Abstract:TastyTrade is an unregulated broker with a low trust score, and high-risk warnings. Get the facts before you trade.

Introduction

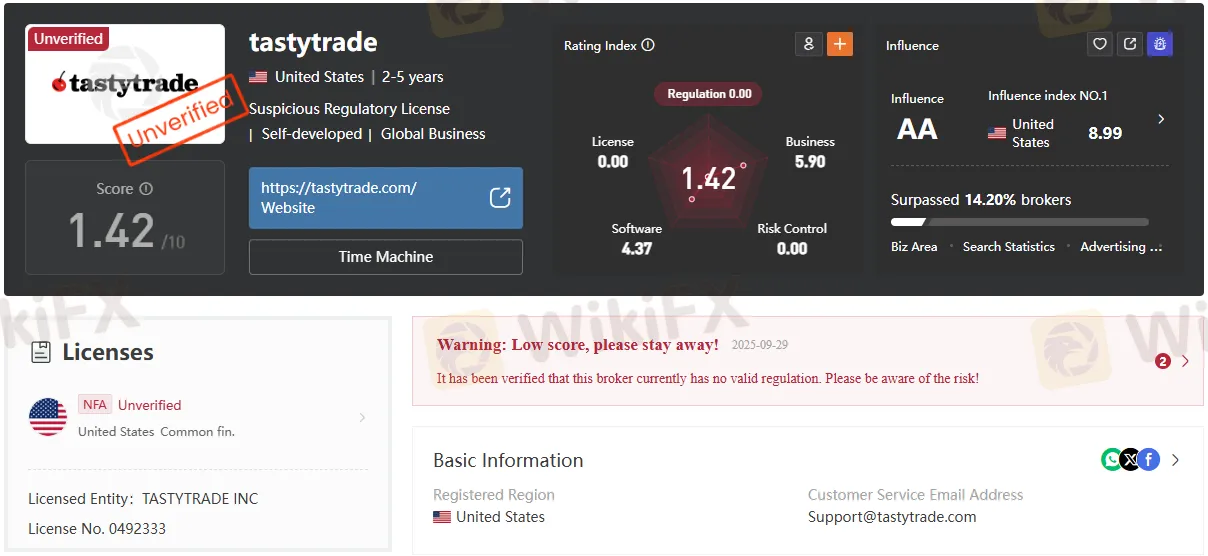

tastytrade is presented as operating without a currently valid regulatory license, with an “Unverified” status tied to an NFA reference, signaling elevated counterparty and compliance risk for prospective clients seeking a regulated brokerage relationship. The profile flags a low trust score and an explicit warning to “stay away,” indicating users should proceed with heightened caution and independent verification before opening or funding accounts.

Current regulatory status

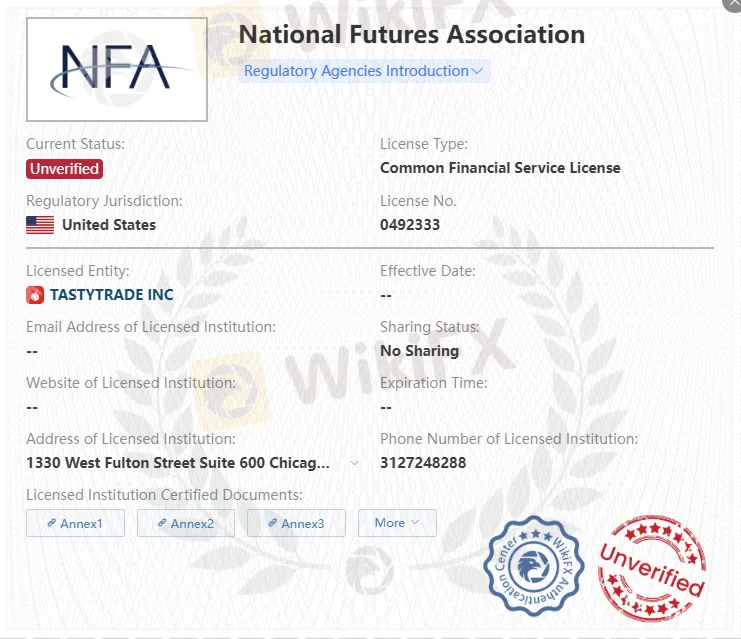

The document lists tastytrades jurisdiction as the United States with an NFA-related entry marked “Unverified,” accompanied by a claim that the broker “currently has no valid regulation” and a low score of 1.42/10 on the referenced ratings page. It also displays a license number “0492333” next to TASTYTRADE INC, but simultaneously labels the NFA line as “Unverified,” which underscores the need to cross-check with primary regulators.

What the risk warning means

The page issues a conspicuous warning—“Low score, please stay away!”—and states it has been verified that there is no valid regulation at present, which, if accurate, suggests limited recourse mechanisms and a higher risk of operational or compliance lapses for clients. A low composite score, zero in “Regulation,” and the “Unverified” badges collectively indicate significant uncertainty around oversight and consumer protections.

Products and accounts offered

Despite the regulatory concern, the profile describes a broad product suite: stocks, options, futures, crypto, options on futures, ETFs, commodities, and indices, alongside multiple account types spanning individual, joint, retirement, entity, trust, and international accounts. It notes commissions “from $0” and availability across desktop, browser, mobile, and iPad, with funding by bank or wire transfer and check, highlighting a retail-friendly commercial offering.

Company background

The summary dates the firm‘s founding to 2006 in the United States and reports roughly “2–5 years” in the specific listing’s age designation while asserting nearly 20 years of operations—an internal inconsistency that reinforces the need for direct regulator lookups. The listing provides an address on West Fulton Street in Chicago and a phone number, details that can be used for independent validation against regulator records and corporate registries.

Due diligence steps

Given the “Unverified” status and “no valid regulation” claim, traders should independently query primary databases such as official NFA registrant search or state-level corporate records to confirm current authorization before engaging services or wiring funds. Where verification fails or remains unclear, risk management best practice is to avoid funding, seek alternative regulated brokers, and document any communications for potential dispute resolution needs.