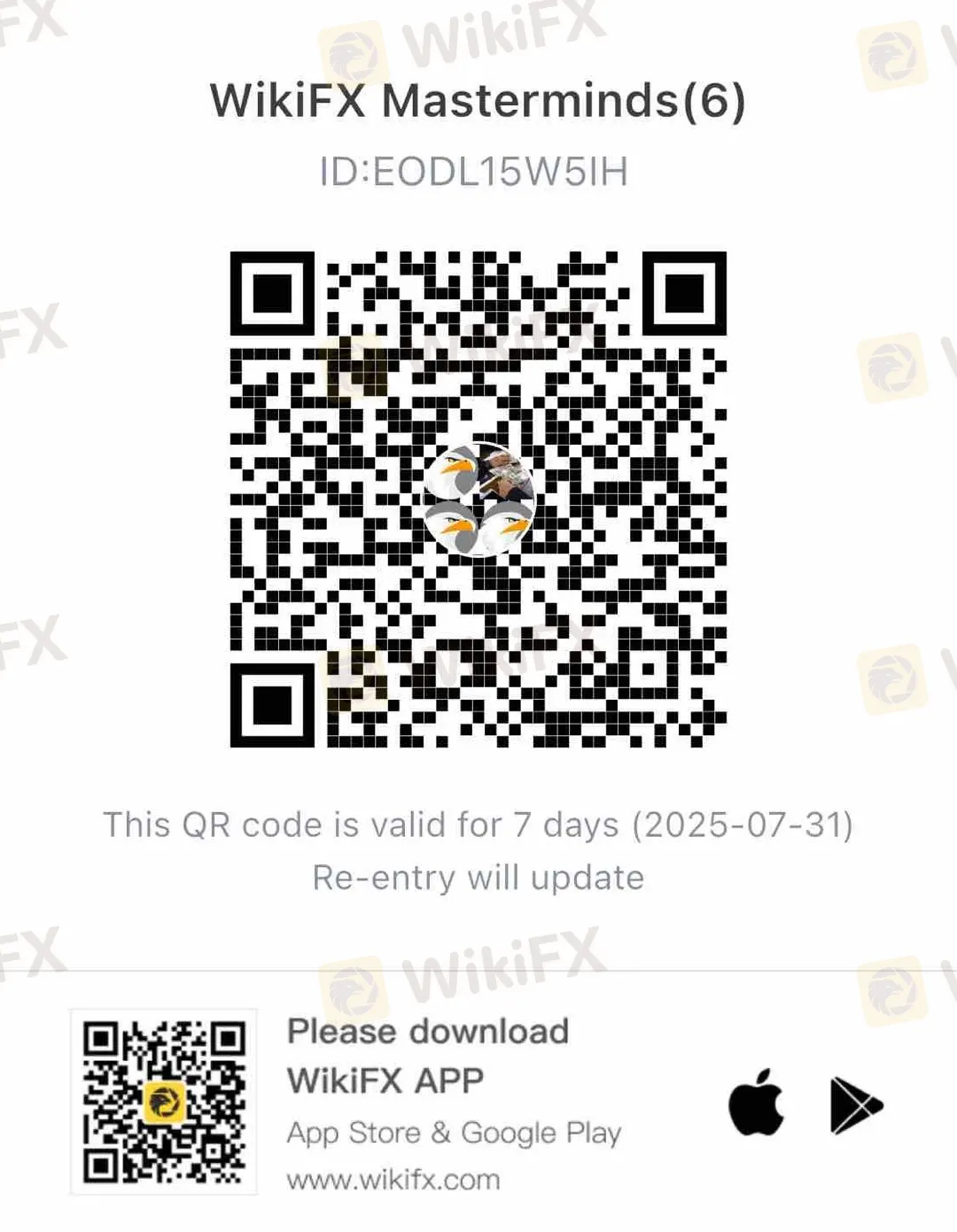

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!