简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tradeview Markets Review: Warning of Fraud Risks in 2025

Abstract:In the fast-paced world of forex trading, traders are always looking for reliable brokers that offer low spreads and high leverage. But is Tradeview Markets, a company registered in the Cayman Islands, really safe? In this comprehensive 2025 review, based on WikiFX data, we examine regulatory details, reviews, and complaints to reveal potential risks.

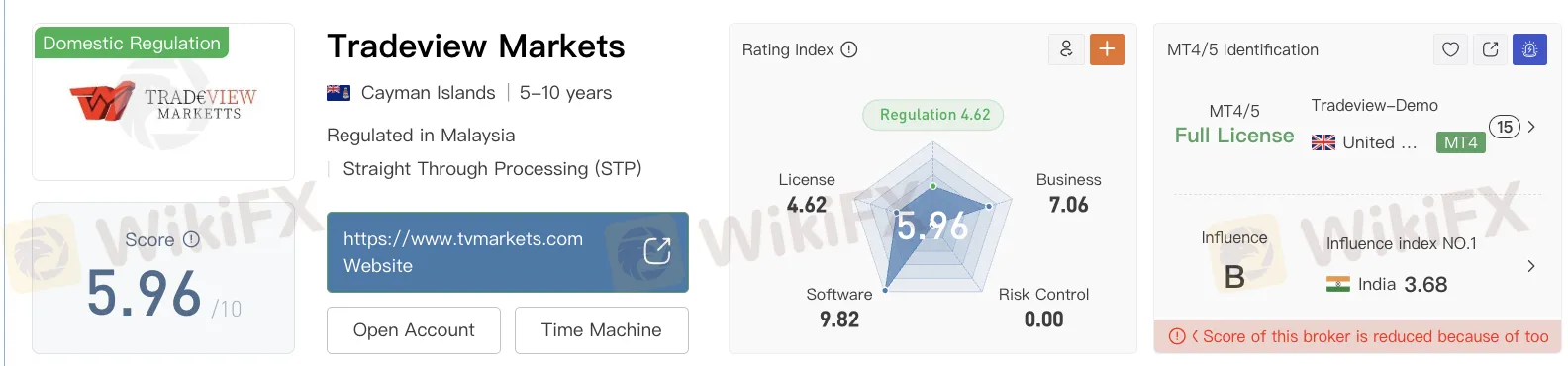

Overview of Tradeview Markets

Founded in 2004 under the name Tradeview LTD in the Cayman Islands, Tradeview Markets has been operating for 5-10 years in forex trading, commodities, indices, stocks, and futures, in addition to contracts for difference (CFDs). It does not offer cryptocurrency trading or exchange-traded funds (ETFs). It relies on a Straight Through Processing (STP) model for fast execution and provides demo accounts for beginners. The minimum deposit starts at $100 USD for forex accounts, with leverage up to 1:400, and spreads starting from 0.0 pips for the EUR/USD pair in the ILC Forex account. Available platforms include MT4, MT5, and cTrader, with an average server speed of 163.17 milliseconds. There are no Islamic accounts, and deposits and withdrawals are free from the company's side, though banks may impose additional fees.

However, the company raises questions about its credibility, particularly due to the lack of strong regulation, as we will see in the following sections.

Regulation and Licenses: Lack of Official Safeguards

Despite being registered in the Cayman Islands, Tradeview Markets is not fully subject to any globally recognized regulatory authority, meaning there is no protection for client funds or dispute resolution mechanisms. However, the company currently holds one main license:

Labuan Financial Services Authority (LFSA) License: Number MB/19/0037, issued in Malaysia as a full Common Financial Service License, covering Straight Through Processing (STP). Address: Labuan Jalan Mustapha, 87000 Labuan FT, Malaysia. Email: miller@tvmarkets.com.

As for the Cayman Islands Monetary Authority (CIMA) license: Number 158163, which was issued on 2012-04-04 as a Common Financial Service License, it has been removed. This license provides some basic registration but does not equate to strict regulation from bodies like the FCA or CySEC, making the company susceptible to non-transparent practices.

WikiFX Rating and Reviews: Recurring Complaints of Fraud

WikiFX gives Tradeview Markets an overall rating of 5.96/10, with sub-rating details as follows: customer service 4.62/10, platform 5.96/10, spreads 7.06/10, deposits 3.68/10, and execution 4.82/10.

Out of 12 reviews, all are negative and unverified, focusing on serious issues:

- Unauthorized Withdrawals: Multiple complaints about large amounts withdrawn without permission, such as $166,000 from an account in the UAE, $14,293, $62,000, $16,742.81, and $227,197 across multiple accounts in Nigeria, plus an illegal deduction of $11,000 and more than half the funds without reason.

- Negative Balance and Coercion: Clients accuse the company of creating mysterious negative balances (such as -$19.78, -$1022, or -$20 million), forcing them to sign agreements to prevent complaints or litigation, and wiping accounts after losses from large slippage and suspicious price movements.

- Non-Responsiveness and Deception: Ignoring customer service, deleting data and accounts, intimidation, and false claims of abundant funds or offices in the US, Dubai, and Japan, with delays in withdrawals and refusal of refunds.

Affected countries include Nigeria, the UAE, the United States, Hong Kong, Canada, and Greece, with most complaints in August 2025.

Risks and Positives: Is It Worth the Risk?

Positives: A wide range of instruments (forex, stocks, futures), modern platforms like cTrader, and low spreads (such as 0.0-0.2 pips for EUR/USD with a $5 round-trip commission). Free standard VPS (1*CPU, 1GB RAM).

Risks: The lack of full regulation exposes your funds to danger, with complaints about illegal withdrawals and threats. No negative balance protection, and withdrawal processing times are unspecified.

Conclusion: Evaluation of Tradeview Markets in 2025

Based on the review, Tradeview Markets appears to be a high-risk option, especially with the increasing complaints about fraud and unauthorized withdrawals. We advise traders to verify using WikiFX tools before any deposit. If you are affected, contact local regulatory authorities immediately.

This review is based on WikiFX data as of October 9, 2025, and is not financial advice. For more, visit the broker's page on WikiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

UK Retail Sentiment: Inflation Reality Check Damps Appetite for Cash

Equity Volatility Signals Risk-Off Shift as Prime Broker IPO Stalls

OANDA Japan Slashes Gold Trading Limits as Volatility Drains Liquidity

Currency Calculator