简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Sep 18, 2025

Abstract:Fed Cuts by 25bps, Signal More Easing Ahead; Whats Next on Dollar, XAUUSDThe Federal Reserve delivered its first rate cut since December, lowering the federal funds rate by 25 basis points to 4.00%–4.

Fed Cuts by 25bps, Signal More Easing Ahead; Whats Next on Dollar, XAUUSD

The Federal Reserve delivered its first rate cut since December, lowering the federal funds rate by 25 basis points to 4.00%–4.25%. Policymakers also signaled that additional easing is likely, with the updated dot plot pointing to two more cuts by year-end.

This marks a clear shift in focus toward supporting the labor market, even as inflation remains above target.

Fed Stance at the September Meeting

Chair Jerome Powell described the decision as a “risk management” step, stressing that while inflation has not yet been defeated, the labor market is cooling faster than expected.

He noted that the dot plot reflects the Committees sensitivity to its dual mandate: “We must remain focused on inflation, but we also cannot ignore our maximum employment goal.” This underscores why the Fed has resumed its easing cycle.

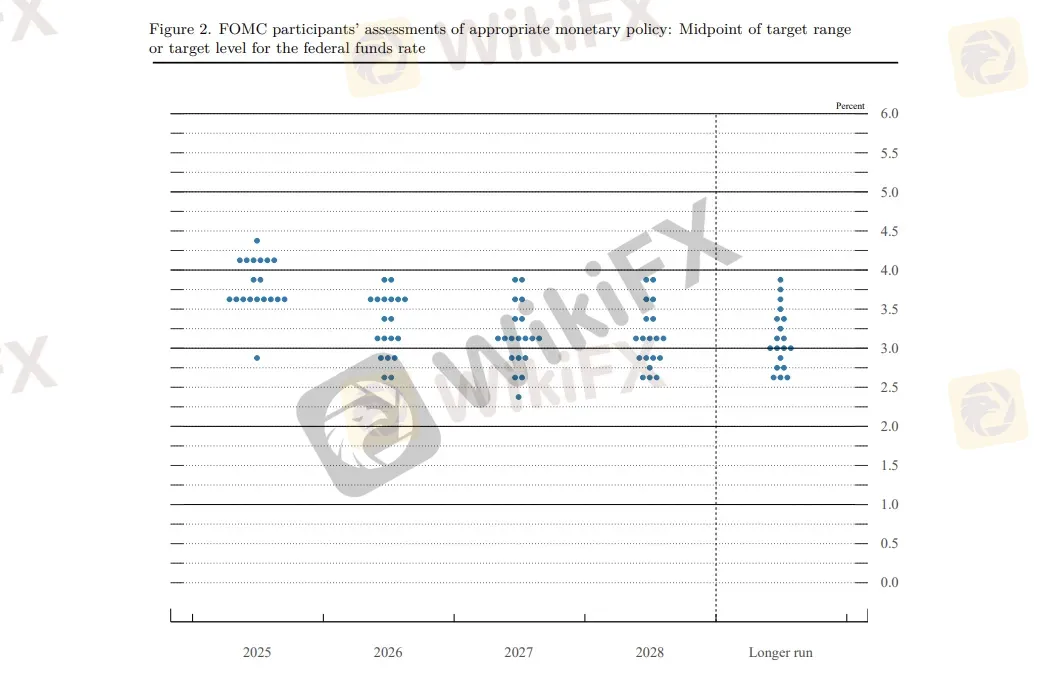

Fed Dot Plot in September Meeting; Source: Federal Reserve

The updated economic projections reinforced the dovish tilt. Growth expectations for 2025 were revised down to 1.6% from 1.9%, while the unemployment forecast was lifted to 4.6%. Inflation is expected to remain around 3% in 2025 before gradually moving toward the 2% target over the medium term.

Meanwhile, the dot plot suggests two more cuts are likely by year-end. The decision was not unanimous—newly appointed governor Stephen Miran dissented, arguing for a larger 50bps cut. His dissent highlights growing divisions within the Committee on how aggressively to ease policy.

Market Reaction: Dollar Whipsaws, Gold Faces Resistance

Markets initially interpreted the Fed‘s guidance as confirmation of a new easing cycle. U.S. Treasury yields fell sharply at the short end, while futures markets priced in nearly three cuts in 2025, aligning with the Fed’s projections.

The U.S. dollar weakened immediately after the announcement, pushing EURUSD and GBPUSD higher, while gold surged to a new record at $3,706. However, the move quickly reversed as traders viewed the event as a “sell the news” moment.

Both EURUSD and GBPUSD ended the day with long bearish candles, while the dollar index rebounded off its 96.30 support area.

US Dollar Technical Outlook

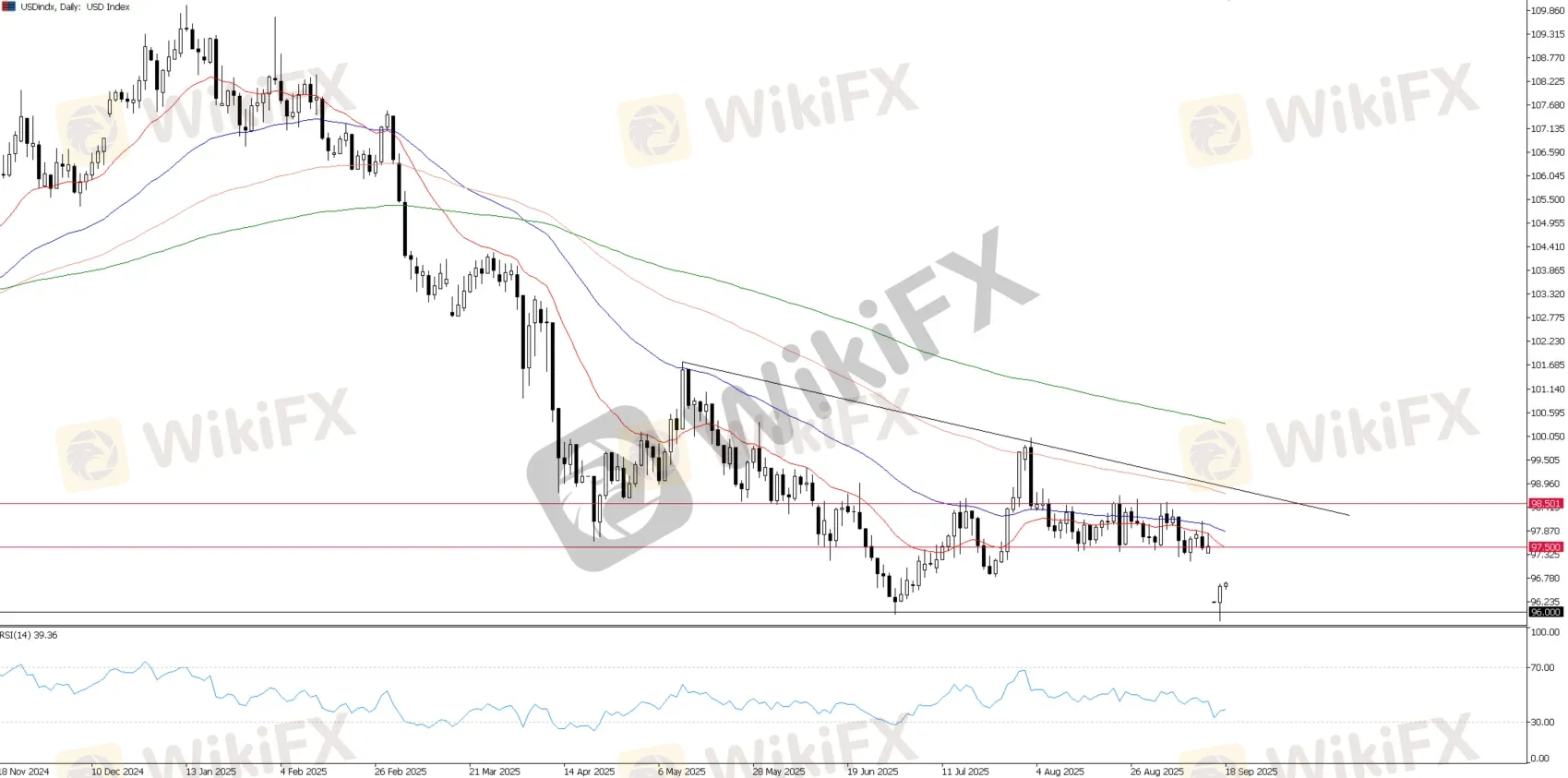

USD Index, Daily Chart

The US Dollar Index (DXY) rebounded after testing the 96.00 support, suggesting that buyers are defending this level in the near term. However, the broader trend remains bearish unless the dollar can reclaim the 97.50–98.50 resistance zone.

· Bullish scenario: A decisive break above 98.50 would signal a potential trend reversal, opening the door for renewed dollar strength.

· Bearish scenario: Failure to sustain above the 97.50–98.50 zone leaves the dollar vulnerable to renewed downside pressure, with the next key support near 96.00.

Looking ahead, the dollars trajectory will hinge on incoming data and the macro-outlook. If economic conditions continue to justify further Fed rate cuts into late 2025, the broader bias for the US Dollar is likely to stay bearish.

Gold Faces Resistance at $3,700

Golds rally briefly extended to an all-time high of $3,706 before running into strong resistance at the key $3,700 psychological level. A daily bearish engulfing candlestick now suggests that gold could enter a corrective phase.

XAUUSD, Day Chart

XAU/USD, 1-Hour Chart

Technically, support is seen between $3,655–$3,630, which may provide a short-term floor. A sustained break below this zone could open the door to deeper retracement toward $3,600, though the broader long-term trend for gold remains bullish as rate cuts and weaker real yields continue to support demand.

The Bottom Line

The Feds 25bps rate cut and dovish economic projections signal the start of a renewed easing cycle, though divisions remain within the Committee on how aggressive policy should be. Markets reacted with volatility—initial dollar weakness and gold strength quickly reversed as traders booked profits, leaving the dollar supported above key levels.

Technically, the US Dollar Index remains in a bearish structure unless it reclaims the 97.50–98.50 resistance zone, while gold faces near-term resistance at $3,700 but retains a long-term bullish bias supported by lower yields and easing policy expectations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex24 Faces CySEC Fine for Late Compliance Filing

One Wrong Move Wiped Out a Government Retiree’s Lifetime Savings

MH Markets Review 2025: Trading Platforms, Pros and Cons

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

"Our Business Has Died": Texas Services Sector Sentiment Slumps Further In October

D Prime to Exit Limassol Office Amid Doo Group Restructure

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

Currency Calculator