Abstract:Want to invest in forex trading options? You should first learn the concept of foreign exchange options. A lot of traders remain unaware of it. Forex options serve as a great tool for investment diversification and hedging of a spot position. They can also be used to predict short or long-term market views as opposed to trading in the currency spot market.

Want to invest in forex trading options? You should first learn the concept of foreign exchange options. A lot of traders remain unaware of it. Forex options serve as a great tool for investment diversification and hedging of a spot position. They can also be used to predict short or long-term market views as opposed to trading in the currency spot market.

Elaborating on Forex Options Trading

Initiating currency options trades is similar to those in equity options. Both new and experienced traders use basic FX option setups.

Plain Vanilla Option

Basic forex trading options strategies often commence with plain vanilla options wherein the trader purchases an outright call or put option to put forward a directional view of the foreign exchange trading.

Debit Spread Trade

Besides a plain vanilla option, traders can create a spread trade, which may seem complicated at the beginning. However, with more practice, traders can get accustomed to this practice. Debit spread, also called bull call or bear put, showcases a trader confident of the direction at which the exchange rate will move. However, the trader plays it slightly safer by taking relatively less risk.

Credit Spread Trade

The credit spread trade works similarly to a debit spread trade. However, the currency option trader, instead of making the premium payment, looks to earn profit from the spread premium while maintaining a trade direction. This strategy can also be known as a bear call spread or bull put.

Option Straddle

If traders remain neutral against the currency but anticipate a change in price volatility over the short term, they will likely formulate an option straddle strategy to capture a potential breakout move. It is slightly simpler to set up compared to debit or credit spread trades. In a straddle strategy, the trader is aware of the imminent breakout scenario but is not clear about the direction.

Benefits of Forex Options Trading

Limited Risk Exposure

The maximum possible loss is limited to the option premium, making the risk more predictable.

Unlimited Profit Potential

While risk is capped, the potential profit can grow significantly with favorable currency movements.

Hedging Capability

Options allow traders to hedge existing spot or futures positions, protecting against sudden market volatility.

Strategic Flexibility

Traders can use diverse strategies, such as calls, puts, straddles, and spreads, to accommodate different market conditions.

Profit in Any Market Direction

Forex options make it possible to earn from both bullish and bearish trends.

No Margin Requirement

Unlike leveraged spot trades, buying options does not require maintaining margin positions.

Leverage Advantage

With a small premium, traders can control larger positions, maximizing efficiency.

Portfolio Diversification

Options add variety to trading approaches, helping spread risks across instruments.

Time Flexibility

Options can be customized with different expiries, aligning with short-term or long-term trading goals.

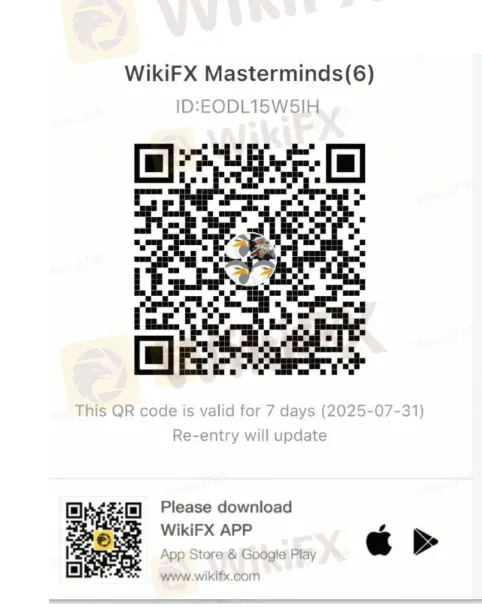

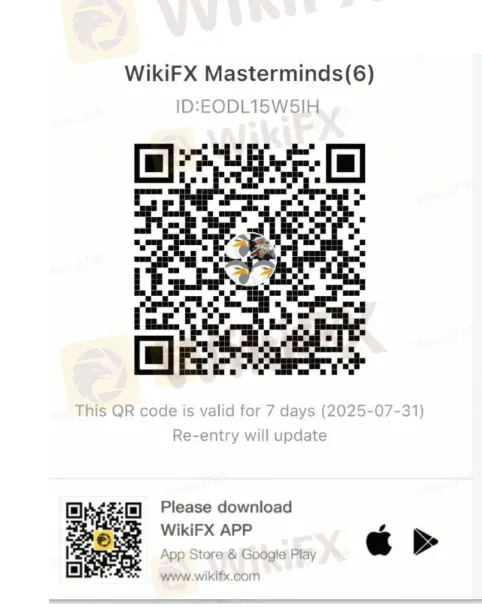

Want to Learn More About Forex? Connect with Our Experts on WikiFX Masterminds

Follow these steps to join the community.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.