Abstract:Multibank Group is reportedly operating two entities in India: one in Lucknow (MEXD Worldwide Private Limited) and another in Gujarat (MEX Global Financial Services (India) Pvt. Ltd.). However, it also offers forex and other financial products to Pakistan and other parts of South Asia. While its products may seem impressive, investors (especially forex traders) have been at the receiving end of scams inflicted by this brand. Trade manipulation, withdrawal denials and capital losses have been so rampant that many were prompted to review against this financial powerhouse. Read on to know more about it.

Multibank Group is reportedly operating two entities in India: one in Lucknow (MEXD Worldwide Private Limited) and another in Gujarat (MEX Global Financial Services (India) Pvt. Ltd.). However, it also offers forex and other financial products to Pakistan and other parts of South Asia. While its products may seem impressive, investors (especially forex traders) have been at the receiving end of scams inflicted by this brand. Trade manipulation, withdrawal denials and capital losses have been so rampant that many were prompted to review against this financial powerhouse. In this article, we will take a hard look at the pain and annoyance traders in South Asia have had while trading with Multibank Group.

Revealing the Top Scam Allegations

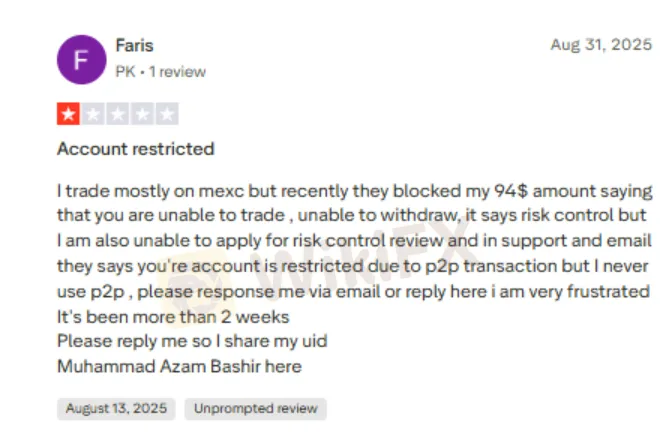

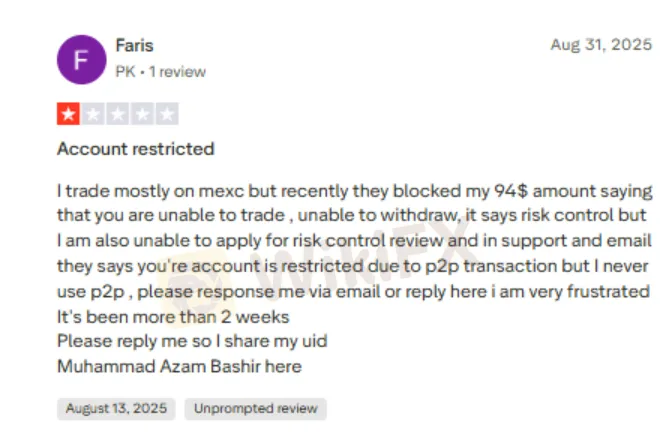

Restricted Account Access Leaves Traders Fuming

Disallowing traders from using their accounts and preventing them from accessing their funds has become too normal at Multibank Groups South Asia operations. The screenshot below demonstrates the helplessness of the trader who was restricted from withdrawing $94.

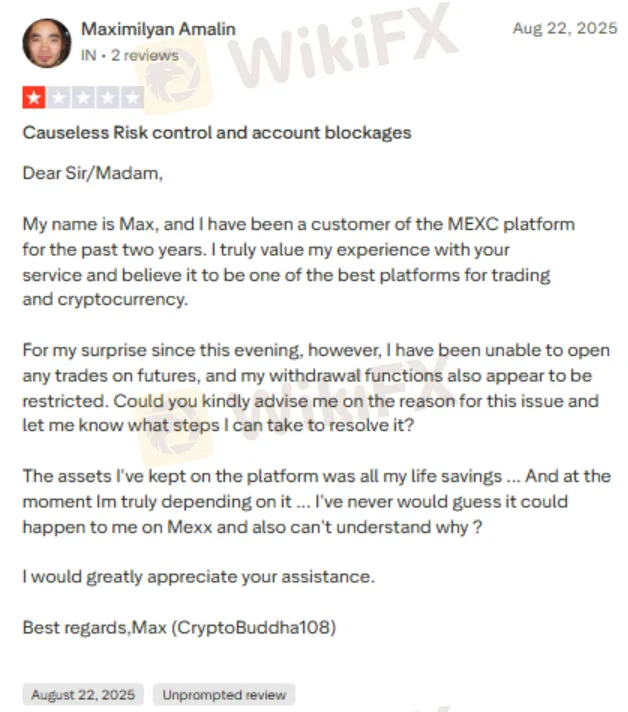

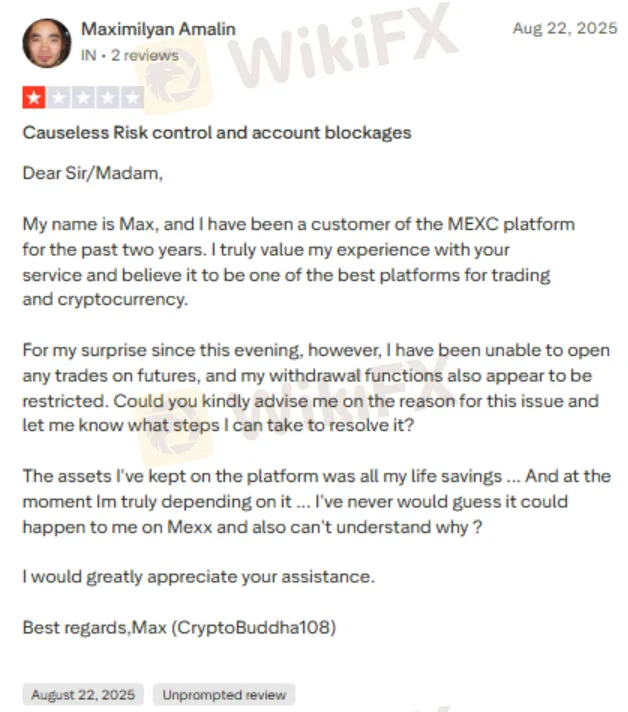

Account Blocked Even After Two Years of Trading

Another trader in South Asia faced an account blockage case despite having two years of good experience with Multibank Group. Due to the account blockage, the trader could not trade on futures and faced restrictions on withdrawals. Sharing a screenshot explaining the financial turbulence the trader went through recently with Multibank Group.

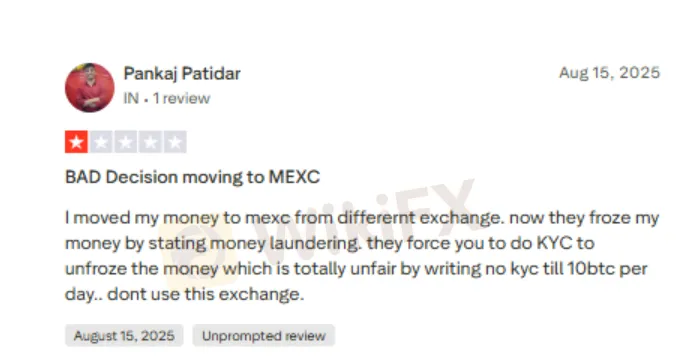

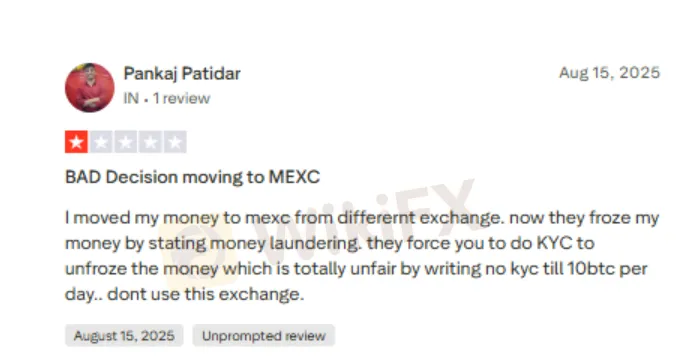

The Capital Freeze Case

One trader is ruing his decision to shift to MEXC as the invested capital was frozen by the exchange. The trader, in his argument, said the KYC norm imposed by the exchange was unfair. Here is what the trader commented.

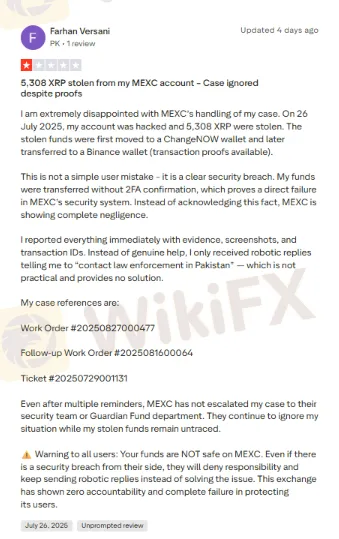

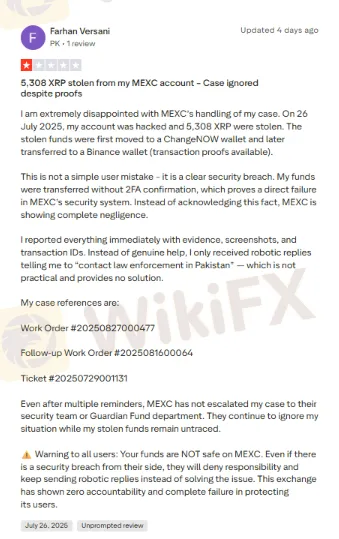

Siphoning of Funds Worth Above 5,308 XRP

If the capital freeze and account blockage were not enough, the security breach that led to a trader losing 5,308 XRP would surely make everyone believe that not all is right at Multibank group. The trader claims that MEXC, a sister concern of Multibank Group, has failed to provide a satisfactory answer to the security breach and the losses that resulted afterward. It thus widens the need for thorough investigation into the system and process it implements for traders. Here is the screenshot explaining the financial trauma a trader faced.

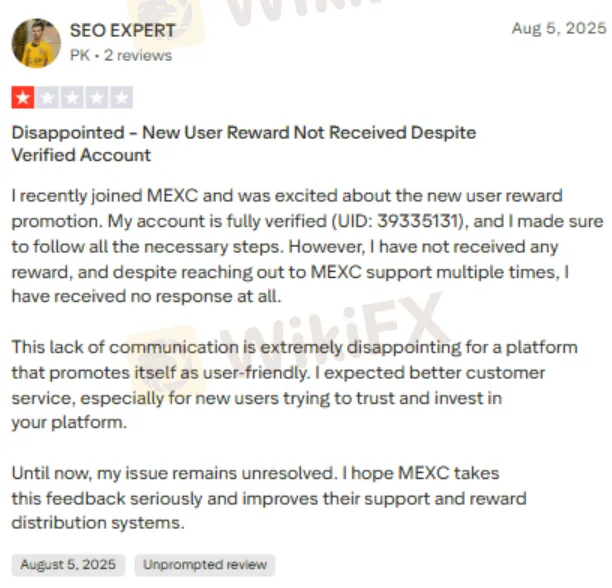

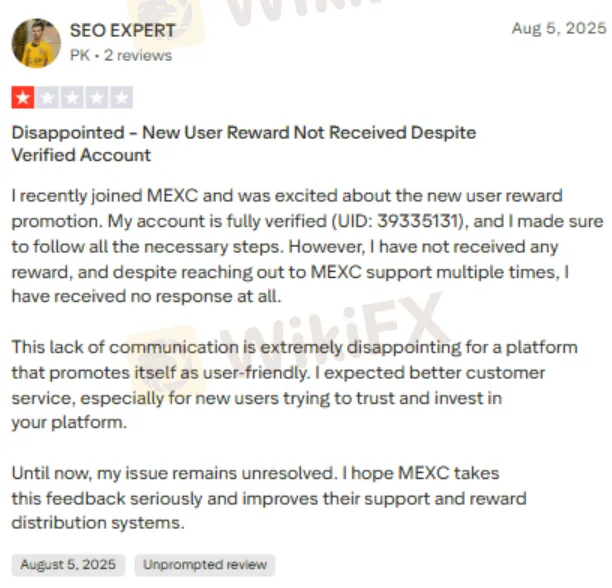

Unfulfilled Reward Promises

Despite having a verified account, a trader from Pakistan could not receive the rewards from Multibank Group as promised. The trader followed all the steps and deserved to be rewarded. However, that did not happen, resulting in further disrepute for the broker. Sharing the screenshot below for you to glance at.

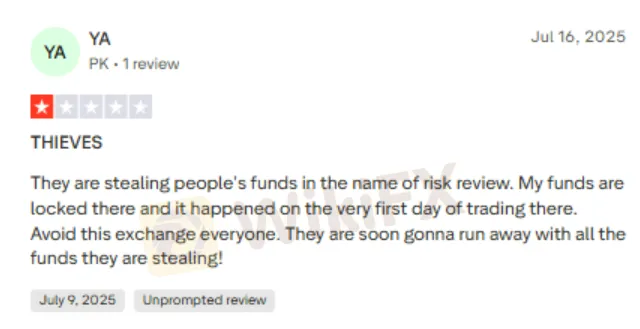

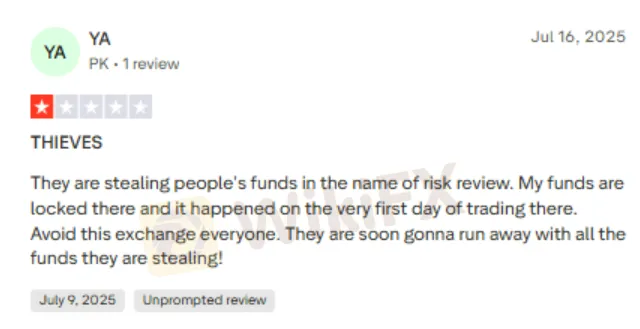

Funds Locked on the First Day of Trading

Stunning! This adds to the list of investment scams MEXC is doing under the guise of risk review, as per a trader who saw the funds locked on the first day of trading. Do check the screenshot below to understand the concerns better.

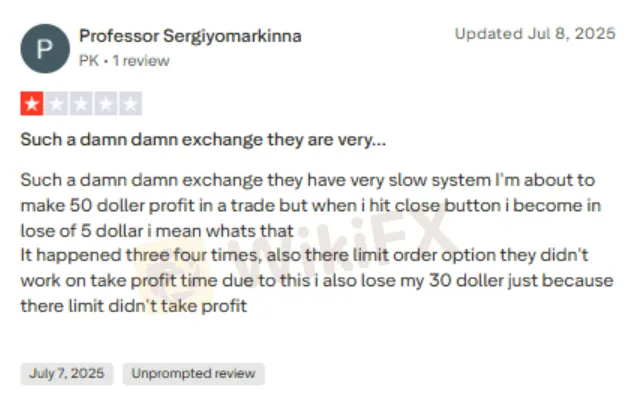

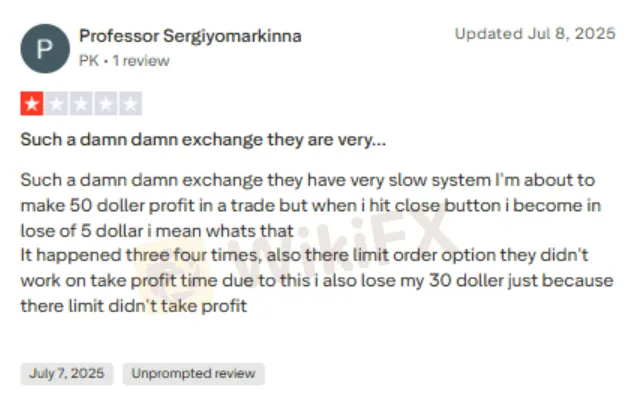

Losses Due to Trade Manipulation

MEXC follows manipulative trade practices involving profit loss and discrepancies in limit order and take-profit time. This led to unfair losses for the trader, prompting him to give this negative review.

Conclusion

The allegations against Multibank Group and its sister concern MEXC paint a worrying picture for traders in South Asia. From blocked accounts and frozen funds to siphoned assets, security breaches, and unfulfilled promises, the complaints highlight recurring issues that have severely impacted investors trust. While the broker markets itself as a global financial powerhouse, the experiences of traders suggest otherwise.