WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Even though Darwinex is regulated, has a high online rating, and a strong web presence, it might still be hiding serious red flags. Don’t judge a broker just by their website. In this article, we’ll reveal the major drawbacks of Darwinex and the key warning signs to watch out for. Read until the end to stay informed and avoid scams.

Even though Darwinex is regulated, has a high online rating, and a strong web presence, it might still be hiding serious red flags. Don‘t judge a broker just by their website. In this article, we’ll reveal the major drawbacks of Darwinex and the key warning signs to watch out for. Read until the end to stay informed and avoid scams.

Darwinex is a legitimate and regulated broker. It is authorized by the UK's Financial Conduct Authority (FCA) and was founded in 2012. The company operates under the domain Darwinex.com and is based in the United Kingdom.

Drawbacks of Darwinex

1. High Minimum Deposit Requirement

To open a live trading account with Darwinex, users are required to deposit a minimum of $500. This amount may be considered high, especially for beginners or casual traders who want to test the platform with a smaller investment. In comparison, many brokers today offer account setups with minimum deposits as low as $10–$100.

2. Limited Asset Offering – Only US Stocks

Darwinex currently offers access to US stocks only, which significantly limits the investment choices for traders interested in international equities or more diversified portfolios. Traders looking to access global markets or a wider range of asset classes, such as cryptocurrencies or commodities, may find the platform restrictive.

3. No Islamic (Swap-Free) Accounts

Darwinex does not offer Islamic or swap-free accounts, making it unsuitable for traders who need Sharia-compliant trading conditions. This limitation excludes a segment of global traders who cannot earn or pay interest due to religious beliefs, a feature commonly available with other brokers catering to diverse clientele.

4. No Live Chat Support

Darwinex does not offer live chat support, which can be a significant drawback for traders who need quick assistance. Unlike many competitors that provide 24/7 live chat, Darwinex relies on email communication and a contact form. This can lead to slower response times, particularly for time-sensitive trading issues or urgent account-related concerns.

5. Complex Account Types & Trading Conditions

The platform's account types and brokerage structure can be confusing, especially for beginners. Darwinex operates both as a broker and asset manager, using its proprietary “ DarwinexZero ” strategy model, which may not be straightforward to understand. The lack of clarity in fee structures, account setups, and trading conditions may deter less experienced users.

Conclusion

While Darwinex is a regulated broker but it may not be the ideal choice for all traders. The lack of live chat support, a relatively high minimum deposit of $500, limited access to only US stocks, and the absence of Islamic accounts are notable drawbacks. Additionally, the platforms complex account structure and trading model can be confusing, especially for beginners. Traders considering Darwinex should carefully evaluate these limitations to determine whether the platform aligns with their trading needs and preferences.

Many traders are familiar with WikiFX as a platform that verifies broker licenses. However, not as many know that WikiFX also provides dispute resolution support for traders who have been misled or harmed by unregulated or dishonest brokers. How you can report on WikiFX app-

1. Download the WikiFX app (available on Google Play and the App Store).

2. On the app's homepage, tap on “Exposure.”

3. Submit the details of your issue include screenshots, transaction receipts, emails, or any relevant proof.

4. The more complete your submission, the faster the WikiFX Team can begin their investigation.

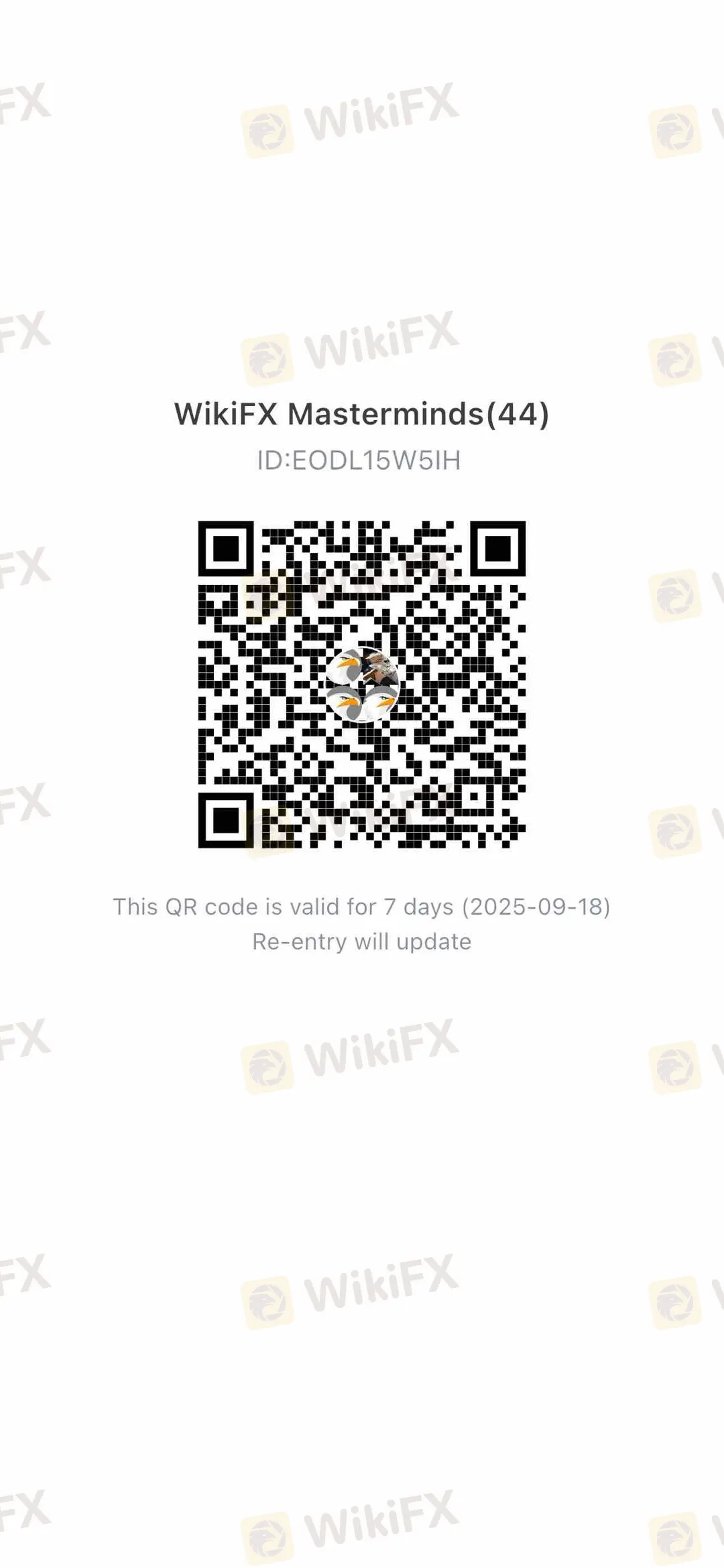

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.