Abstract:Multibank Group faces mounting withdrawal complaints, regulatory scrutiny, and scam warnings from traders worldwide. Learn the facts before investing.

Multibank Group Withdrawal Problems Under Global Scrutiny

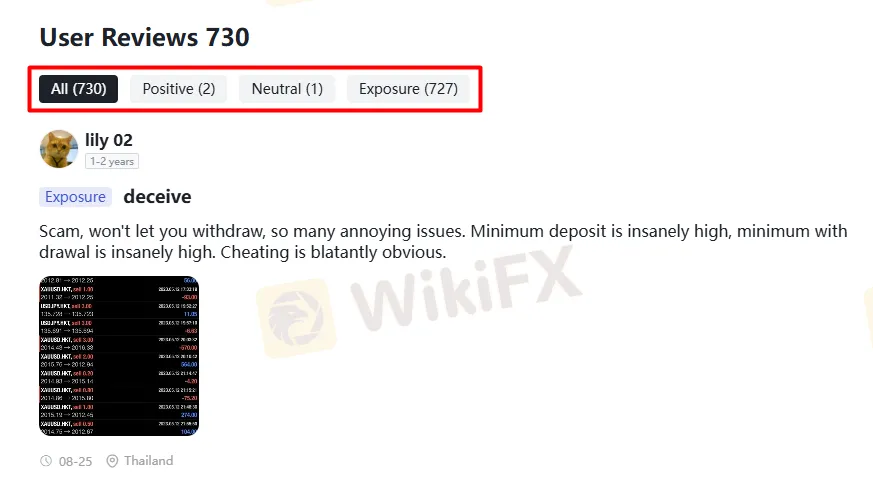

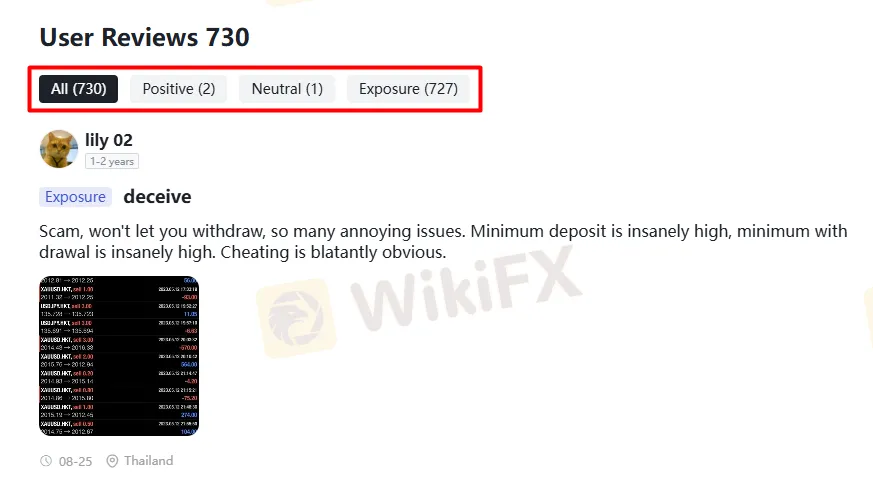

As of September 2025, 727 complaints have been recorded against Multibank Group, with at least 10 new cases reported in recent months.

The most common grievance: blocked or delayed withdrawals, often stretching for weeks or months without resolution. Traders from Thailand, Hong Kong, and Indonesia have reported trading accounts frozen, minimum withdrawal thresholds set unusually high, and ignored support requests.

One trader alleged:

“They refused my withdrawal for over a month. Emails went unanswered, and my account manager disappeared.” Such cases have fueled growing online discussions under search terms like Multibank Group scam, Multibank Group complaints, and forex broker withdrawal delay.

Patterns in Customer Experiences

Analysis of customer reports reveals recurring red flags:

- Withdrawal Denials – Multiple traders claim repeated rejections without clear reasons.

- Dormant Accounts – Some IB (Introducing Broker) accounts were allegedly placed into dormancy after commission withdrawals were requested.

- High Entry & Exit Barriers – Minimum deposit and withdrawal amounts reportedly exceed industry norms.

- Communication Blackouts – Several users say official websites became inaccessible, and account managers are unresponsive.

These patterns align with forex scam warning signs often cited by industry watchdogs.

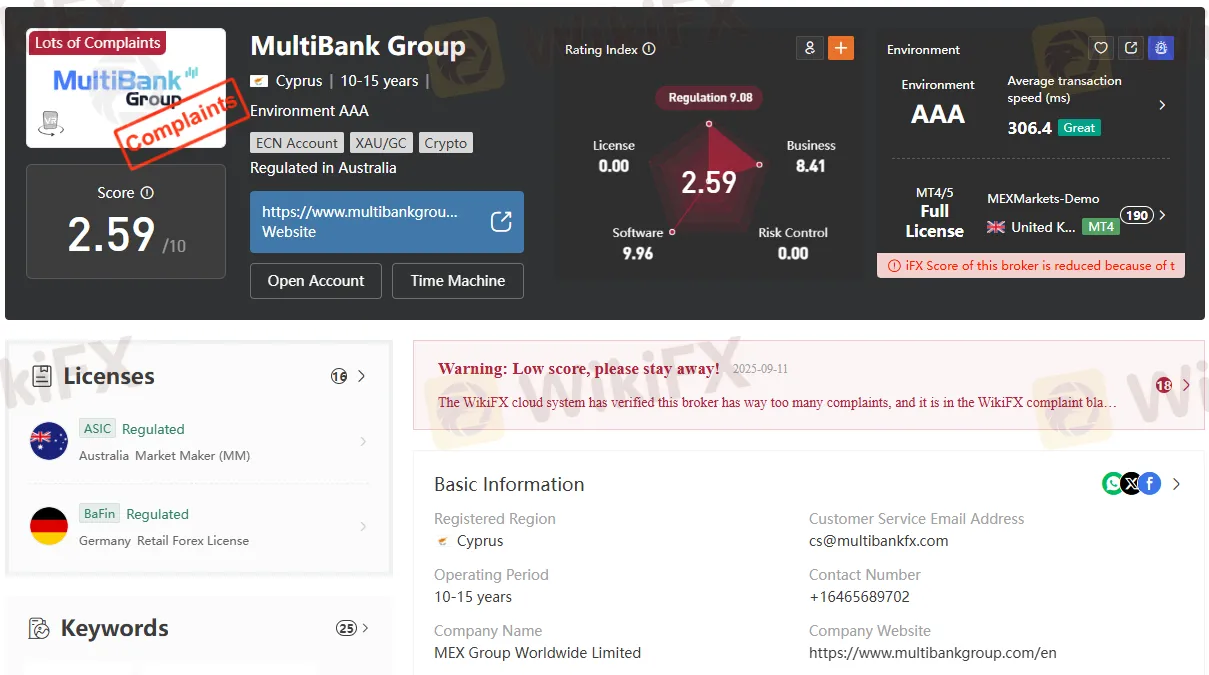

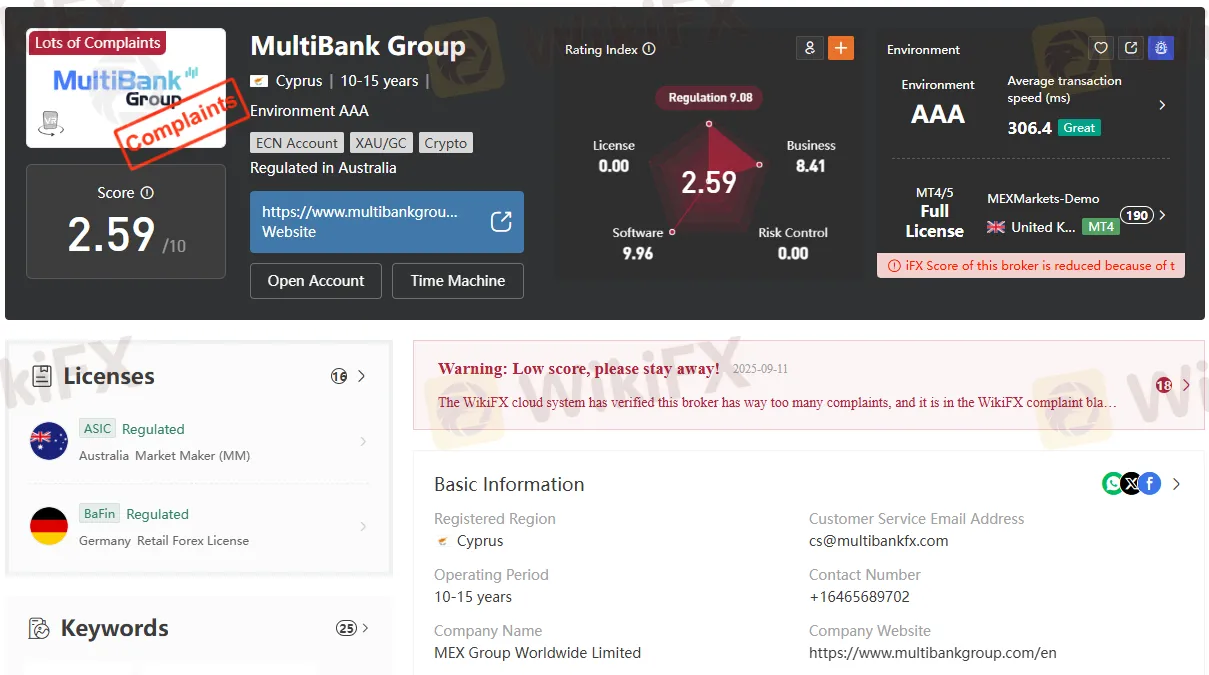

Regulatory Landscape and Risks

Multibank Group operates under a complex web of licenses across multiple jurisdictions, including:

- ASIC-regulated brokers – MEX Australia Pty Ltd (Australia)

- CySEC forex license – MEX Europe Ltd (Cyprus)

- SCA – United Arab Emirates

- MAS – Singapore

However, the group also holds offshore forex regulation in Vanuatu and the British Virgin Islands, where investor protections are weaker. Notably, several licenses have been revoked in the UK, Spain, and the Cayman Islands, raising broker license revocations.

This mixed regulatory status complicates due diligence for traders and underscores the importance of verifying Multibank Group regulation before depositing funds.

Broker Rating and Reputation

According to independent broker rating platforms, Multibank Groups overall score has dropped due to the volume of complaints. While the company promotes itself as a multi‑jurisdictional, long‑established broker (founded in 2005), its customer experiences increasingly highlight operational and trust issues. Potential investors searching for Multibank Group review or Multibank Group broker rating will find a growing number of negative testimonials, many tied to withdrawal issues and account access problems.

Protecting Yourself as a Trader

Before engaging with any broker—especially one with withdrawal disputes—traders should:

- Verify licenses directly with regulators.

- Check for revoked or expired authorizations.

- Research customer complaints on independent platforms.

- Avoid depositing more than you can afford to lose until trust is established.

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone.

Conclusion

The rising tide of Multibank Group withdrawal problems—combined with revoked licenses and offshore regulation—demands heightened caution from traders. While the broker maintains some active regulatory approvals, the volume and consistency of complaints suggest that due diligence is critical before committing funds.