简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Retreats After Fed Rate Cut!

Abstract:The Federal Reserve delivered a 25-basis-point rate cut at the latest FOMC meeting, in line with market expectations. However, Chair Jerome Powell highlighted rising risks in the labor market, leading

The Federal Reserve delivered a 25-basis-point rate cut at the latest FOMC meeting, in line with market expectations. However, Chair Jerome Powell highlighted rising risks in the labor market, leading markets to broadly agree on three rate cuts this year. Interestingly, the Feds updated Summary of Economic Projections (SEP) was more optimistic about next year, helping the U.S. Dollar Index rebound and stabilize above the 96 level.

Following the decision, gold spiked to $3,709.15/oz before reversing lower to test support at $3,650/oz.

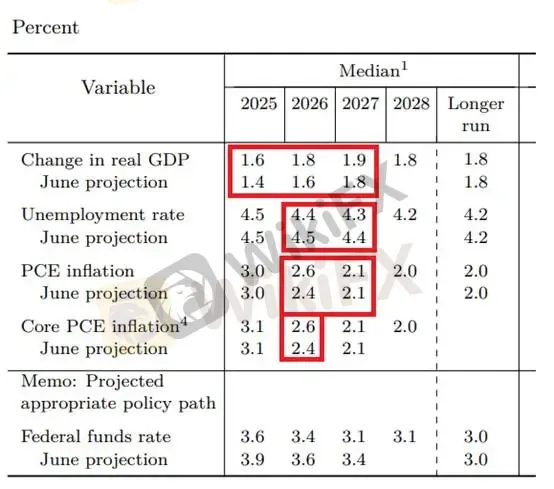

SEP Breakdown

GDP Forecasts

2025: revised up from 1.4% → 1.6%

2026: revised up from 1.6% → 1.8%

2027: revised up from 1.8% → 1.9%

Unemployment Rate

2025: unchanged at 4.5%

2026: revised down from 4.5% → 4.4%

2027: revised down from 4.4% → 4.3%

Inflation (PCE)

2025: unchanged at 3.0%

2026: revised up from 2.4% → 2.6%

2027: unchanged at 2.1%

Core PCE Inflation

2025: unchanged at 3.1%

2026: revised up from 2.4% → 2.6%

2027: unchanged at 2.1%

(Figure 1: Federal Reserve Economic Projections; Source: Fed)

On the Feds dot plot, projections for 2026 showed greater divergence, but there was a broader consensus for rates to ease to the 3.00–3.25% range by 2027.

(Figure 2: Fed Dot Plot; Source: Fed)Our Take

We believe golds pullback was primarily driven by upward GDP revisions and lower unemployment forecasts for the coming years. In other words, Fed policymakers see the current labor market slowdown as manageable rather than a structural issue.

What weighed on gold, however, was Powells comments on balance sheet reduction. He noted that the Fed is close to the level of reserves where it would stop quantitative tightening (QT), and argued that the ongoing balance sheet runoff has minimal macroeconomic impact given its relatively small scale.

From our perspective, the past three years of QT have indeed had limited direct effects, but we expect the economic impact to become more pronounced in the next phase.

Powell also described the labor market as being in an “odd balance” of low hiring and low layoffs. The concern is that if layoffs begin to rise, job seekers could face an environment with “no one hiring,” which could quickly push unemployment higher.

He further emphasized that the decline in labor force participation is cyclical rather than structural (e.g., aging demographics). While participation matters as a barometer of domestic demand, Powell pointed to surprisingly strong consumption data, likely driven by higher-income households. Regardless of who spends, consumption remains a key driver of growth.

In summary: consumer spending appears resilient for now, but its sustainability is questionable. The GDP upgrade largely reflects AI-driven corporate investment. Powells remarks showed inconsistency, and we believe asset bubbles in capital markets continue to build.

Gold Technical Analysis

Gold remains in a bearish divergence between indicators and price action. On the daily chart, prices have fallen below the 5-day moving average, signaling a reversal of the strong bullish trend. The metal is currently retesting support at $3,655/oz, with potential for further downside intraday.

Resistance: $3,670 / $3,676

Support: $3,645 / $3,607

We recommend caution: short positions may be considered on failed retests of resistance, with stops above $3,680. Avoid chasing longs at this stage.

⚠️ Risk Disclaimer: The above views, analysis, and price levels are for general market commentary only and do not represent the position of this platform. Readers should manage their own risks and trade responsibly.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex24 Faces CySEC Fine for Late Compliance Filing

One Wrong Move Wiped Out a Government Retiree’s Lifetime Savings

MH Markets Review 2025: Trading Platforms, Pros and Cons

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

"Our Business Has Died": Texas Services Sector Sentiment Slumps Further In October

D Prime to Exit Limassol Office Amid Doo Group Restructure

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

Currency Calculator