简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

LHFX broker — account types, leverage, typical spreads & commissions

Abstract:All about LHFX broker accounts: live/demo/Islamic availability, leverage up to 1:500, indicative spreads/commission model and how costs impact different strategies.

What Account Types Does LHFX Offer?

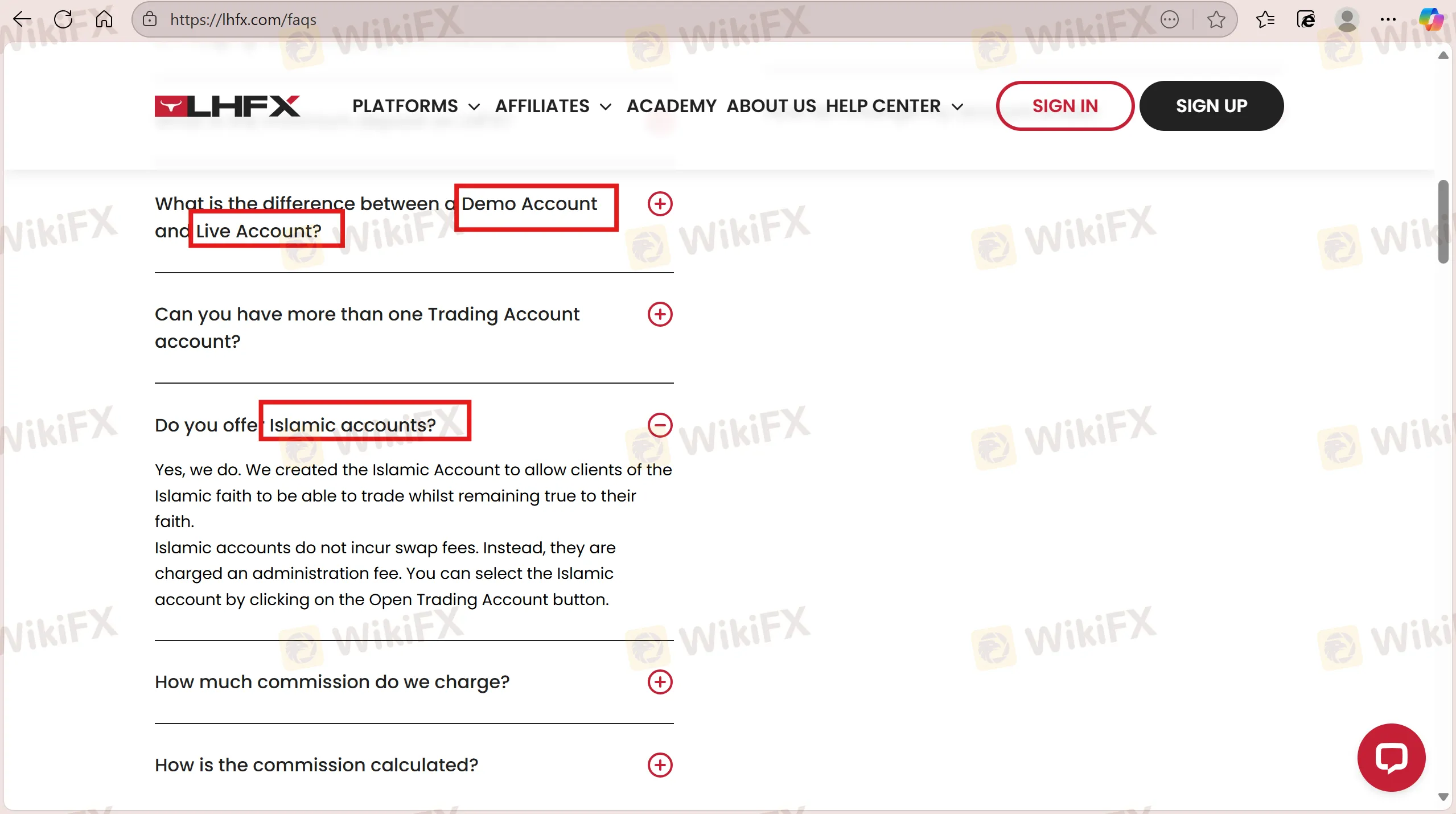

LHFX publishes both Live and Demo account options and addresses Islamic-account enquiries in its FAQs. The broker positions itself as ECN/STP with competitive spreads and low commission structures; it advertises leverage up to 1:500.

Account Options, Leverage and Cost Structure — Quick Table

Below is a compact view of account mechanics and cost signals. We recommend confirming exact numbers inside your dashboard or with support before trading.

| Item | Account / Fee Model | Our interpretation |

| Account types | Live / Demo / (Islamic available on request) | Demo for practice; request Islamic terms from support in writing. |

| Execution model | ECN / STP | Designed for tighter spreads and direct market access; suits active and scalping strategies. |

| Maximum leverage | 1:500 | High leverage magnifies both gains and losses — use strict risk controls. |

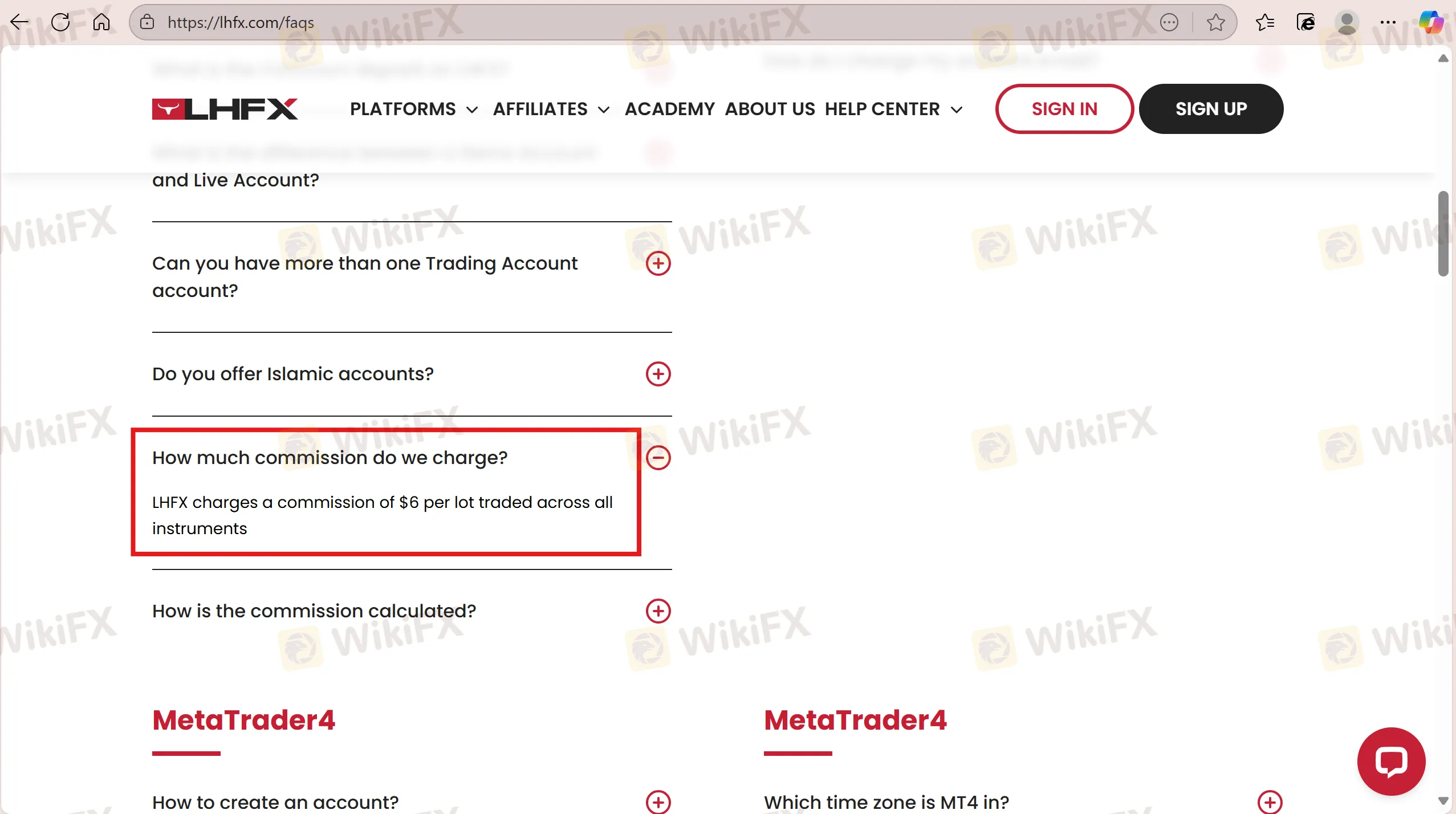

| Commission | External reviews cite ~ $6 / standard lot | Treat third-party numbers as indicative; final fees are in the contract specs. |

| Spreads | Advertised as very low (0.0 starting) | Real-time spreads depend on liquidity and time of day; test with a demo or small live order. |

FAQs about LHFX Accounts & Fees (Q&A)

Q1 — Does LHFX permit hedging and scalping?

A: Yes. LHFX promotes ECN execution and includes FAQ entries that support hedging/scalping strategies.

Q2 — What is the minimum deposit?

A: Reports vary by payment method (examples in market commentary: small crypto thresholds or higher card minimums). Always verify the live minimum shown in the account opening flow.

Q3 — How are commissions and spreads calculated?

A: Commissions (if charged) are usually per lot; spreads vary by instrument and market conditions. Check the contract specifications for each asset.

Q4 — Is an Islamic account available?

A: The FAQ mentions Islamic accounts. Traders should confirm the exact swap-free conditions with support.

Q5 — Can I open multiple accounts?

A: The platform supports multiple trading accounts; check account limits and internal procedures in your client area.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Bitget Review: A Regulatory Ghost Running a Phishing Playground

Yen Surges on Talk of Joint US-Japan Intervention; PM Takaichi Gambles on Snap Election

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Weltrade Review 2025: Is This Forex Broker Safe?

Currency Calculator